From pv magazine 02/2021

Germany’s 2021 EEG places a hurdle at 300 kWp for rooftop PV systems. While projects of this size and above are not required to participate in the public tender process, abstaining means that they automatically forego remuneration for 50% of the energy they feed into the grid. This new option seems so unattractive that many will for the time being prefer the old scheme, in which operators of rooftop systems up to 750 kWp are entitled to full remuneration for the power their systems generate. For installations designed according to the old rules, there is a deadline of March 31, 2021, when rooftop systems up to 750 kWp must be connected to qualify for the full feed-in tariff.

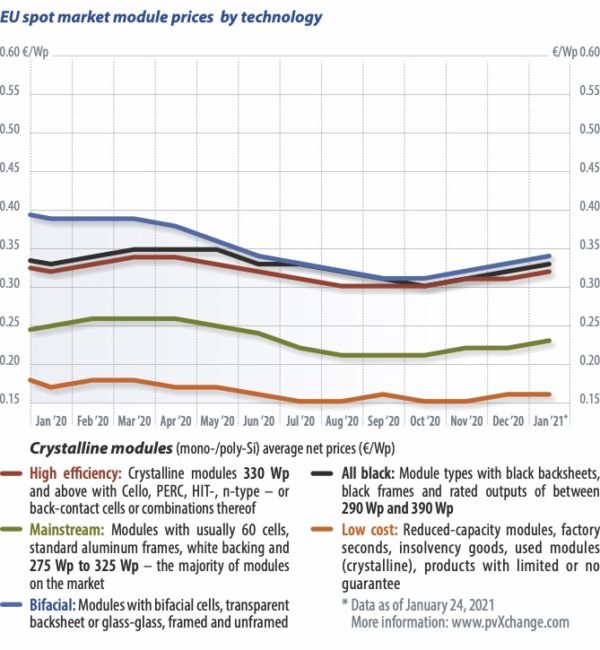

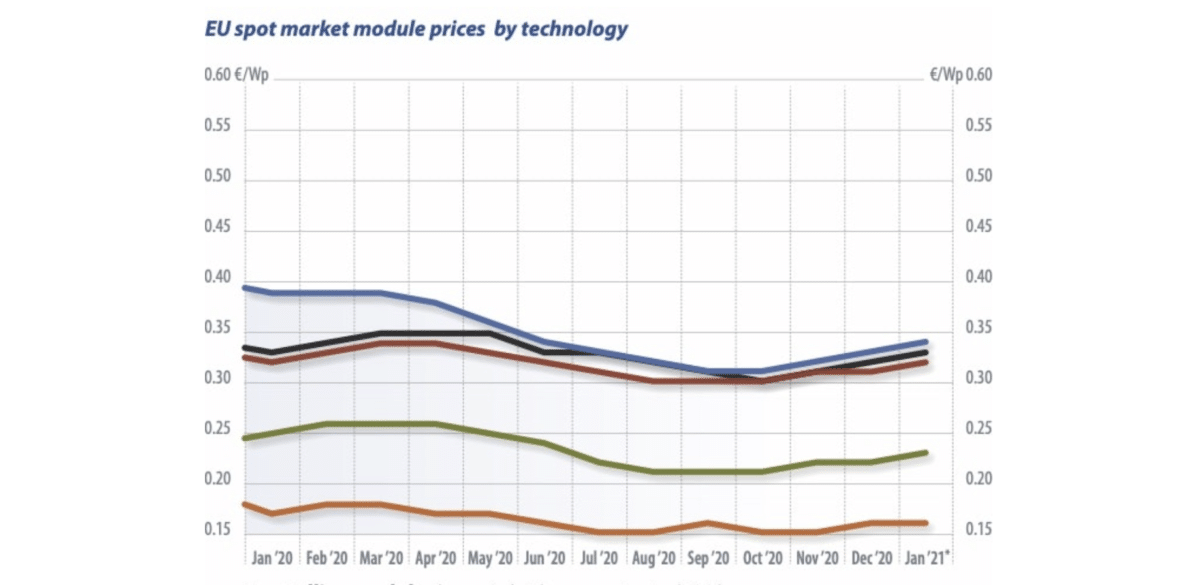

Industry players know all too well what such a deadline means: A scramble for all of the panels and inverters available by mid-March is already running at full tilt. Unfortunately, this has been exacerbated by the fact that Chinese manufacturers cut back on production volumes, and in particular on delivery volumes to Europe, at the end of last year. Raw materials prices rose across the board over the course of 2020, presumably due to pandemic-related production shortfalls in the spring. This caused bottlenecks and price increases, which made inexpensive modules hard to come by.

