From pv magazine 03/2021

Manufacturing capacity continues to grow across the PV supply chain. As manufacturers are ramping up to stay competitive and optimize costs, the impacts of unbalanced supply and demand will become even more pronounced. Manufacturer strategies and market trends are becoming clear toward the end of the first quarter.

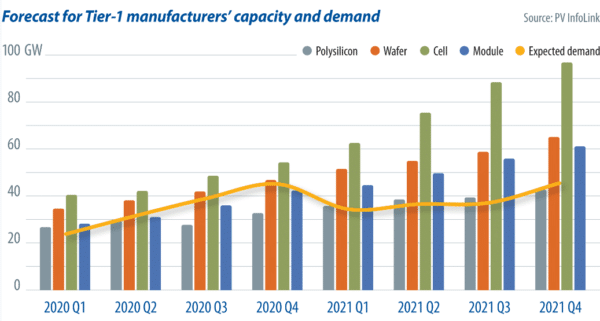

The supply chain will see growing concentration of manufacturing capacity, with the polysilicon and wafer segments showing the dominance of a few big fish. The market share of Tier-1 polysilicon and wafer manufacturers is expected to reach 78% and 90%, respectively. Tier-1 cell and module makers also continue to ramp up capacity in response to large size trends. Capacity distribution is shifting toward large companies. PV InfoLink calculates that the estimated market share of Tier-1 cell and module manufacturers will respectively reach 87% and 60% this year.

From a supply perspective, Tier-1 manufacturer capacities are enough to meet market demand. With advantages in costs, technology, and branding, Tier-1 manufacturers will push Tier-2 players to slow capacity ramps and even edge them out of the market.

As PV production capacity increases, the market risks imbalance. Due to rising costs from accident-induced polysilicon shortages last year, vertically integrated companies announced capacity expansion plans. Consequently, cell capacity becomes excessive this year, and PV InfoLink calculates that continued expansions will bring the self-sufficiency rate of the 10 largest vertically integrated manufacturers to more than 80% by the end of the year.

Cell makers will need to transform to compete with these rivals. Since 2020, manufacturers have formed strategic alliances and signed long-term supply contracts. Some manufacturers have also begun to plan roadmaps for next-generation technology in the face of solar cell overcapacity. Longi, Jinko, Aiko and Tongwei, for example, may all earmark new production lines to be installed later for n-type. However, the progress of capacity expansion of HJT and TOPCon has been slow, as HJT needs to drive down costs and TOPCon needs to overcome technical barriers. The progress of GW-scale projects, the materialization of capacity expansion plans, and market consolidation trends will be crucial this year.

In addition to pushing supply chains to become integrated, the 10 largest vertically integrated companies have announced long-term glass supply plans to ensure smooth supplies. Against this backdrop, last year saw increasing monopolization, and as the market shifts to large-sized products, PV manufacturers will face a structural change in supply and demand, as well as competitive prices.

Size shift

The supply chain has experienced a shortage of products differing in size since 2020, thanks to the rapid size transition in China. This has occurred more slowly in overseas markets, resulting in a gap between end-user demand and products being promoted. Thus, solar products and bill of materials underwent short-term price turbulence, with prices for 158.75 mm G1 mono PERC cells exceeding that of 166 mm M6 cells for the first time. The size shifts suggest that such short-term structural gaps may occur at the final stage of a product’s life cycle: Prices will rise in the short term and decline as demand shifts.

The structural gap may also occur in the glass segment due to limitations in furnaces and longer time requirements on capacity expansion and adjustment. This year, Xinyi Glass, Flat Glass Group, CSG Holding, and Almaden will be ramping up capacity, while small-sized glass manufacturers reopen older production lines or plan to expand capacity. Meanwhile, the Chinese government has relaxed regulations on glass capacity expansion. However, supply of large-format glass will remain short because it will take time for new capacity to come online. In light of this, vertically integrated companies are active in signing long-term contracts in advance.

Price trends

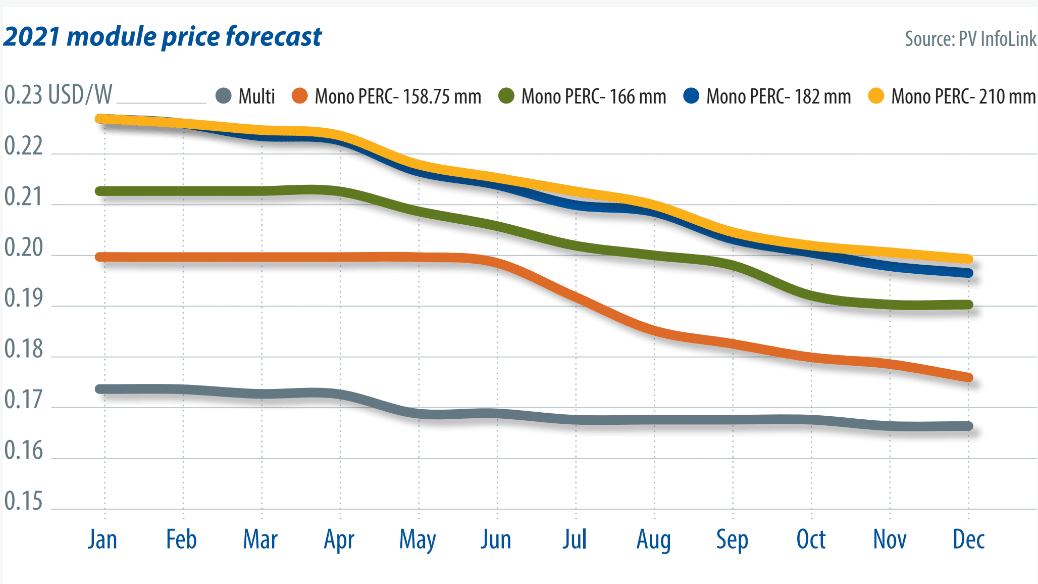

Polysilicon shortages sent prices in the mid- and upstream segments up in Q1. As polysilicon and module bill of materials prices are expected to remain high in Q2, module manufacturers face rising cost pressures. Module prices will remain at a high level throughout the first half, with modules using M6 wafers expected to sit at $0.202-0.208/W, with a price gap of $0.01/W for modules based on 182 mm M10 wafers. The average prices of modules based on the 210 mm G12 wafers may be slightly higher.

Given that new production lines are expected during Q2 and Q3, in which the low season will fall, monofacial modules based on M6 wafers may decline to lower than $0.20/W. Moreover, manufacturers that supply large-format modules become more monopolized, and supply of large-format glass won’t be sufficient compared with conventional sizes. Therefore, there won’t be much price reduction in Q3. Prices for M10-based modules will decline to $0.202-0.21/W, but prices won’t collapse as they did after China’s June 30 installation rush in previous years. Overall, high module prices, high freight rates, and a weakening U.S. dollar, as well as the ongoing pandemic, may impact PV demand.

Vertically integrated companies are tightening controls over their supply and moving production in house, while manufacturers are active in forming partnerships to secure supplies and stay competitive amid the transition to large sizes. Some manufacturers are also planning n-type technology roadmaps to stay ahead in a rapidly changing market. Clearly, manufacturer strategies play a defining role in market concentration.

About the author

Amy Fang focuses on research and analysis of the solar cell segment of the supply chain. She supports the team at PV InfoLink in producing market trend analysis, and works across price forecast and production capacity data services. She contributes to solar cell technology research efforts and provides timely analysis of market trends.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.