From pv magazine 06/2021

1: Big PV is back

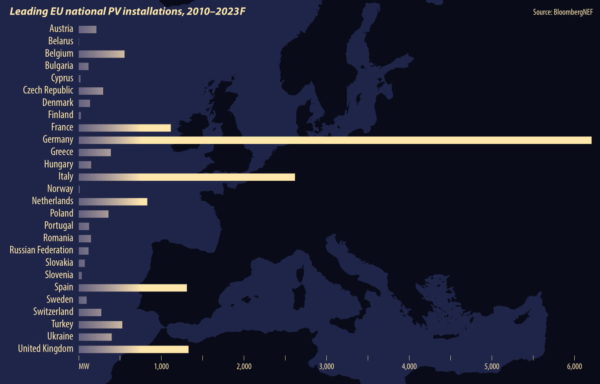

While markets outside of Europe have hogged the limelight when it comes to size and record low tenders for the last five years or more, this decade has already been notable for the return of very large utility-scale projects on the continent. And very large means 100 MW and up.

IHS Markit is tracking a pipeline of some 80 GW of utility-scale solar projects 100 MW+. Athough Josefin Berg, a research and analysis manager of clean energy technology for the company, acknowledges that they “are in very early stages and many are not going to happen.”

But there are 100 MW+ projects going ahead in Europe, with the transition away from FITs to auctions and eventually merchant PV enabling big projects to get off the ground.

Southern and southwestern European markets provide many notable 100 MW+ examples. Solaria Energía was set to begin work on the 626 MW Trillo project in Spain this May, while Iberdrola reports that work is underway on its Francisco Pizarro Spanish project, for which it has signed a PPA with pharmaceutical giant Bayer. In France, Neoen and Engie have announced their intention to develop the vast, multifaceted Horizeo project, with a proposed capacity of 1 GW. And Greece is back with gigawatt-scale ambitions as a part of its lignite exit (pp. 26-29).

“There are so many ways to find remuneration now, making it possible to get to that scale, and you need it [scale] to get your prices to the right level be to become competitive in the power market,” explains Berg.

Analysts note that grid capacity is likely to be a limiting factor for these vast projects, with developers responding by racing to lock in available capacity. This dynamic informed Portugal’s second solar auction, which stunned the PV market with a record low strike price of €0.0114/kWh at a scale of 670 MW.

“The thing that is worth a lot of money in Europe, and all developers want access to, is grid connection,” says Jenny Chase, the head of BloombergNEF’s Solar Insight team. “In Portugal, the developers aim to sell at a loss for 15 years to get access to a grid connection for as long as they want – and that is where they are hoping to make their money.”

The development of big solar in Europe is not limited to the sunny south. Having completed a 187 MW solar project in Germany in December 2020, utility EnBW announced its intention to develop two 150 MW projects in the country’s north. The projects are developed outside of the country’s renewable energy system, the EEG, and will operate on a merchant basis – likely a combination of wholesale and PPAs.

Even further north in Denmark, where wind power and cloudy skies are more prevalent than solar, local developer Better Energy has begun construction on its 200 MW unsubsidized PV power plant in the municipality of Holstebro. The project will be owned by a subsidiary of Danish clothing company Bestseller, and will supply its electricity to the fashion company, along with Danish retail chains Normal and Nemlig.

“Solar holds a major cost advantage in many markets, including over offshore wind, and the market for PPAs is really picking up,” says Brian Gaylord, a principal analyst covering southern Europe and Latin America for Wood Mackenzie. “There is a definite acceleration [in large scale PV in Europe] even without looking at the 2030 targets.”

2: Ways around grid constraints

While developers of large projects scramble to acquire land close to the grid and connection rights, PV is demonstrating its versatility and set to deliver ongoing demand. The Dutch government has set a hugely ambitious 27 GW solar ambition by 2030. However, the densely populated nation lacks the wide open spaces for big PV. In response, developers are showing remarkable creativity, getting close to 3 GW installed in 2020.

