The use of decentralized rooftop or ground mounted solar systems to meet this energy demand is fast gaining popularity due to several advantages, including sustainability and electricity prices, over centralized power generation systems. Use of such systems plays a key role in the ability of nations to achieve their sustainability and decarbonization targets along with ensuring energy access and security to their populations.

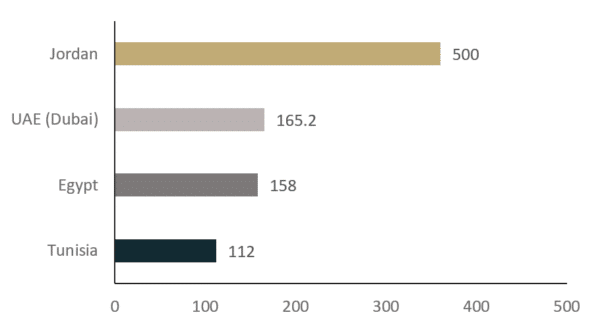

In the MENA region, which includes the UAE, Oman KSA, Bahrain, Kuwait (GCC), Jordan, Lebanon, Egypt, Tunisia, Morocco and Algeria, the clear frontrunners in terms of installed capacity are Jordan, UAE, Egypt and Tunisia.

Image: Finergreen

The addressable market for C&I projects in the UAE (Dubai), Jordan and KSA combined amounts to 4+ GW at a minimum, and installed capacity in these three countries has not yet reached 1 GW.

Over the past few years, Finergreen has had the opportunity to collaborate with a large number of players in this industry and has seen the market developing. Despite a difficult year in 2020, it is expected that more and more C&I sector activity will occur in the region soon.

C&I business models & regulations

Several business models exist today in the MENA region that support the growth of solar systems for C&I clients. These include:

- EPC/CAPEX model: Here, a client purchases the entire solar PV system with upfront cash. A certified EPC contractor provides turnkey services to design, construct, and install the PV system. The user enters into a contract and, based on payment milestones, pays the full amount to the contractor to connect the system and generate savings as soon as in a month. This model is popular with businesses/users that have surplus cash or a budget assigned towards sustainability goals.

- Lease model: A third party finances, constructs, and installs a PV system on a client’s premises (rooftop, carports, etc.) and leases it with a fixed monthly/annual leasing fee over a predetermined duration of time. During this lease contract, ownership of the system remains with the third party, which is transferred to the client at zero cost at the end of the duration. Although the lease contract can be transferred from one consumer to another, in case the building occupier changes, there is no guarantee that a new occupier will want to maintain the lease contract.

- Build-Own-Operate-Transfer Model: A developer designs, finances, constructs, installs, and operates a PV plant at the premises of a client or at an off-site location, and receives revenues for the energy produced by the PV plant at a predetermined tariff for a fixed duration of time, under a detailed Power Purchase Agreement (PPA). The plant is owned by the developer till the end of PPA life, after which it is transferred to the client at zero cost or a residual value.

These models and regulations have been successful due to the regulatory mechanisms prevalent in the countries with an active C&I market. Self-consumption, for example, directly reduces energy bills by using solar energy produced by a PV plant installed on-site. The solar plant directly supplies a share of the client's electricity demand during sunlight hours and can even be augmented by using battery storage for a longer supply of electricity.

For its part, net metering is a billing mechanism whereby clients can inject excess solar energy into the grid and are compensated through energy credits or via net billing where the exported electricity is credited at a fixed and pre-determined tariff rate (typically lower than imported electricity price). Usually, the PV plant is installed on rooftops, car ports, nearby ground within premises and are on-site.

Finally, wheeling is the transfer of electrical power via a utility’s transmission or distribution system between different grid or network service areas. For solar PV, the areas with strongest and most consistent solar irradiation are often geographically separate from the urban areas with maximum demand. Through wheeling, clients can benefit from the offset of energy bills by using solar energy produced by a plant off-site, at an additional wheeling fee on top of the solar tariff.

The Covid -19 effect

Numerous businesses have been severely impacted by the coronavirus pandemic. With almost no to low revenues due to the lockdown and reduction of business activity, the main focus has been on cutting costs wherever possible. Solar projects give them the opportunity to significantly lower their electricity bills at a minimum cost (in a lease model).

