The European Commission, in approving the €69.5 billion recovery and resilience plan (RRP) submitted by the Spanish government this week, said the nation plans to spend €3.9 billion developing innovative renewable energy technology.

The commission yesterday announced it had approved the plans for post-Covid recovery submitted by Spain, meaning the heads of state which make up the European Council of Ministers can rubber-stamp that finance package within a month or so.

With plans for residential energy efficiency, sustainable transport and decarbonization of industry included, the commission said 40% of the budget drawn up by Madrid would be devoted to the green transition, more than the 37% required for EU member states to gain access to a slice of the €673 billion recovery and resilience facility (RRF) cash.

Solar and sustainability

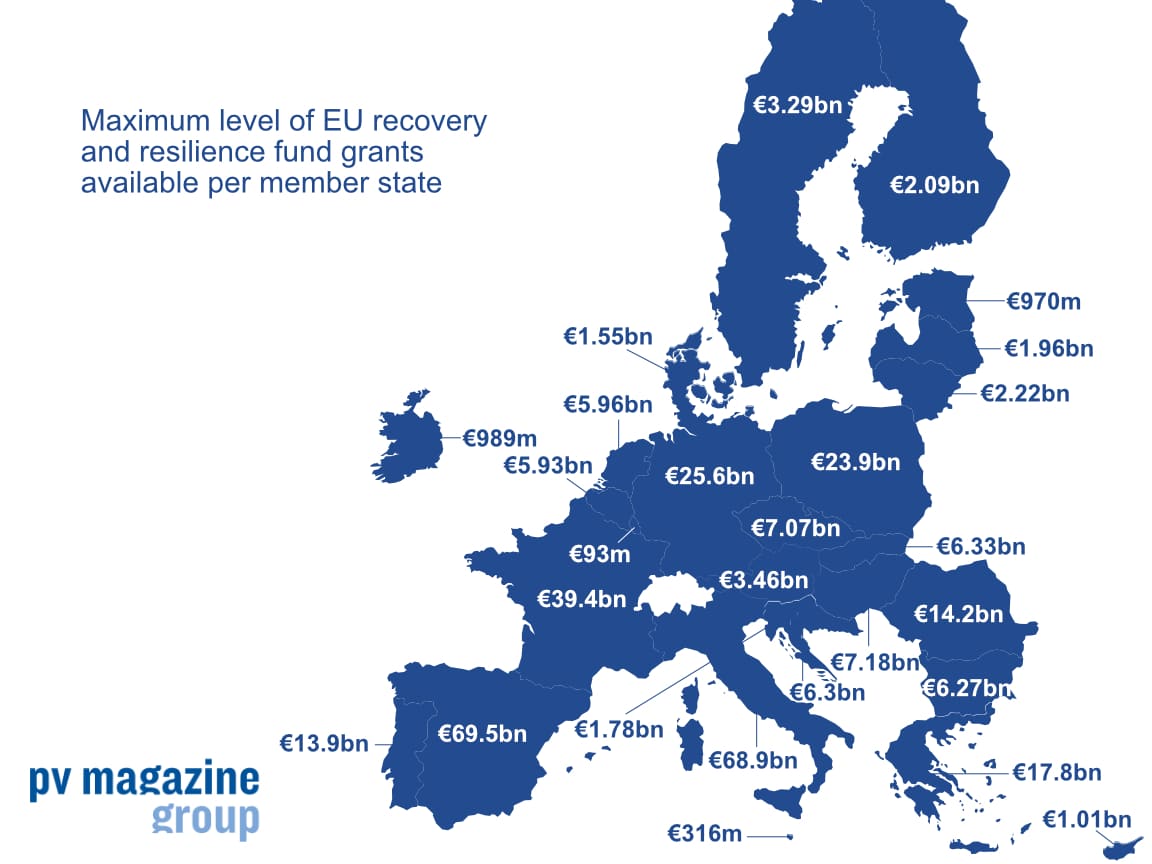

The RRF package, which will disburse funds until 2026, comprises €313 billion in grants and €360 billion in loans. The Spanish allocation is made up entirely of grants, the commission said on Wednesday.

Provided the council approves the Spanish plan, the member state will gain access to 13% of the total package – €9 billion – immediately, as ‘pre-financing.'

Portugal‘s €16.6 billion RRP was approved by the commission on the same day. Council approval would free up an immediate €2.2 billion of the total, which will be supplied as €13.9 billion of grants plus €2.7 billion loans.

And the commission today approved Greece‘s €30.5 billion plan – €17.8 billion loans, €12.7 billion grants – opening up the prospect of Athens gaining access to an initial €4 billion in four weeks or so.

Although member states were advised by the EU to submit recovery plans by the end of April, they will still be able to do so until the middle of next year.

The EU will fund its post-Covid, NextGenerationEU recovery plan by borrowing up to €800 billion through 2026, at a rate of around €150 billion per year, and on Tuesday announced it had raised the first €20 billion through a ten-year bond described as the biggest amount the bloc has raised in a single transaction.

€80 billion

The bloc expects to raise €80 billion this year through further bonds and short-term bills with €407 billion of the finance anticipated to be allocated to grants for member states and €386 billion for on-lending.

The commission said fund managers made up 37% of the purchasers of Tuesday's bond, with bank treasuries buying 25%, central banks and equivalent bodies 23%, insurance and pension funds 12%, non-state banks 2%, and hedge funds 1%. U.K. investors snapped up the biggest proportion of the bonds, with 24%, ahead of purchasers in the Benelux nations, who accounted for 15%. The commission added, 10% of the bonds were sold to investors in Asia and 3% to purchasers in the Americas.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.