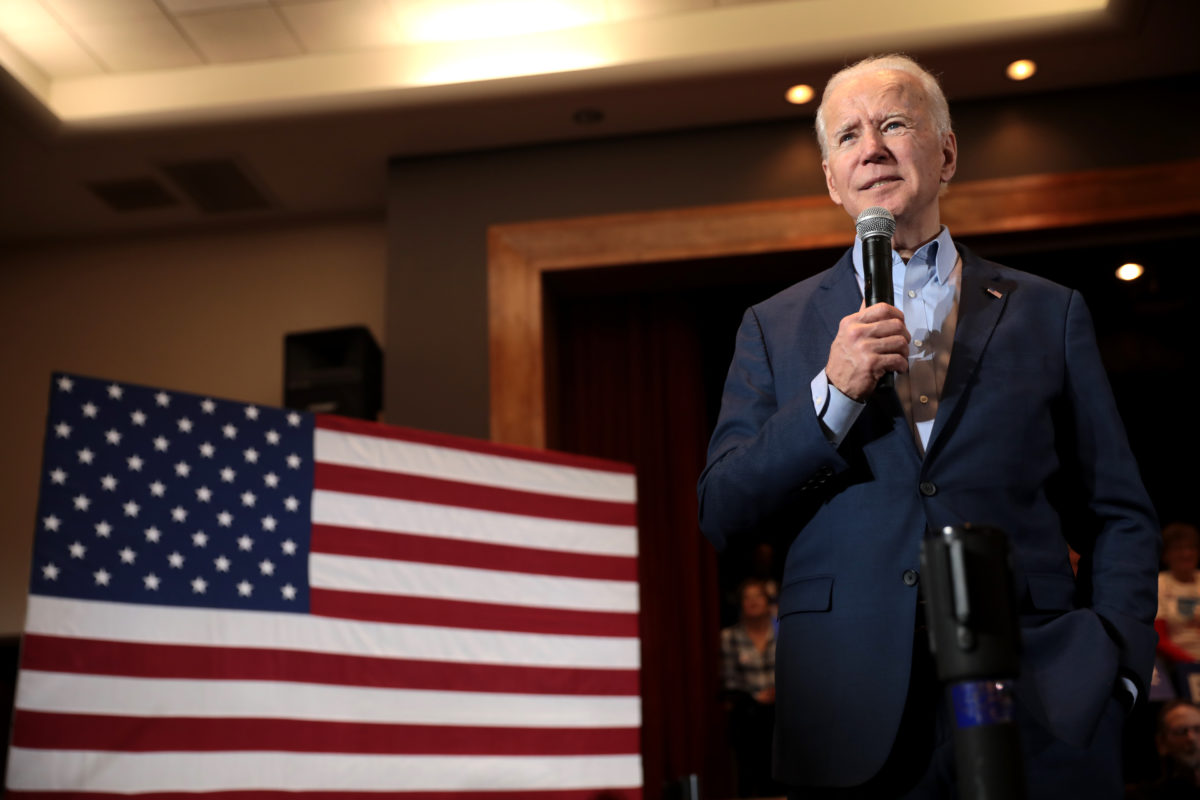

The election of Joe Biden as the next president of the United States – together with ambitious EU emissions targets and a net-zero carbon commitment from Beijing – will usher in a golden age for solar, according to Chinese manufacturer Jinkosolar.

Jinko chief executive Kangping Chen made some big predictions in a bullish third-quarter stock market update today, stating: “We strongly believe that the PV industry has ushered in a golden age, together with strong support from government policies to adopt renewable energy, promote grid transformation and green investments.

“In the U.S., solar demand is expected to more than double over the next five years under the Biden administration. In Europe, the EU has officially announced plans to increase the GHG [greenhouse gas] reduction target from 40% to at least 60% below 1990 levels by 2030. In China, we are expecting the next, 14th five-year energy plan to focus on non-fossil [fuel] energy sources, with higher proportions of renewable energy, construction plans for large scale energy storage and grid transformation, and the introduction of supporting policies.”

A global solar boom would be good news for major PV manufacturers such as Jinko, which said it expects to have cornered 15% of worldwide solar panel sales this year, up from 12% in 2019. The company shipped a record 5,117 MW of modules last quarter and is on track for an impressive annual production capacity of 30 GW of panels by the end of the year, having already reached 25 GW by the end of September, as well as 20 GW of wafer production lines and 11 GW of cell fab capacity.

Lower module selling prices during the July-to-September period did see gross profit fall from RMB1.51 billion ($231 million) in the second quarter to RMB1.49 billion in the latest window, however. And the sharp rise in the company stock price last quarter, driven by the more positive sentiment for global solar, had a heavy impact on Jinko's net profits, thanks to the RMB313 million loss booked for a change in fair value of the $85 million worth of 4.5% senior notes issued by the business in May last year. That change in value helped Q3 net profits for Jinko shareholders come in at just RMB6.85 million, compared to RMB318 million in the previous window and RMB364 million in the third quarter of last year.

Jinko also remarked upon the materials shortages experienced across the Chinese solar manufacturing industry in the last quarter, noting it had used “substitute materials” in some cases, without revealing any further details. The supply chain situation will “gradually improve,” according to Jinko.

Revenue rose from RMB8.45 billion, in the second quarter, to RMB8.77 billion, for expected full-year figures of $1.31-1.43 billion, with expected shipments of 5.5-6 GW of modules in the current window set to add up to 18.5-19 GW for the year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.