“I think there will be way more floating PV than many people think,” says Prashant Khorana, a director of consulting at Wood Mackenzie. “There are abundant lakes with shallow water, and floating PV is pretty simple – particularly when you compare it to the complexity in offshore wind. I mean, the biggest problem is bird droppings.”

“The Dutch are sticking solar on everything at the moment,” observes Jenny Chase. “It’s a pretty healthy way to install solar in your grid.”

Dutch grid operator Tennet produced a study finding that between 500 MW and 1 GW of flexible grid demand can be created by coupling solar with heat pumps.

In terms of larger projects, IHS Markit’s Berg describes the situation of developers “taking control of the situation rather than having curtailment imposed,” and points to projects adding storage, coupling with heat pumps or even green hydrogen production (in the longer term), as ways in which PV production and demand can be brought closer into alignment.

“Simply overbuilding your plant so that you have more modules than inverters, and clip off some production midday but higher production in the mornings and evenings is all about taking control.” These innovations, the analyst notes, can be limited by costs. “Every company wants to innovate, but it still has to be within your budget.”

3: Policy innovation shines

Innovation is also occurring in Europe’s solar tenders, auctions or support programs, and a move toward a zero-emissions technology neutral basis is a commonality between countries. Italian lawmakers have dedicated more than €3 billion in funding toward agrivoltaic installations and “energy communities.” The programs anticipate seeing up to 4 GW of solar capacity installed.

France is also backing agrivoltaics, though large projects like the Engie-Neoen array mentioned earlier are meeting some local opposition. CRE, France’s energy regulator, announced the results of its second tender for innovative technology, a yield of around 145 MW of projects at an average strike price of €0.0815/kWh.

Germany has announced plans to ramp up its solar tender ambitions, with as much as 6 GW in 2022 expected in plans agreed to by its ruling coalition parties. There are signs that these tenders could include 150 MW of floating and/or agrivoltaics.

In April, Germany’s “innovation” tender results were announced for combined solar+storage facilites, with some 258 MW of projects successful. Strike prices ranged between €0.0333 – €0.0429/kWh.

“Solar+storage is where we are going,” says WoodMac’s Khorana. “And I think the discussion will move away from wind versus solar and move to technology neutral. Governments are going to say, we want big, firm generation – 16/9 or 24/7.” And, indeed, Germany will hold another 250 MW innovation tender in August.

“We are going to be focused more on when electricity is delivered and less on how much [electricity],” says Jenny Chase. “Tenders that move things in this direction are a good thing, but they probably won’t go perfectly the first time.”

4: Make it in Europe

Module prices in Europe, and elsewhere, are on the up and there is significantly enhanced scrutiny on both the sustainability and labor practices across the PV cell and module supply chain. Combined with a significant uptick in demand, the stage could be set for an expansion of Europe’s PV manufacturing base – even further up the supply chain to polysilicon, wafers and cells.

Former tool maker Meyer Burger is making much fanfare of its module series launch, with its in-house HJT cell production. And a host of pure-play module makers in Europe have been investing in equipment for larger cell and module formats – taking the opportunity to expand production capacities at the same time.

“For ‘Made in Europe’ to happen, you need to have a local market,” says Berg, from IHS Markit. “You need to make sure there is demand for what you produce in Europe and stability in that demand for five, 10 or hopefully 20 years. Without that kind of visibility, investments will hardly take place.” And, indeed, demand expectations in Europe are more robust, however competition from Asia in terms of price, quality and technology remains strong.

“I think the ship has sailed on that one. But maybe there is some space for some innovative products,” says Khorana.

BloombergNEF’s Chase is equally subdued in her expectations. “It is good if people can choose to buy ‘Made in Europe’ modules, but there is also nothing wrong with Chinese modules. If we had always relied on European solar production, solar would still be a cottage industry. But I do like what Meyer Burger are doing and I wish them well.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Offshore solar could be a very big thing in the eastern Mediterranean. Plenty of sheltered water near to shore, where you could easily build a 5GW steerable array, with no issues about land acess, rights of way, historical monuments or difficult geography.

They do however need grid access and that needs to be a focus of the EU’s Green Recovery fund.