From pv magazine 05/2021

It has taken science and markets until 2021 to realize that the very things which make coastal desert regions sparsely habitable, namely excessive sun and wind, are precisely what makes them the near future’s great havens of energy.

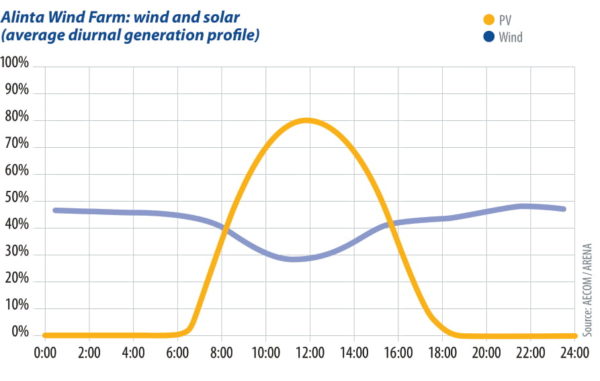

Wind turbines and solar PV can operate together symbiotically, and in deserts bordering seas in particular, this relationship is especially “anti-correlated,” meaning the sun shines during the day and the wind blows during the night.

This ensures for, say, a green hydrogen production plant, a near 24/7 source of renewable energy in a newly prized location. It seems then that the world’s wastelands are no more, for they are now the most prized locations on the planet for our energy future and emissions reduction.

In the last 18 months, hybrid power plants have become more common for their ability to complement a generator’s lifeline – their grid connection. Hence why Swedish state-owned energy company Vattenfall invested €35 million in 2019 to add solar and energy storage to its Haringvliet onshore wind project in South Holland. However, when it comes to green hydrogen production, the grid connection is not even always necessary. More important is the co-location of solar and wind.

So why is the co-location of solar and wind important for green hydrogen production?

Co-location advantages

BP and its solar joint venture Lightsource BP are currently concluding a feasibility study into the prospect of a 1.5 GW co-located wind and solar green hydrogen plant in Western Australia, with the ambition to export the green hydrogen as ammonia to Asia.

Scott Orchard, a project developer at bp Australia, told pv magazine that “co-locating renewables with a hydrogen/ammonia plant has the advantage of reducing the transmission infrastructure required [power lines]. If it is configured so that the plant is connected only to on-site renewables, infrastructure costs are within greater control of the project, with potential savings on network charges.”

Ad van Wijk, a professor of future energy systems at TU Delft, concurs with Orchard, noting that in the case of green hydrogen, a “grid connection is not required. What you want is to produce in locations with very low cost of electricity, with solar and wind, and then you ship the hydrogen … the idea is that the combination of solar and wind can sometimes have a better capacity factor.” Wijk points to Neom, an under-construction green city in Saudi Arabia. “It has very good wind and very good solar … But what is the wind over there? It’s a sea wind produced when a hot desert meets a cold sea.”

This near-perfect anti-correlation makes such locations ideal for clean energy generation. The hot air rises above the landmass throughout the day, causing a cold wind to blow in from the sea to replace it. Which is to say, the wind picks up when the sun goes down.