Industry players know all too well what such a deadline means: A scramble for all of the panels and inverters available by mid-March is already running at full tilt. Unfortunately, this has been exacerbated by the fact that Chinese manufacturers cut back on production volumes, and in particular on delivery volumes to Europe, at the end of last year. Raw materials prices rose across the board over the course of 2020, presumably due to pandemic-related production shortfalls in the spring. This caused bottlenecks and price increases, which made inexpensive modules hard to come by.

Even more dramatic, however, is the bottleneck in the logistics sector. Freight prices from Asia to Europe have increased almost fivefold in recent months. This sharp rise, which accounts for the largest proportion of current module price increases, is probably due to the lack of return freight to Asia. In European seaports, containers – both full and empty – are piling up, and that is squeezing the supply in Shanghai and Shenzhen. The pandemic has meant that for some time now fewer goods are being exported from the United States and Europe to Asia, rather than vice versa. The lack of affordable transport has likely resulted in many modules being sold and installed in Asia.

In China, after a weak first half of 2020, there was a race to catch up to 40 GW of new PV capacity. In 2021, this trend is expected to continue, with up to 50 GW of new installations. Accordingly, supply capacities for Europe are likely to be limited for some time. The Lunar New Year is also just around the corner. Time will tell whether travel around the country leads to another extensive lockdown in China, as was the case in 2020. After last year’s lockdown, it was impossible to imagine a regular flow of production and distribution of important goods for several months.

Overall, we should expect a further module price increase of $0.02 to $0.03 per watt-peak in the commercial and large-scale plant segment for future deliveries. In the already higher-priced small plant segment, the increase might be less pronounced. The current sharp surplus in demand will settle down somewhat after March 31, at least in Germany. Modules in the higher-efficiency range will probably be somewhat easier to come by in April and May.

Gambled away

For most in the PV sector, 2020 went comparatively well. After the first few months in the tight grip of the pandemic, something akin to normality returned to the solar market. Prices were on target, orders were in the pipeline, and for the first time it was possible to plan for the future. In December, which was slowed by the lockdown, everyone had been preparing for a quiet Christmas and did not want to hear anything about precautions and materials hedging. Thus, most players unfortunately did not see the dark clouds gathering.

Then in the first few weeks of January came a rude awakening. Suddenly, nothing seemed to fit together anymore, long-term plans were not working out, and supposed winners were turning into losers. Manufacturers, for instance, are dissatisfied with contract prices from 2020, which they can no longer maintain without incurring losses. In some cases, agreed selling prices are already 10% below current procurement costs. But fierce resistance from contractual partners means it is seldom possible to raise agreed prices. Suppliers can only hope that they will be allowed to deliver the quantity owed at a later date, when production costs come back down to earth.

Module buyers’ are not much better off. At the very least, installers for plants up to to 750 kW that have failed to make timely preparations are now likely to be in a world of hurt. They neither have access to the materials they need at the conditions they had previously calculated, nor sufficient time to procure and install new installations. There are simply not enough modules left on the market that can be delivered by the deadline. Everything that does arrive in time is sold to the highest bidder at steep markups. In fact, the products that are available are coming from those who made provisions in time but do not have to meet a deadline. Many of us know this type of hustle, not only from the stock market, but from the early years of the EEG, when the feed-in tariff degression kicked in on Dec. 31, and in the depths of winter, during the holidays, assembly and installation work had to keep going. This time, however, the deadline falls in spring, when temperatures will hopefully have risen again and work on the rooftops will be a bit more pleasant.

About the author

Martin Schachinger has been active in the field of photovoltaics and renewable energy for more than 20 years. In 2004 he founded the internationally renowned online trading platform pvXchange.com, where wholesalers, installers, and service companies can purchase standard components, solar modules, and inverters that are no longer manufactured but are urgently needed to repair defective PV systems.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.