From pv magazine 03/2021

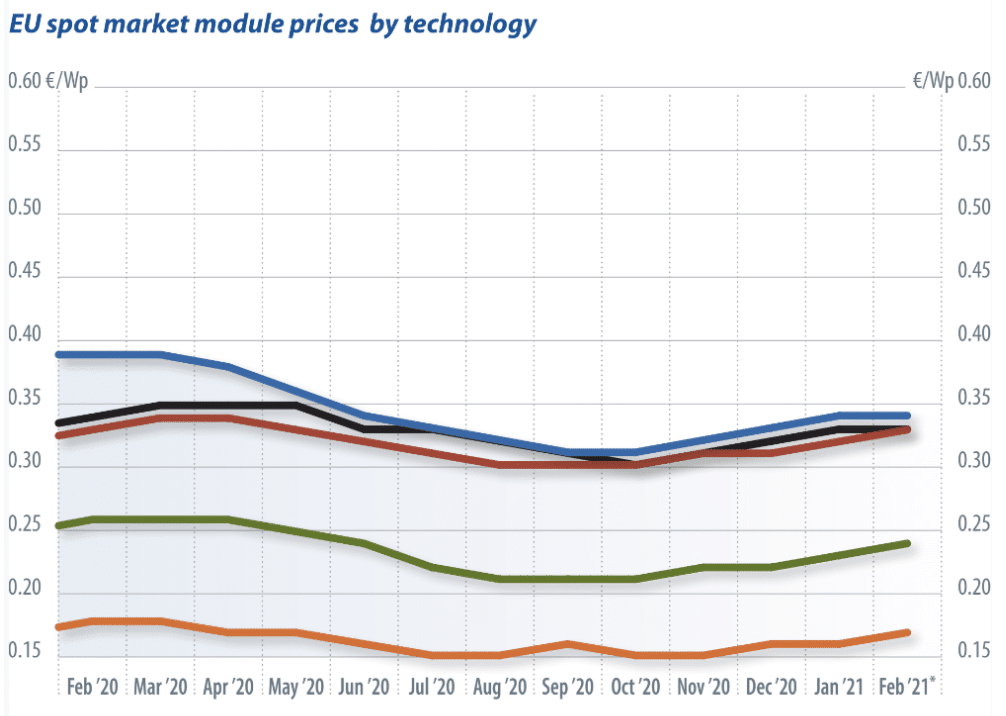

Last month, I reported on various factors shaping the current PV market and module prices. In addition to political factors, there are transportation bottlenecks between Asia and the rest of the world, and supply constraints with many essential materials required in panel production. Since then, an increasing number of Asian manufacturers and suppliers have raised prices or announced increases in the period after Chinese New Year. Given the ongoing pandemic and resultant pressure on business strategies, it is highly unlikely that something unexpected will happen to relax the current situation and cause a reduction in module prices. In fact, a further increase in prices is more likely.

Supply constraints

One hand is no longer enough to count which basic materials required for continuous module production have become supply constrained, and therefore more expensive. It has become commonly accepted that polysilicon and solar glass are a challenge to source. Some industry participants are also on alert for steel and aluminum – required materials for module frames and racking products, but supplies are slowly becoming critical. Considering that these constraints are generally the result of insufficient production and transport capacities, supplies should increase within a matter of months, thanks to the re-expansion of production and shipping.

A far grimier picture presents itself in the case of precious metals, where mining and processing capacities cannot be readily expanded. Based on the Covid-19 pandemic, institutional and private speculators are pouring money into assets like platinum, silver and copper; leading to sharp price increases on the relevant commodities exchanges. Unfortunately, these precious and semi-precious metals are utilized in the production of PV cells and modules, creating further cost increases.

Grimier still, some of us might already be familiar with Xinjiang, an autonomous region in China recently mentioned in the context of forced labor. Specifically, alleged measures taken by the Chinese government to the detriment of the Uighur people, a Muslim minority in this westernmost part of China. Forced labor, wherever it may occur in the world, is cause for concern, but not many in the solar sector are aware that a large part of the globally available polysilicon, which is the raw material used to manufacture solar cells, is produced in Xinjiang. The United States has already moved towards sanctions on other materials produced in this region, including cotton and cotton-based products. The next step is to possibly extend sanctions to the import of polysilicon or, at least, to impose significant punitive tariffs on such goods. In addition, pressure is mounting on the European Union to follow suit.

Such import measures could have a dramatic impact on the global trade in solar products. 50% of the polysilicon produced in China comes from Xinjiang, amounting to a global market share of 40%. Some polysilicon manufacturers – including Daqo New Energy, TBEA, and East Hope – produce almost exclusively in this region and cannot move their heavy industry so easily. And all this is happening in an environment in which supply constraints are already elevated and the situation is challenging. It is too early to tell if the statements released by some manufacturers, in which they verbally distance themselves from the use of forced labor and human rights violations generally, can still prevent the imposition of sanctions against the solar industry. Meanwhile, reports of human rights abuses of the Uighur minority continue.

Let’s be candid – environmental and social standards are still not accorded the value they should have in our economic system. In Germany this is made plain by the currently controversial discussion surrounding a new law on global supply chains – a law that is long overdue.

This law requires companies to assess production steps across the entire supply chain to then certify that none of these steps harm the environment or violate employment conditions. The law applies to all materials and finished products sourced outside Germany. No real consequences are attached to non-compliance with this law, but it will serve to increase transparency and make greenwashing or profit maximization on the backs of workers in other countries more difficult.

Products that do not satisfy this law in Germany will also become less attractive in the market. But at the same time, European companies faced with increasingly stringent environmental and social standards, will be strengthened by such a regime. This should be in all of our interest. Martin Schachinger, pvXchange.com

About the author

Martin Schachinger has been active in the field of photovoltaics and renewable energy for more than 20 years. In 2004 he founded the internationally renowned online trading platform pvXchange.com, where wholesalers, installers, and service companies can purchase standard PV components as well as solar modules and inverters that are no longer manufactured but are still urgently needed to repair defective PV systems.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.