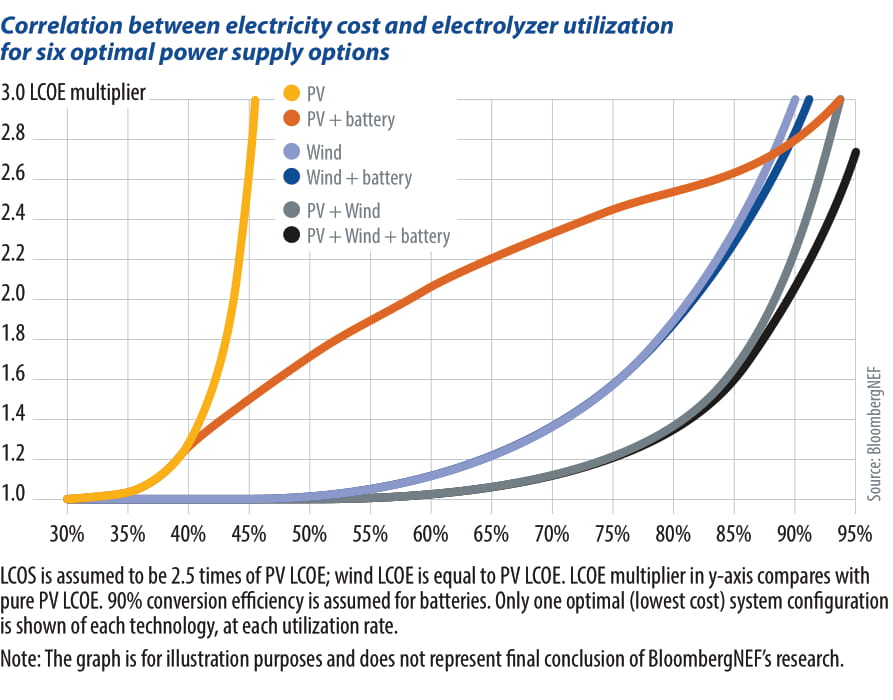

Xiaoting Wang, BloombergNEF’s leading researcher on green hydrogen production, highlighted “coupling” as a key factor in the levelized cost of hydrogen equation.

Wang recently hosted the hydrogen panel with Air Products’ president as part of BNEF Energy Summit, and told pv magazine that Air Products chose Neom because of the cheap electricity provided by its large-scale co-located renewables. And that if it wasn’t for Air Products’ specific need for a nitrogen plant, the whole project would not require battery energy storage at this stage, co-location would be sufficient. Though the economics of Neom’s offtaker deals are undisclosed, it may be assumed that large-scale green hydrogen projects looking to get off the ground before 2030 don’t necessarily need battery energy storage, and that saving could prove crucial to rapid development of scale.

Western Australia is another especially anti-correlated region, according to Aecom’s 2016 modeling for the Australian Renewable Energy Agency (ARENA), “Co-location Investigation: A study into the potential for co-locating wind and solar farms in Australia.” Take the 89 MW Walkaway Wind Farm (also known as the Alinta Wind Farm) outside the town of Geraldton on Western Australia’s mid-west coast (see chart, top right).

According to Aecom’s director of energy for Australia and New Zealand, Craig Bearsley, one of the writers of the report, co-location’s great benefit is as a way of “removing variability without adding cost.”

“It’s a coincidental benefit of co-location that comes for free,” Bearsley continued, “and the benefit is greater where you have greater anti-correlation … and with these hydrogen projects going for economies of scale getting benefit without cost is a huge factor.”

Battery storage

Another option being considered by large-scale green hydrogen developers, and one not mutually exclusive with co-location, is that of battery storage. London-based Eco Energy World (EEW) recently announced a 300 MW solar plant north of Gladstone, in the Australian state of Queensland, with a 200 MW hydrogen plant and 100 MW of battery storage. However, as Orchard noted, battery storage is not yet a cost-effective option, hence why EEW CEO Svante Kumlin told pv magazine that the Queensland project would therefore not only require a grid connection, but also probably a wind power purchase agreement (PPA) to run the plant at night and charge the battery. Of course, attaining grid connection remains an expensive and time-consuming process, especially in grid-constrained regions like Queensland, as Kumlin can attest. Therefore, such projects are at a disadvantage compared to projects like the 26 GW Asian Renewable Energy Hub, which finds its economic basis in the benefits of co-location.

Oversizing options

Be it co-location or battery storage, the crux of the idea is to flatten the daily cycle, generating a constant pattern year-round, enabling the electrolyzer to provide baseload which can be liquified, put in a pipeline, converted, or otherwise transported. And of course, as Wijk points out, oversizing means that the electrolyzer capacity needed for, say, 1 GW of solar, is not 1 GW, but 200-300 MW, as the generation is spread out over the daily cycle.

