From pv magazine 05/2021

Note: In the past, the average prices for mono PERC modules considered the prices of earlier orders and delivery cycles, which could lag when prices changed rapidly. Since the price gap between spot prices and prices of long-term orders signed earlier has widened significantly this year, PV InfoLink has started using spot prices for module price forecast from this month.

Despite weak end-user demand, polysilicon prices remained high at CNY 135-140/kg ($20.7-21.5/kg, falling to $18.4-19.1 when China’s 13% VAT rate is excluded), in mid-April, a peak for recent times. Accordingly, PV InfoLink has revised its price forecasts upward.

The first half of the year has seen polysilicon capacity additions from East Hope and GCL-Poly, as well as some smaller Chinese manufacturers reopening production lines amid high prices. Tongwei’s Yongxiang unit will bring a larger volume of new capacity online at the end of the year. The PV supply chain currently embodies more than 200 GW of annual polysilicon capacity, enough to fulfill 155 GW of end-user demand. However, the large scale of recent wafer and cell capacity expansions has led to panic buying and stockpiling. Gaojin and other manufacturers will add larger volumes of ingot pulling capacity in the second half of the year, while some large polysilicon manufacturers will conduct annual equipment maintenance in the third quarter. Polysilicon is now the biggest bottleneck in the supply chain. In anticipation of a further shortage in the third quarter, trading prices for large orders between large manufacturers reached CNY 128-130 ($19.6-19.9)/kg at the beginning of April, up 10% from the CNY 115-120 ($17.7-18.4)/kg orders signed in March. The upward trend continued to mid-April, with prices sitting as high as CNY 130-140 ($19.9-21.5)/kg.

Since the second half of 2021 will see significantly stronger demand than the first, and new polysilicon capacity won’t come online until the end of the year, shortages will persist until the arrival of the low season and after the Lunar New Year 2022, when new production lines are up and running. The average price of polysilicon in 2021 will come in at CNY 117 ($17.9)/kg, far higher than the average of CNY 76 ($11.7)/kg last year.

China’s Xinjiang region accounts for more than 40% of global polysilicon production. The impact on the solar sector of international moves against forced labor should be watched very carefully. If a ban on import of modules using Xinjiang-made polysilicon takes effect, polysilicon supply in non-Xinjiang regions, although sufficient to fulfill U.S. demand, will be tight due to the pre-existing shortage. If restrictions are brought in, a price gap between polysilicon in Xinjiang and non-Xinjiang regions will emerge.

Polysilicon prices

In the face of price hikes, cell manufacturers continue to buy wafers for fear of difficulty acquiring enough materials. This is despite significantly lower utilization rates and purchase volumes of cells among module makers in April. As a result, wafer prices have been on the rise along with polysilicon between March and April.

Since the end of the Lunar New Year, wafers and cells each have around 16-17 GW of monthly production, an identical factory output. However, there is only around 13-14 GW of module production and 10-12 GW of end-user demand each month, suggesting cell and module makers are faced with inventory pressure.

While production cuts did not help to ease pressure on module inventories in April, price competition did not occur as before. Large module makers were busy securing profits and seeking to keep prices stable. Even prices for 3.2 mm glass slipped from CNY 38-40 ($5.8-6-1)/m² to CNY 28 ($4.3)/m² in April and brought down overall costs by CNY 0.04-0.05 ($0.0054-0.0068)/W. Module prices in the Chinese market only declined by CNY 0.02/W as of mid-April. Another round of price increases in mono and multi-Si wafers in April again hurt PV module profits.

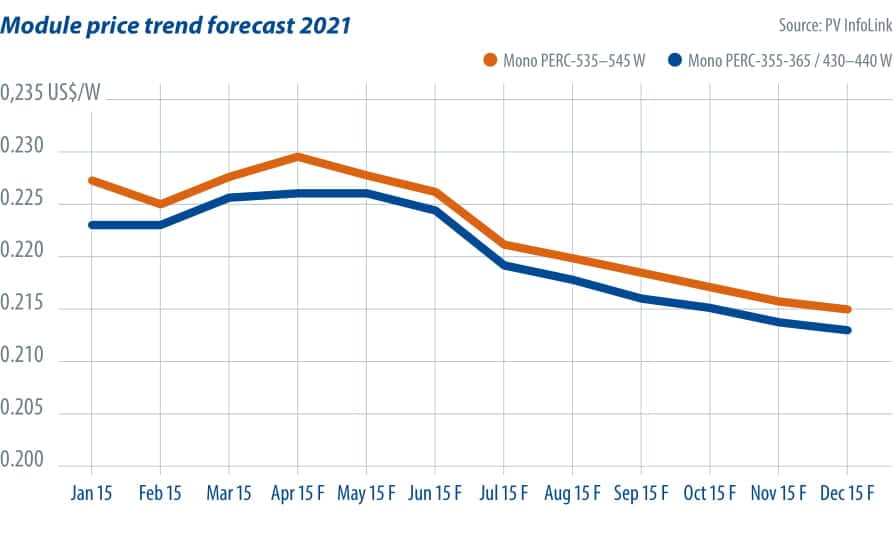

Price quotes for modules for the second half are much higher than the pre-Lunar New Year period. Monofacial modules rated beyond 500 W are estimated to be priced at CNY 1.65-1.67/W and $0.22/W in the third quarter, a marginal decrease compared with CNY 1.68-1.7/W and $0.225-0.23/W. No intense price competition occurred, because large manufacturers, which have become increasingly dominant this year, prioritized keeping profits and stabilizing prices rather than grabbing market share. Therefore, the mainstream trading prices are little impacted, even though Tier-2 and Tier-3 module makers offered lower prices.

As the upward price trend for modules continues, with orders signed earlier being renegotiated more recently, the internal rate of returns for PV power plants has also taken a hit, forcing many projects to postpone construction. For now, demand forecast for non-China markets is around 100 GW – not much increase compared with last year’s 95 GW. Having said that, Chinese demand outlook still looks bright this year, because PV plant developers wish to stay in line with the government’s renewable energy directive to meet installation goals, and the residential sector will continue to be subsidized this year. It’s estimated that the global PV market will see around 155 GW of solar PV module demand.

Corrine Lin

| Estimated global monthly factory output (GW) |

||

| Q1 2021 | Q2 2021 | |

| Polysilicon | 46.5 | 45.6 |

| Wafer | 50.6 | 51.8 |

| Cell | 47.8 | 51 |

| Module | 42.3 | 39.9 |

| Estimated demand for modules | 32.6 | 36 |

| Source: PV InfoLink | ||

About the author

Corrine Lin is the chief analyst at PV Infolink, and she collaborated with her team in Taiwan to produce this article. PV InfoLink is a provider of solar PV market intelligence focusing on the PV supply chain. The company offers accurate quotes, reliable PV market insights, and a global PV market supply/demand database, as well as market forecasts. It also offers professional advice to help companies stay ahead of competition in the market.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.