From pv magazine 05/2021

Stabilization has given way to renewed price adjustments by most module manufacturers in recent weeks. We saw price hikes in March of up to one U.S. cent per watt, more or less across the board. Compared to the foruth quarter of 2020, prices on average have risen a full $0.02 to $0.03 per watt, which corresponds to 10-15% at current levels, and cannot simply be compensated elsewhere in calculations for existing projects. It is rare for a manufacturer to agree to binding price commitments for new orders. Wholesalers and project customers can still lock in quantities, but generally can no longer receive firm prices, at least not beyond the current quarter. One reason for this is that upstream suppliers, especially for polysilicon, wafers, and solar glass, no longer want to be bound by price guarantees, preferring to trade on the basis of daily prices.

Stabilization has given way to renewed price adjustments by most module manufacturers in recent weeks. We saw price hikes in March of up to one U.S. cent per watt, more or less across the board. Compared to the foruth quarter of 2020, prices on average have risen a full $0.02 to $0.03 per watt, which corresponds to 10-15% at current levels, and cannot simply be compensated elsewhere in calculations for existing projects. It is rare for a manufacturer to agree to binding price commitments for new orders. Wholesalers and project customers can still lock in quantities, but generally can no longer receive firm prices, at least not beyond the current quarter. One reason for this is that upstream suppliers, especially for polysilicon, wafers, and solar glass, no longer want to be bound by price guarantees, preferring to trade on the basis of daily prices.

Demand continues unabated, at least in Europe, especially in the booming small-scale sector and for medium-sized installations. Restrictions in Germany’s EEG have not led to a decline in demand – at least from the point of view of wholesalers – and it far outstrips the current supply of modules. For inverters and battery systems, the situation is a bit better. However, sought-after module types are sold out months in advance, and in some cases fresh supplies have not even been announced, even in the case of new module formats. When manufacturers are asked about the reason for this shortfall, they sometimes reply that they have had to cut production due to the difficult supply situation and high raw materials prices – is that even possible?

Analyst armada

An armada of analysts regularly predicts global trends in PV demand with great accuracy. Every quarter, forecasts are published with installation figures that point only in one direction – up. In addition, climate experts and activists also regularly note that the figures predicted or set by politicians are still far too low to achieve the CO2 reduction targets mentioned in the same breath. Why, then, is the industry unable to keep capacity planning in step with the rate of development? It cannot be due to investor money, of which there should be enough by now that could be channeled towards rebuilding a European solar industry with all stages of value creation, instead of being parked in cryptocurrency for lack of other stable and lucrative forms of investment.

Instead, we are still at the mercy of Asian manufacturers, who have massively expanded cell and module capacities in recent years, but at the same time have apparently missed the boat on successfully expanding polysilicon production. Of course, investment sums on a completely different order are required here. Asian manufacturers can usually rely on the generous support of their central governments. Apparently, they are still afraid of overproduction and a resulting drop in prices, and therefore often lag behind the market. Yet politicians and producers should be wary of overly pessimistic forecasts and trust in rapid demand growth, especially if prices are right. Unfortunately, we cannot necessarily rely on former industry leader, Germany’s Wacker Chemie AG. Its U.S. factory, which opened in 2016, has been a constant source of problems, with the result that the planned output, at least for solar silicon, has not been achieved to date.

Steadily rising prices have brought a different aspect of the global solar expansion into focus: the quality of solar installations. Low electricity prices make headlines and are celebrated by solar and climate activists, but they do not necessarily have anything to do with the genuinely achievable value. Given the current state of the technology, a multi-MW PV plant cannot produce electricity for $0.01/kWh on a sustained basis, regardless of where it is built. Either massive savings must be made in the quality of products used, or it is a risky bet on future electricity prices. Outside of Europe, participation in auctions is often solely about rapid grid access – even bids of €0/kWh are not uncommon. After the fixed price period has expired, however, revenue must be at least $0.02 to $0.03 or more for the project to pay for itself in the long term.

The second option – that only the cheapest components are used and savings are achieved in the cost of calculation, planning and subsequent operating costs – is rather rare, according to an industry expert, because clients are usually experienced energy conglomerates or international investor groups. Such an approach would be negligent and should be a thing of the past. As the saying goes: buy cheap, buy twice. But in the field of large-scale projects, this means that the initial operator will not experience the second time.

I can only urge that project prices be planned realistically, that only serious bids be submitted at auctions for grid access and subsidy volumes, and that the solar industry itself finally try to adapt to the generally known, always positive market development and formulate offers that fit the respective demand.

Martin Schachinger

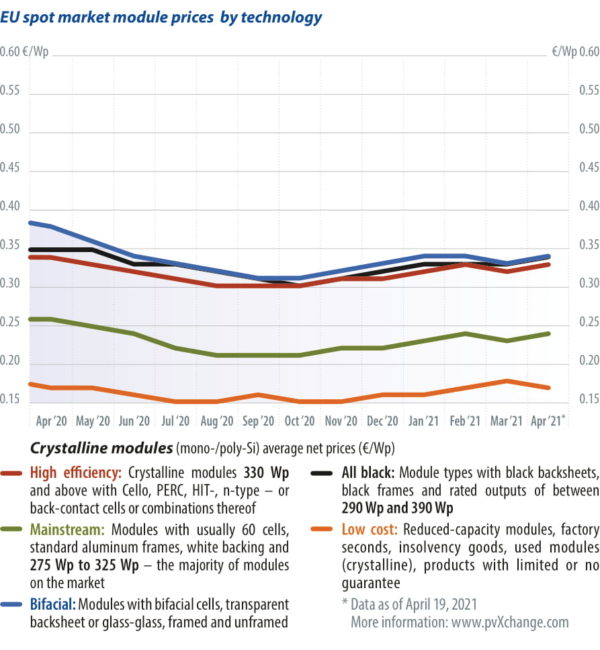

| Overview of the price points broken down by technology in April 2021, including changes over the previous month (as of April 19): |

||||

| Module class | €/Wp | Trend since March 2021 |

Trend since Jan. 2021 |

Description |

| Crystalline modules | ||||

| Bifacial | 0.34 | +3.0% | 0.0% | Modules with bifacial cells, transparent backsheets, or glass-glass, framed and unframed |

| High efficiency | 0.33 | +3.1% | +3.1% | Crystalline panels at 330 Wp and above, with PERC, HJT, n-type, or back-contact cells, or combinations thereof |

| All black | 0.34 | +3.0% | +3.0% | Module types with black backsheets, black frames, and rated power between 290 Wp and 390 Wp |

| Mainstream | 0.24 | +4.3% | +4.3% | Modules typically featuring 60 cells, standard aluminum frames, white backsheets, and 275 Wp to 325 Wp. |

| Low cost | 0.17 | -5.6% | +6.3% | Factory seconds, insolvency goods, used or low-output modules, and products with limited or no warranty |

| Notes: Only tax-free prices for PV modules are shown, with stated prices reflecting average prices on the European spot market (customs cleared) Source: pvXchange.com |

||||

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.