From pv magazine 11/2020

PV InfoLink’s Amy Fang researches the solar cell segment of the supply chain. She supports her team by producing market trend analysis. She also contributes to PV Infolink’s research efforts in solar cell technology and analyzes market trends.

Nowadays, it doesn’t take long to modify lines to produce bifacial cells and modules. In terms of front-side efficiency they are basically identical; some bifacial cells even outperform by 0.1%, which helps bring down the cost per watt. With Tier-1 cell manufacturers’ production lines for M6 cells mostly being compatible with bifacial processing, bifacial will gradually become an industry standard.

Since the second half of 2019, the price gap between monofacial and bifacial modules has been negligible, allowing bifacial modules to gain more advantage with their increased energy yield potential. Bifacial modules can be used in highly reflective regions such as deserts, in combination with trackers to optimize power generation. On the other hand, bifacial cells that are assembled into a single-side module with reflective backsheet structure can improve their front-side power ratings. For instance, a 60-cell single-side module based on M6 bifacial cells can increase the power output by 1 W to 2 W.

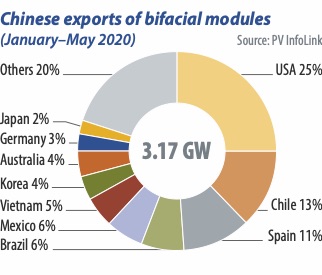

From a demand perspective, around 30% of utility-scale projects in China in the second half of 2019 used bifacial solar modules. There is also an increasing number of bifacial solar projects in non-China markets. According to China Customs statistics, China exported more than 3 GW of bifacial solar modules during the January-May period, accounting for 12% of total exports. The largest export market was the United States, which represented 25% of all bifacial solar module exports. The high volume of exports to the U.S. market was attributed to the exclusion of bifacial modules from the Section 201 tariffs during that period.

These factors are spurring Tier-1 cell and module manufactures to promote bifacial modules. In the first six months of the year, bifacial modules accounted for 30% of each Tier-1 manufacturer’s total shipments, and those figures are expected to reach 35-60% in the second half, as demand is growing in China and overseas markets. Meanwhile, end user acceptance is improving, as more field tests show promising results. Indeed, demand and market share for bifacial modules have grown sharply this year.

Different sizes

The 158.75 mm (G1) wafers, which were adopted by the market in the second half of 2019, maintained their dominant position for about a year. In pursuit of product differentiation and cost reduction, wafer manufacturers accelerated the shift to larger sizes and pushed M6 (166 mm) into the mainstream in the second half of this year. Meanwhile, an alliance promoting the M10 (182 mm) size – formed by module companies in June – brought an end to uncertainty surrounding sizes beyond 180 mm. With several sizes existing amid the rapidly changing size trend, compatibility is now the top concern for manufacturers’ expansion plans next year.

On the cell side, most lines have been upgraded from G1 to M6 in the second half and a few manufacturers are evaluating the feasibility of upgrading lines to M10. However, upgrades to existing lines are expensive and it takes time to adjust production efficiency losses and yield rates. That’s why most cell makers opt to install new lines that are compatible with size up to 210 mm. Some vertically integrated companies chose the 182 mm technology roadmap due to their business strategies. For module manufacturers, some have tried to upgrade existing lines of 158 mm, 163 mm and 166 mm to the 182 mm format, but very few would actually do so, because module capacity expansion is planned based on a unit of 3 GW or 5 GW. Therefore, gear that is compatible with 210 mm will be largely adopted through next year.

To avoid extra capex incurred when the sizes change again, most manufacturers, regardless of whether they make cells or modules, will build new production lines to work with sizes up to 210 mm. But the installation of equipment that is compatible with large formats to produce products of smaller sizes could lead to production and profit loss. Therefore, manufacturers will continue to promote large sizes.

Demand outlook

Given the positive demand outlook for the second half and the arrival of the high season in the final quarter, supplies of glass will remain tight throughout the end of the year. Prices for 3.2-mm glass have skyrocketed by more than 20%, from RMB 30 ($4.45)/m² in September to at least RMB 35/m² at the beginning of October. This is slightly driving up costs for PV module makers. Moreover, rapidly growing demand for bifacial modules is also adding to the shortage of glass capacity, because glass-glass is the most common structure of bifacial modules.

As the impacts of Covid-19 subside in 2021, the solar demand outlook appears bright. PV InfoLink projects that global module demand will reach 140.1 GW next year, with projects deferred by Covid-19 this year and the expected June 30 installation rush in China keeping up demand in the first half. By then, glass supplies will again run short. Moreover, the limitation of furnace sizes – coupled with the long time required for capacity expansion – glass capacity for large modules based on M10 and G12 wafers is estimated to be only 40-50 GW by the end of 2021, meaning that supplies of glass are far behind module size shifts. Against the backdrop of insufficient glass capacity, the real production of large format modules will not grow at a fast pace next year, but M6 will remain the mainstream format. The market will then experience a gradual shift to M10 in the second half, when capacities for M10 and glass are ready.

While talks begin on 217 mm, as well as the 220 mm and 230 mm cell formats, technical barriers facing sizes beyond G12 will need to be solved, such as breakage rates, texturing, and coating. Acceptance of such formats is also a challenge. So M10 and G12 are expected to remain mainstream in the next two years.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.