From pv magazine 10/2020

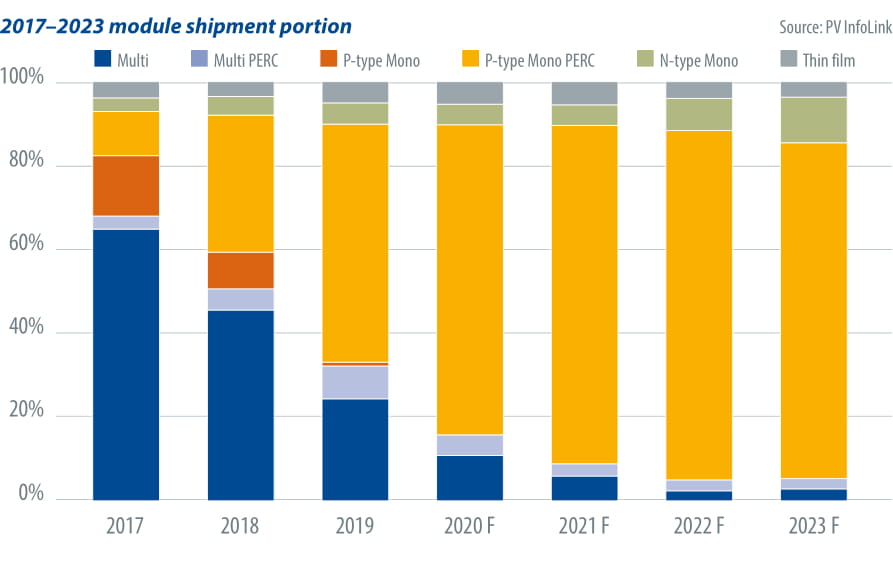

High growth in global module demand is expected in 2021, from 121 GW to more than 135 GW. Demand for n-type modules, however, is not the main driver of this, and is predicted to grow only slightly from 6 GW to around 8 GW.

Over the 2020-21 period, demand for p-type mono PERC modules is expected to grow from 89 GW to 110 GW, pushing market share to a new high at 80%. Mono PERC will remain the mainstream next year, since the rise of larger cell formats and related systems cost optimizations has so far kept the gap in cost per watt between n-type and PERC cells narrowing at a snail’s pace. Indeed, cost factors – as well as the rapid shift in technology and wafer sizes – are hindering the development of n-type. The technology also faces the challenges of capacity utilization rates and production output.

TOPCon vs. HJT

Utilization rates for manufacturers of n-type technologies sit below 50%. The high technical requirements make it difficult for manufacturers to produce interdigitated back contact cells. At present, only a few manufacturers still produce passivated emitter rear totally diffused (PERT) cells stably, and PERT is expected to be replaced by tunnel oxide passivated contact (TOPCon) once the technology reaches maturity. While TOPCon is advancing slower than expected this year and some Tier-1 manufacturers have switched to conduct R&D in heterojunction (HJT), TOPCon manufacturers still have gigawatt-scale capacity expansion plans. Many have earmarked new PERC lines to be installed this year and for upgrade to TOPCon in the future. In light of these plans, TOPCon capacity additions will likely exceed those of HJT over the next one to two years.

The outlook for HJT production in 2021 is less optimistic due to cost issues and low sales. However, there is still potential for HJT, as some large manufacturers and equipment suppliers are gearing up for capacity ramps. TOPCon and HJT are forecast to dominate n-type, taking up to 88% of global n-type capacity in 2021. Next year is expected to see TOPCon outstrip HJT, with the former’s production growing from 2.6 GW to 4.9 GW and the latter’s from 1.9 GW to 3.2 GW.

Challenges, advantages

TOPCon and HJT each have advantages and barriers to overcome. TOPCon and p-type PERC share similar process flows, but TOPCon has four extra steps, expanding capacity costs, which is why many Tier-1 solar PV manufacturers are reserving room for upgrades to TOPCon. While coating, silicon oxide and boron diffusion issues remain to be resolved, a clear direction has been offered to overcome the failure of passivation caused by silver paste piercing through the silicon oxide layer during doping. HJT processing is relatively simple and the technical barriers are considerably easier to solve. However, a number of obstacles – including high costs for equipment and target materials, as well as the high consumption of silver pastes – are slowing the development of HJT. Cost reductions will therefore remain a priority in the next two to three years to come.

Movements in the bifacial market are also worth noting. At present, Tier-1 cell and module manufacturers are actively promoting bifacial modules and the test results are promising for end users. This year saw significant growth in bifacial demand and market share. More than 30% of utility-scale projects in the second half in China are bifacial. Overseas markets also saw an increasing number of bifacial projects. Assembling n-type cells can bring cell bifaciality to more than 80%, offering higher energy yield. Moreover, n-type modules perform better in climate zones with higher albedo, temperature and day and night temperature gap, owing to higher bifaciality and low temperature coefficient. Therefore, n-type demand is expected to grow steadily.

Cost optimization achieved by the localization of equipment, improvements in technology, and continued bifacial market growth may lead to n-type capacity ramps becoming a trend in 2021. However, it’s difficult for n-type to catch up with the rapidly advancing p-PERC modules in terms of efficiency improvement, rapid adoption of new assembly techniques and large wafers (182 mm, 210 mm, and beyond) due to higher requirement on equipment and technology. This also affects the market acceptance of n-type products. Having said that, more and more manufacturers are investing in n-type. Initially, there were more vertically integrated companies investing in TOPCon because of the relatively lower upfront costs, but as HJT costs started to decrease and the technology becomes mature, some vertically integrated players also join cell manufacturers and new entrants to develop HJT. Considering aspects of technology, costs, and bifacial market, as well as Tier-1 manufacturers’ engagement in n-type technology, more TOPCon capacity expansion is expected to materialize next year.

About the author

Wells Wang has an academic background in materials science, focusing on metal and semiconductor processing. Throughout his career in the solar PV industry, he has gained industry experiences in p-type multi-Si pattern design and conductive adhesive testing. He is currently an analyst at PV InfoLink, where he provides analysis on the application of new technologies and their costs.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.