From pv magazine 02/2021

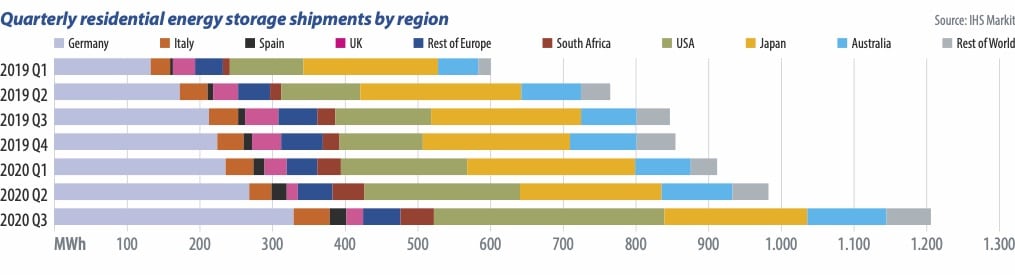

Although most economies were hit by various efforts to curb the global pandemic, some countries with more lenient restrictions for energy storage installers performed stronger than expected in the second quarter.

Germany provides a standout example, having now delivered quarter-on-quarter growth in residential storage installations for eight consecutive quarters (Q4 2018 – Q3 2020). Shipment data for the first three quarters of 2020 amounts to nearly 850 MWh and more than 90,000 systems, compared to 741 MWh and 85,000 systems during the whole of 2019. However, many of these systems shipped earlier in the year will not be installed until the fourth quarter or later.

IHS Markit predicts that a strong fourth quarter in Germany will lead to it overtaking Japan to become the largest residential market for the first time. In part, this sustained growth has been driven by homeowners choosing to invest in their homes instead of traveling or taking vacations, as options to travel were significantly restricted, and by local subsidy schemes supporting the uptake of rooftop solar and energy storage.

During this time, the German market has also seen a shift in leading players, as domestic suppliers E3/DC, Senec, and Sonnen performed strongly. Together, they accounted for more than 52% of the market in the first three quarters of 2020. At the same time as these changes in market dynamics, a trend which IHS Markit previously highlighted was coming to fruition, as Li-ion iron phosphate (LFP) tech has gained traction and become the favored battery chemistry.

The United States had a strong start to the year, with more than 15,000 systems shipped in the first quarter (a 66% increase on Q1 2019). This was helped by concerns about wildfires ahead of the summer, which have led to power outages. Shipments continued to rise in the second quarter, as state restrictions in California (the largest market in the United States) allowed the installation of solar and/or residential energy storage systems to continue. As the summer arrived, utility Pacific Gas & Electric took a cautious approach to managing its network and implemented rolling outages as a method of mitigating against the potential risk of wildfires following the disaster in 2019, which sent it into bankruptcy. These outages saw many homeowners turning to solar and storage, leading to record quarterly shipments of 317 MWh (over 25,000 systems) shipped in the third quarter.

IHS Markit also tracked a new trend in the U.S. residential sector. Systems able to provide full home backup were selling faster than those that provide only partial backup. This is one factor that helped Tesla to secure a dominant share of the market in 2020. An additional factor was the acquisition of Vivint Solar by Sunrun. Vivint Solar had historically been a strong sales channel for LG Energy Solutions (formerly LG Chem), but is now merged with Sunrun, which favors Tesla solutions for residential energy storage.

Other markets

Lockdown restrictions across Europe saw many residential energy storage markets stall sharply – notably Italy and the United Kingdom. However, there was no significant reduction in shipments, as international suppliers continued to ship systems.

The Lombardy region of Italy, which would typically see a large volume of storage installations, went into total lockdown, along with neighboring regions (and eventually the entire country). This resulted in almost no installations in the second quarter. However, shipments continued to arrive in anticipation of a market recovery. As restrictions were relaxed, uptake increased, driven by Lombardy’s renewed subsidy scheme and a new EcoBonus (110% tax credit) that started in July. This has allowed for the market to recover, and so far unit shipments in the first three quarters of 2020 are only 7% lower than for the whole of 2019.

The United Kingdom saw a similar reaction to Covid-19, as many installers took advantage of the government’s furlough scheme to reduce their workforce as lockdown went into force. Shipments did continue, however, with varied levels of restrictions remaining in place. And with no direct incentives for residential storage installations, they have taken a significant hit in 2020, with IHS Markit predicting a 37% decrease in shipments in 2020, compared to 2019.

Key trends

After a challenging year, the global residential energy storage market will accelerate in 2021, and IHS Markit forecasts that global installations will grow by 27% compared to 2020. This will be aided by the ongoing recovery of the global economy, specific incentives for energy storage, and a continued desire for self-consumption for rooftop solar owners. Several other key market developments are also predicted to take place this year.

Germany will reinforce its position as the largest residential market, having surpassed Japan and the United States in 2020. New markets in Europe, such as Spain and Belgium, will see an acceleration, following the European Union’s clean energy initiative and stimulus packages.

And on the technology side, LFP battery chemistry will continue to grow in strength and popularity, as long as demand from the automotive sector does not grow faster than anticipated and affect availability. Integration with home management systems and the smart charging of electric vehicles (EVs) will also emerge as new drivers for homeowners to install residential energy storage systems.

By Michael Longson

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.