From pv magazine Spain

As pv magazine reported earlier this week, the Spanish Ministry for the Ecological Transition and the Demographic Challenge (Miteco) allocated a total of 3.034 GW of clean-energy capacity on Tuesday at an average price of €24.47 ($29.62)/MWh, under its latest renewable energy auction. The capacity allocations included 2.036 GW of solar PV and 998 MW of wind energy.

A total of 84 participants submitted offers for 9.7 GW of capacity, which was more than three times the amount allocated in the procurement exercise. Only 32 companies were successful.

There were high expectations for the auction, as many expected it to deliver prices such as those seen in Portugal last summer. José Donoso, general director of the Spanish solar energy association (UNEF), said that the new auction model has worked very well.

“There has been a very important reduction in the average auction price of 28% over the average price of the electricity market in 2020, and over that of 2021, 62%,” he told pv magazine.

José María González Moya, the CEO of the Spanish renewable energy association (APPA), also praised the auction. “At an international level, the average price does not attract much attention, but we think it is a very reasonable and positive price for the sector,” he said.

Both González Moya and Donoso agreed that the auction will have an impact on final prices over the long run.

“The results of the auction are good news for consumers and to help the massive development of renewables,” said Antonio Delgado Rigal, CEO of Aleasoft Energy Forecasting. He hailed the results of the auction as “very positive for the sector,” and added that “they coincide with what we expected.”

Javier Asensio, the managing director of Falck Renewables in Spain, said he was satisfied with the results. “It has become clear that wind power continues to have higher remuneration expectations the solar. Or in other words, it is clear that solar is cheaper and will surely continue to lower costs faster than wind power.”

However, Fundación Renovables was more critical. It argued that the auction “delved further into the gap between large and small agents.”

PPA market

Spain was the largest PPA market in Europe and will continue to be in 2021, with an average price of €35/MWh for solar PV, according to the Swiss consultancy Pexapark.

Although there is consensus over expected prices, not everyone who spoke to pv magazine agrees on whether the auction will have an impact on the PPA market.

“It will have a great impact on the sector … PPAs will not be affected in general, but offtakers will look for lower prices,” said Delgado Rigal, adding that long-term price forecasts, if done well, will not be affected by the latest auction. “An auction is like a PPA or a bilateral contract where the off-taker is the state. If the off-taker has a high credit rating, it will be able to aspire to a lower PPA price, otherwise, he will have to settle for a higher PPA price.”

Donoso believes that the PPA market and the auction market are different.

“Here there are companies that seek certainty (auctions) and others that do not mind taking more risk going to the market or building plants based on PPAs,” he said. “We are prudent when analyzing the influence of the auction on the PPA prices.”

Asensio said that auctions are just one more instrument in a broad renewable energy market. He added that there are a number of factors that affect the electricity market.

“There is a lot of life outside of auctions and the important thing is that market regulation is clear, although I think that much progress has been made in this regard in recent months,” he said. “However, in the medium and long term, when the volume of plants with low remuneration grows, it may affect global electricity market prices, and therefore corporate PPAs and all derivatives.”

González Moya, meanwhile, said that “in some way, this is going to give a signal or index to PPA buyers.”

Future auctions

Despite the auction's positive outcome, future auctions could still be improved, some of the industry sources said. In particular, future auctions could include more smaller PV projects.

González Moya also said that for medium-sized companies, it is very difficult to compete under the current auction design: “We are asking that specific quotas are established by size for small companies.”

Fundación Renovables echoed his sentiments.

“The non-incorporation of quotas for distributed generation has caused the 3,043 MW to be concentrated in only 32 winners,” it said.

Donoso said UNEF also expects that in upcoming auctions, “20% will be earmarked for projects of less than 10 MW … and there will be a specific auction for storage.” Falck Renewables said that it believes that “the small ones will have to make an additional effort in managing the sale of power, with complex instruments and creativity.”

González Moya said that he believes that storage and hydrogen should be included in the next auctions. “I would be in favor of making an even greater effort to encourage the consumption of renewable energy to the detriment of polluting energies, which would involve the whole of society and create a demand for green generation that would ensure the objectives of the energy transition,” said Asensio.

Donoso, meanwhile, demanded more realistic auctions. “That the time coincides with the maturation period which, instead of 12 years, we would ask for 15 years,” he said. “Also, as we have indicated, we would ask for an auction for small plants and storage.”

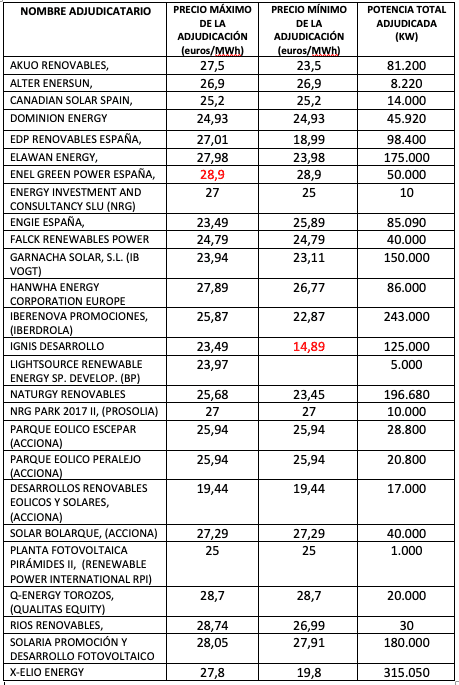

Winners, prices

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.