With the 1.4 GW flood of new solar generation capacity added across North Africa in 2019 having slowed to a trickle of just 36 MW last year, an English data company has warned policymakers across the continent will have to decide their energy priorities.

Amid fears African governments are planning to strangle a vigorous market for independent commercial and industrial clean power generation in a bid to protect financially-stricken state-owned power utilities, Dan Marks, of African Energy Live Data, said political leaders “must ask themselves whether the economy is there to serve utilities, with companies prevented from procuring the cheapest or most reliable power and growing their businesses, or whether utilities are there to serve the economy.”

African Energy Live Data, part of Middle East and Africa-facing consultancy Cross-border Information, was highlighting the lack of net new electricity generation capacity added in Africa last year, with the 9.6 GW installed in 2019 falling to 7.7 GW in a Covid-hit 12 months.

May edition of pv magazine

Whilst the data company, which is based in Hastings, England, acknowledged the project development problems caused by the Covid-19 pandemic, it pointed to the fact the 2019 figure had also been a steep fall, from the record 19 GW of new power capacity installed in 2018. It is that, longer-term pattern which prompted the analyst to suggest politicians are struggling with the demands caused by the energy transition – and by the rise of private power developers – on state-owned electric companies.

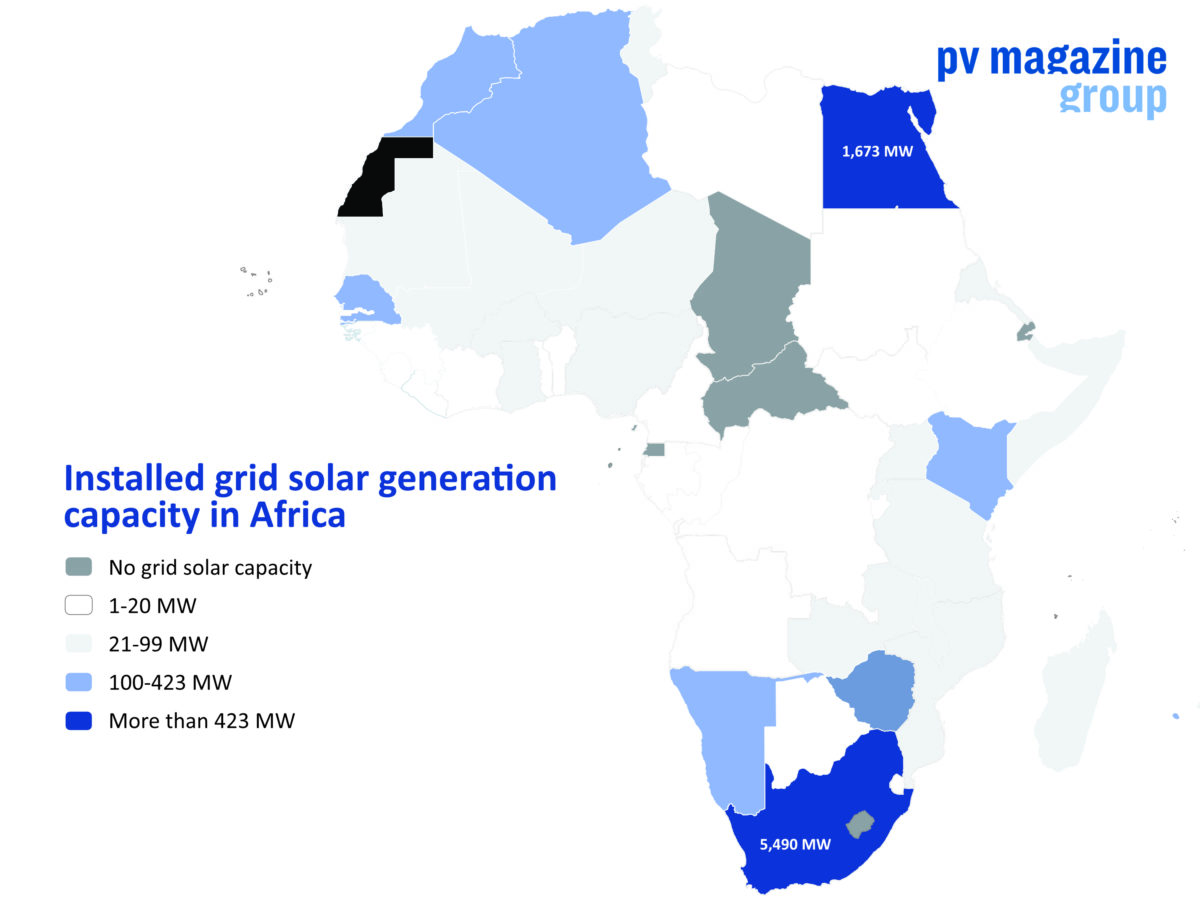

The effects on the solar industry were particularly stark in North Africa, where African Energy MD John Hamilton reported 3.1 GW of new gas generation capacity – of the 3.2 GW of gas added across the continent in 2020 – helped the region account for 4.3 GW of the 7.7 GW of projects installed across all of Africa. Hamilton cited “awkward regulatory and political blockages” as halting an energy transition which had seen 500 MW of solar projects added in 2018, before the following year's 1.4 GW peak.

The analyst said gas dominated the new generation capacity added in 2020, ahead of hydropower, which added a net 911 MW across the sub-Saharan Africa region from which African Energy Live Data removes special case South Africa. Solar was the third largest contributor to the new power mix, with 842 MW of new projects added last year, placing it ahead of wind capacity, which rose 829 MW.

Removing PV front-runner South Africa from the sub-Saharan equation saw the region add just 100 MW of new solar capacity, the same level as coal and wind and less than half the 207 MW of new liquid fossil fuel generation capacity, according to the data company.

Noting encouraging renewables progress in Togo, Burkina Faso, Mali, Chad, Mauritania and Senegal, however, the analyst said the proportion of renewables in the power mix rose across all of Africa except the north; the proportion of non-hydro renewables was almost as impressive, with just the north and east regions failing to rise; and the growth rate of non-hydro clean power capacity accelerated in West, central and southern Africa.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.