The international community can give a big helping hand to the deployment of renewables in East Africa by playing match-maker between project developers and investors, an event dedicated to sustainability in the region has heard.

Patrick Nussbaumer, industrial development officer at the United Nations Industrial Development Organization (UNIDO), told the second edition of the Sustainable Energy Forum for East Africa (SEFEA) event, there are plenty of developers and willing investors but a lack of visibility between the two.

The UN official was addressing an event organized by the Kampala-based East African Centre of Excellence for Renewable Energy and Efficiency and Brussels-headquartered business association the Alliance for Rural Electrification (ARE).

pv magazine print edition

Nussbaumer, stressing the need to de-risk clean energy project investment as well as reduce start-up costs, said international bodies could help fill the shortfall when renewables developers lack the skills to also be able to secure financial support for their plans.

Event moderator and ARE board member Prosper Magali pointed out the $16 billion spent annually on off-grid renewables worldwide falls far short of the more-than-$41 billion it has been estimated will be required to bring universal electricity access this decade.

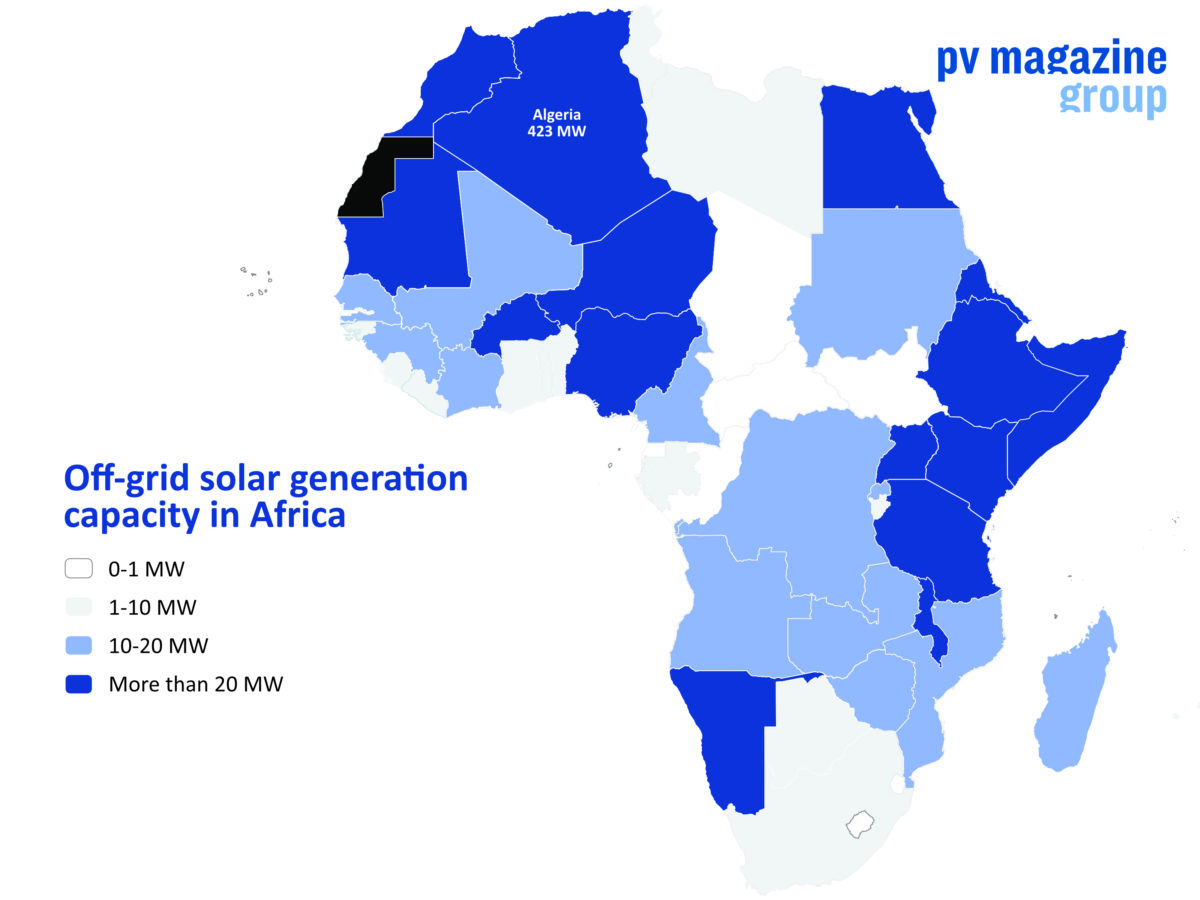

Daniel Schroth, acting director for renewable energy and efficiency at the African Development Bank, offered hope when he cited a 2021 status report which noted Rwanda and Kenya are among the world's top seven nations for access to off-grid clean power, with 9% and 6.8% of their populations, respectively, able to use such facilities.

Ambition

The bank director added, however, the International Energy Agency has estimated half of the world's new electricity connections this decade will have to be associated with distributed-generation plants if universal access to electricity by 2030 is to be achieved.

He also noted a lack of grants and affordable loans in the region for mini-grids – and of any form of basic finance – is being compounded by “limited engagement from local financing institutions which are reluctant to invest, despite the fact there has been an increasing track record, particularly in … solar home system[s].”

Michael Ahimbisibwe, acting principal energy officer at Uganda's Ministry of Energy and Mineral Development, told the event his government had set up the Uganda Energy Credit Capitalisation Company to offer long-term loans to private businesses. The organization will help the nation exploit geographically scattered renewable energy resources which, in combination with an East African electricity access rate of “perhaps about 30%,” offers commercial clean energy opportunities in areas including irrigation, phone charging, and the medical industry.

Ahimbisibwe's Kenyan counterpart Paul Mbuthi – senior deputy director of renewable energy at his nation's Ministry of Energy and Petroleum – also stressed the vital role off-grid renewables can play in the region.

“Many of the areas required to be electrified are far from the national grid, or the grid is too expensive to extend to such areas, and it's not possible to reach to every citizen wherever they are,” said Mbuthi. “That is why decentralized renewables have a big role to play, even in developed countries. There is an abundance of renewable resources in Kenya. However, most of these places are located in regions where it is challenging to develop infrastructure. Therefore, it only makes sense to have on-site development, like mini-grids or standalone system[s], which can be easily deployed.”

That grid capacity shortage, as well as a lack of public institutions dedicated to clean power, was among the obstacles to renewables roll-out highlighted by Erwin Küenzi, head of unit for themes and quality at the Austrian Development Cooperation program run by the European country's international development agency.

Mini-grid conundrum

Current system costs mean mini-grids are not financially sustainable in East Africa, added Küenzi.

The problems facing private-sector renewables developers across East and West Africa were outlined by Winnie Shwashwa, VP for finance at Nairobi-headquartered PowerGen Renewable Energy.

She pointed to familiar complaints about licensing paperwork as well as a multiplicity of electricity tariff-setting regimes, which vary from country to country; the effect on mini-grid economics once central grids extend into the same communities; sluggish payments from government bodies; and the small scale of many mini-grids in the two regions.

The SEFEA event, which was held from Tuesday to Thursday, was backed by the EU's Get.invest program, which is funded by the bloc and the governments of Germany, Sweden, the Netherlands, and Austria.

This article was amended on 30/06/21 to reflect UNIDO is not among the sponsors of the EU's Get.invest program, as previously stated.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.