From pv magazine 02/2021

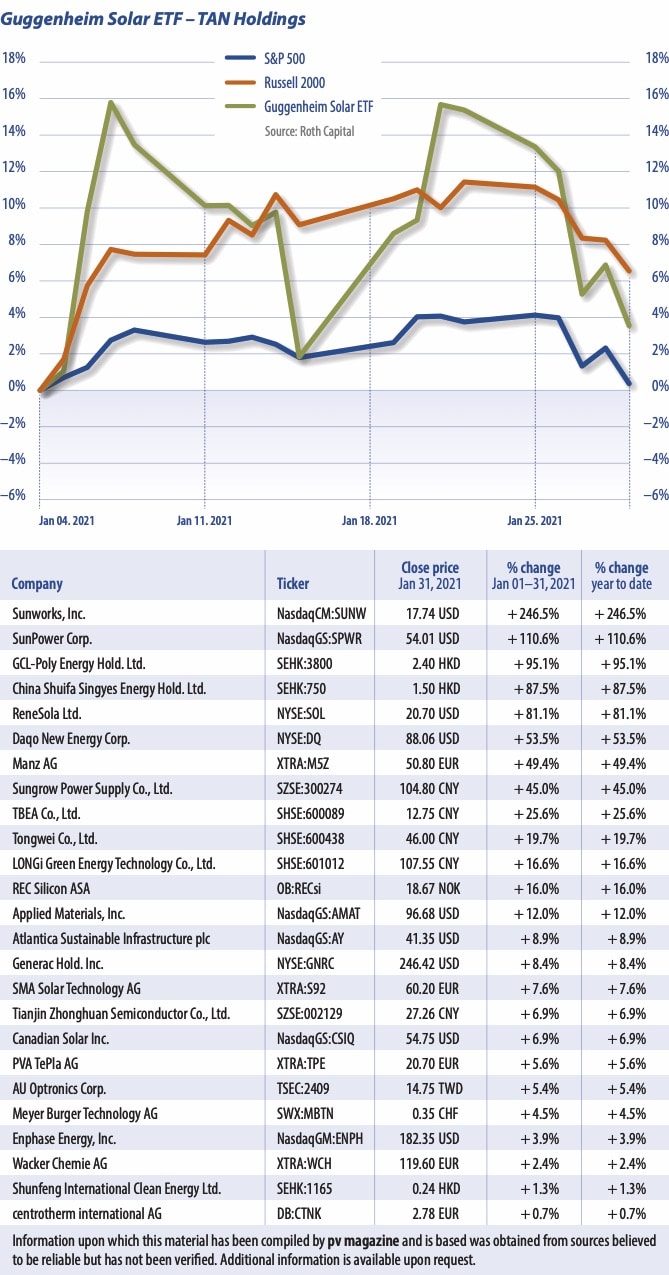

In the month of January, the Guggenheim Solar ETF (TAN) increased 5.8%, while other major market indices, includng the S&P 500 and Dow, decreased by 1.1% and 2.0 %, respectively, over the same time period.

In terms of monthly returns, the top five stock performers within the U.S. solar market for January were Sunworks (SUNW), SunPower (SPWR), ReneSola (SOL), Daqo New Energy (DQ), and Applied Materials (AMAT), which increased by 247%, 111%, 81%, 54%, and 12%.

In terms of monthly returns, the top five stock performers within the U.S. solar market for January were Sunworks (SUNW), SunPower (SPWR), ReneSola (SOL), Daqo New Energy (DQ), and Applied Materials (AMAT), which increased by 247%, 111%, 81%, 54%, and 12%.

While no clear indicators can explain SUNW and SPWR’s tremendous growth, the overall surge in solar stocks last month can be attributed to a combination of the Biden administration’s focus on climate change and a historic rise of retail investors entering the market.

Following a ‘Blue Wave’, the U.S. market is expecting more incentives to be implemented, specifically in the solar and energy storage sectors. They include (1) a permanent Incentive Tax Credit (ITC); (2) refundability or direct payments; (3) a storage ITC; (4) a permanent ITC at 10% for consumers, i.e. loans; (5) a jobs program and prevailing wage requirements, which the unions want, and; (6) national standardization of permitting and interconnection, among other priorities still to be determined.

The global market outlook for solar also remains positive for 2021. ROTH Analyst Phil Shen suggested that China’s demand in 2021 is forecast at 50 GW. It might even reach as high as 80 GW, depending on grid parity project demand and the development of solar module prices throughout the year.

EU installation capacity could also increase by 10 times from 2020 to 2030, driven by significant development growth on the commercial side and cost efficiency on the residential side.

By Jesse Pichel, ROTH Capital Partners

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.