At far less expense, co-location also enables the flattening of the daily cycle, and still saves on the electrolyzer capacity. This is no mean difference. After all, Wijk reminds us that “the cost of electricity is the dominant factor in determining the price for hydrogen … It is not the capex or the opex (although we have to lower these costs) … When you have 1c/kWh, the energy cost of hydrogen is €0.5/per kilo. And therefore, when you have 2c/kWh, the price is €1/per kilo, and 4c/kWh means €2/per kilo, and then the Capex and Opex costs add about another €0.5…so you can see that you have to go where you have the lowest energy costs by renewables. And that is in the areas where you have very good solar or very good wind,” or what is even better, very good wind and solar working together.

Location, location

Unfortunately, these requirements blow away the notion that large-scale green hydrogen can be developed around the steel plants in the rural areas of, say, Germany, at least in the near future.

Of course, many countries will produce as much green hydrogen for themselves as they can, but the energy demand of countries like Germany or Japan far outstrip their natural resources of wind and solar. Germany and Japan will have to import, and they will import from the cheapest possible sources, places like Algeria, Saudi Arabia and Australia, where vast areas of desert and sea winds are predictably available.

“For green hydrogen production you always search for these locations,” stresses Wijk. The future possible scale required of green hydrogen is much larger than the current scale we have for electricity. After all, approximately 500 square kilometers are needed for 25 GW of solar.

“So, there will be competition,” continues Wijk. “And the competition is not necessarily about which is the best technology, or what is the highest efficiency, but what is the lowest system cost. That is what you have to see, that a solar panel in Morocco has two to three times the production of the same solar panel in a northern latitude.”

Pierre Etienne Franc, is the CEO of FiveT Hydrogen. The company has a hydrogen fund dedicated to developing large-scale private clean hydrogen infrastructure. Franc notes, “hydrogen is the common denominator between industry, energy and transportation sectors, and ultimately offers the opportunity for power producers to monetize their green electrons on a much wider range of local and export markets than if they were in the form of electricity.”

This is to say, the demand for green hydrogen is not simply to replace growing electricity demand, but demand across the board, and to do this green hydrogen needs to be produced on a huge scale. Given the enormous scale required for green hydrogen production to replace electricity demand, let alone the wider industry sectors detailed by Franc, it is in regions especially suitable to anti-correlated co-location that this scale is likely to be reached first.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The point is obvious, but the data to back it up are welcome. Three additions.

1. The former Spanish Western Sahara, annexed by Morocco, fills the technical conditions ieally: a coast for ships, plenty of sun, and clockwork trade winds. It is also conveniently close to potential markets in Europe and North America. The snag is political: the annexation is not recognized internationally, and is contested by a (currently rather inactive) liberation movement supported on and off by Algeria. Investors and insurers will look at the political risks and shy away. Perhaps the opportunity is golden enough for Rabat to seek a permanent settlement. The indigenous population is tiny.

2. You can add DRI ironmaking to the candidates for colocation. Upgrading iron lore into sponge iron briquettes or pellets cuts transport volumes and costs quite a lot compared to simply shipping the ore. The two big ore exporters are Western Australia and northern Brazil, so we can be sure that Vale (which ships ore in 400,000 tonne carriers) and BHP are looking hard at their options.

3. Neither of these regions has much potential for pumped hydro storage, but there are mountains close to the coast in Oman and northern Chile. If there’s no rain, you can use seawater, as proven by a long-running small PUHS scheme in Okinawa.

It looks like the fossil fuel industry is on its way out eventually. There is simply too much wind and sunlight available in the deserts worldwide.

Unfortunately or fortunately, this also makes Concentrating Solar Power (CSP) more attractive, due to availability of clear skies and water nearby.