A senior adviser to the U.S. government's Power Africa program has told a webinar the Biden administration hopes to win the backing of Congress to double the volume of finance awarded annually to developing countries.

Michael Jordan, senior adviser to the Power Africa initiative run by the United States Agency for International Development (USAID), said the president intends to triple its climate change-related adaptation finance by 2024.

Jordan was speaking as a panelist during a webinar held by London-based continental business group Invest Africa to debate donor financing to the African energy sector. The event was held on Africa Day – May 25 – which marks the foundation of the Organisation of African Unity in 1963.

The Power Africa scheme is supporting African utilities in developing new business models, particularly in the low-margin markets of sub-Saharan Africa, Jordan told the webinar, and is also exploring the productive use of solar power in agriculture and other sectors. Agrivoltaics is a good example of how innovation can drive down African power costs, the USAID adviser said.

Agri PV

“There is a great opportunity for innovation to bring down the cost of power, make utilities more sustainable [and] help private and public sector investments,” said Jordan. “Innovation is not only key but essential and needs to be supported through all avenues, whether it's public or private sector or a combination of both.”

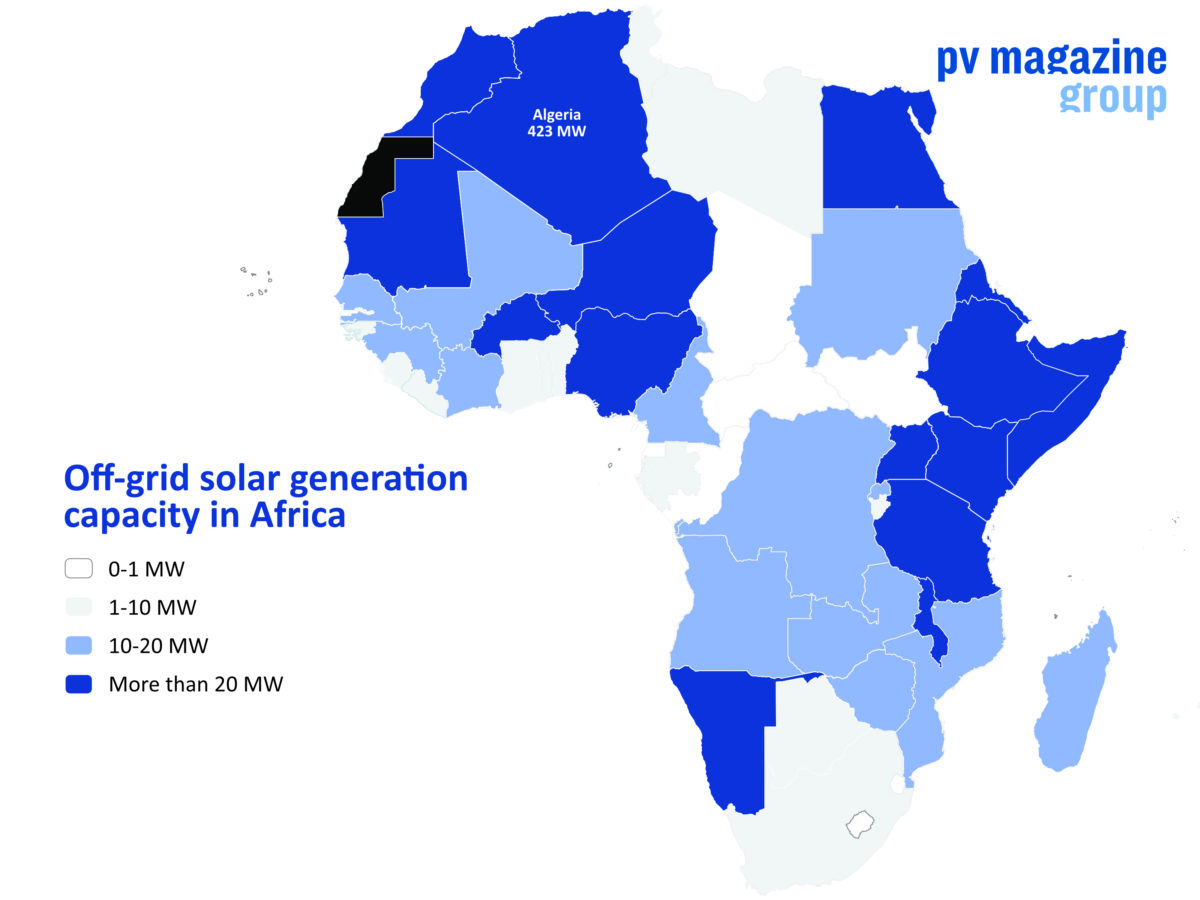

Jordan pointed to clean power mini-grids as the most successful form of renewables deployment across the continent but said such systems still require an element of subsidy. Power Africa, he added, is deploying such mini-grids to power healthcare facilities in six African nations.

That need for financial feasibility was echoed by Ammarens Bruggenkamp, manager for energy in West Africa and the Middle East and North Africa region for Dutch development bank FMO. Stating the Dutch state entity wants to venture into solar and wind power deployment to help plug a financing shortfall – with an additional emphasis on energy storage, mini-grids and off-grid systems – Bruggenkamp said the energy investment environment was crucial. “It all depends on the regulatory framework and the environment, and also the feasibility,” she said.

James Mackay, strategy and Africa south market lead for energy at accountant PwC South Africa, pointed to recent data which indicated the volume of power generation capacity added across Africa last year was at its lowest since 2008, with most of the new plants government-funded fossil fuel facilities.

Stranded assets

Mackay highlighted estimates the energy transition could mean as much as US$1 trillion of public money could be invested into stranded fossil fuel assets and Angela Nalikka, manager for national and regional power systems at the African Development Bank (AfDB), said fossil fuels were the biggest hurdle to renewables deployment on the continent.

Commenting on the role played by her employer in disbursing donor funds, Nalikka said: “The AfDB approach is in three ways: market building, preparation, and catalytic financing. We grant funds for project preparation. In most cases, they are small projects. Lastly, we provide catalytic funding. We can provide local currency options in many of the projects.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.