In the current situation, financing a project fully through an EPC/ CAPEX model is challenging due to lack of available surplus cash and a leasing model is welcomed by many to quickly start realizing savings without investing upfront cash.

Projects costs have also been fairly volatile this year. If the costs of solar have been lowered this year thanks to technology progress, the production capabilities have been limited because of lockdown, with the order books of the main suppliers being quite full and high uncertainty regarding shipping conditions and costs.

Regarding timing, despite a few project awards and successful financial closures, for which the majority of the work was done prior to Covid-19 (e.g. Qatar, Abu Dhabi), some of the new programs that were to be tendered in 2020 have been postponed to 2021. For instance, the third round of REPDO in Saudi Arabia has been extended twice, while OPWP in Oman has postponed the tender closing date for Manah 1 and 2 projects by three months.

The energy demand of C&I customers has also been greatly reduced because of lockdown and the reduction of commercial activity. It has been reported that Covid-19 led to a 2% decline in global electricity demand, according to the IEA's 2020 Electricity Market Report. Given the uncertainty of electricity demand, potential clients may be reconsidering their plans to implement renewable energy projects in the short term. Moreover, in some countries, governments have reduced electricity tariffs during the crisis to provide some relief measures (e.g. Egypt) leading to less immediate incentives to invest in such projects at the moment.

In terms of development timelines, project activity has slowed down due to Covid-19 restrictions. Meeting clients, conducting site visits, and negotiating contracts in person has been more challenging. Moreover, during lockdown and subsequent periods, governmental organization and utilities involved in permitting have not been operating at full capacities and working hours, hence leading to delays and a backlog of work.

Finally, MENA countries have been severely impacted by the oil price crash, leading to increased country deficits and negative growth rates in 2020. Many countries have had their ratings and projected GDP growth rates revised downwards. This coupled with the political issues faced last year (demise of rulers in Kuwait and Oman, government change in Tunisia, Lebanon and Jordan), have delayed the renewable energy plans of the countries due to restructuring and re-strategizing of national budgets and plans.

What to expect in 2021?

Can we assume 2021 will only be a re-start of missed/postponed business opportunities initially scheduled for 2020? Beyond the economic profile of the region, which has significantly weakened over the last 12 months (downgrade of Oman, Lebanon, Turkey, Sharjah, etc.), we expect a catalyst effect of what has just been presented before. This is the result of an alignment in favor of the C&I: financing, regulations, and bankability.

Though a critical bottleneck in the development process of PV projects, financing sources are becoming more available and easier to process as a result of:

- Reduction of various discrepancies between the regional banks in terms of knowledge in financing PV projects.

- Achieving scale and reaching critical size with the increase of PV pipelines and operational assets, which makes PV assets more appealing and “easier” to consider if structured like portfolios. Recent success of KSA based bank lending to projects in the C&I sector demonstrates such statements so other banks are expected to potentially replicate similar structures.

- More efficient due diligences processes as they become more “industrialized” within financing institutions, thanks to the experience built progressively, reducing costs, and turnaround times.

- Abundance of liquidity levels if we consider the “Evolution of green debt issuances in the MENA region” since 2015 from CEBC, 2020 reaching a floor that is expected to be temporary.

Also, regulations in different countries have evolved significantly, promising faster development of C&I markets. There are still some gaps in some specific countries or Emirates like Abu Dhabi, Oman, and Morocco, where laws are expected to evolve, but the base and framework for solid development already exist.

Finally, bankability is critical, especially with respect to the creditworthiness of off-takers considering contract durations. We expect a “flight to quality” on the development of the projects. This means a slowdown of the race to securing projects below par and more attention paid to:

- Guarantees and liabilities packages will be adapted with a focus on stronger off-takers.

- Tenor of contracts should also be re-evaluated so developers and off-takers find a right consensus between risk and profitability ratios.

- As a result of potential default of off-takers, the documentation phase is likely to be strengthened as well with clauses covering changes in laws, pandemic and unexpected events to be systematically added by default.

Except in the utility scale sector where MENA is steadily growing in terms of projects awarded and installed capacity in the world every year, C&I has often been one step behind when compared to SE Asia or LatAm. The market took time to reach maturity and growth, with oil-based economies limiting the development pace of such projects. At a time where it is evident that the use of solar PV should be the trigger to unlock energy transition, MENA is expected to be as fast, innovative, and ambitious as it has always been on many other domains over the last decade.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.