From pv magazine 10/2020

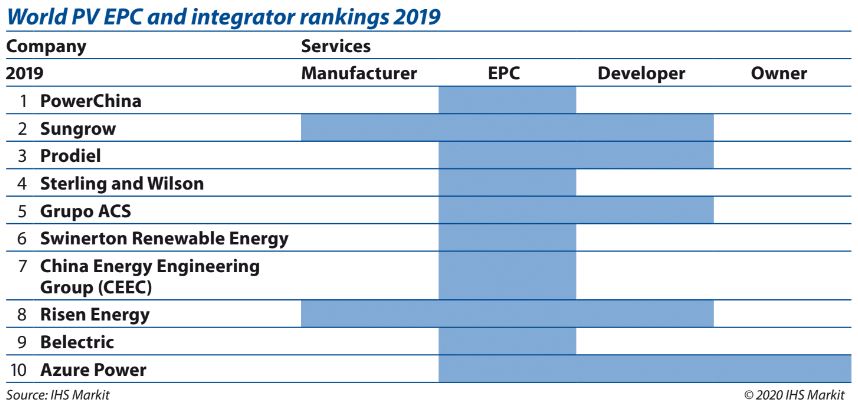

In 2019, PowerChina installed 2.5 GW of PV to sail to the top of IHS Markit’s global EPC providers ranking, from fourth position in 2018. This was possible through 1 GW installed in China, another 1 GW in Vietnam, and several projects in Latin America. In second position we find inverter supplier Sungrow, which took a 6% share of the Chinese market as it continued to grow its EPC business. Following PowerChina and Sungrow are Prodiel and Sterling and Wilson, thanks to leading regional positions in Latin America and Africa and the Middle East, respectively. Combined, these four EPC providers installed 8 GW of PV in 2019, each taking a 2% share of the global EPC market.

Large projects contributed to greater market shares among the biggest companies. More than 140 PV parks larger than 100 MW were completed in 2019, representing 30% of the global PV market (excluding residential systems). In 2018, parks larger than 100 MW counted for less than one-quarter of non-residential PV additions.

In the three largest non-residential PV markets – China, the United States and India – we see local companies dominating the EPC rankings in 2019. An 11% year-on-year decline in PV additions in China contributed to consolidation among EPC providers in this traditionally fragmented market. Of the 29 GW of non-residential PV added in 2019, the largest EPCs – Sungrow, PowerChina and TBEA Xinjiang Sun Oasis – installed 13%, up from 9% in 2018. As we project China to add more PV in 2020 than in 2019, these providers’ market shares are likely to be diluted again.

In the United States, the five largest EPCs installed 27% of new non-residential PV capacity in 2019. At 10% market share, Swinerton Renewable Energy maintained its position as the preferred EPC contractor in the country. First Solar and Cypress Creek Renewables, both among the top five companies in 2019, have stated that they will exit the EPC segment. This creates opportunities for established local EPCs, as well as for the emerging group of international companies that are eyeing the growing U.S. PV market. In the highly price sensitive Indian PV market, the top five integrators installed 37% of PV plants in 2019. Local EPC/developer Azure Power, which is owned by foreign investors, took the lead in the country. As India’s PV market risks being cut in half in 2020, as a result of Covid-19, further consolidation among the main EPCs is likely. Of these three major markets in 2019, only the United States is likely to see an increasing participation of international EPCs, as margins are more attractive.

Outside the three largest markets, we observe a mix of international and local EPC providers in the top positions. Australia has proved difficult to operate in, illustrated by the fall of local EPC and former market leader RCR Tomlinson two years ago. As many active third-party providers steer away from the PV segment in Australia, international developers increasingly perform in-house EPC using local contractors. More fertile ground for third-party EPC providers developed in 2019 in both Spain and Vietnam. Spanish EPCs dominated the country’s 5 GW of installations in 2019, with the top five providers supplying a stunning 77% of the market. In Vietnam, the five largest EPCs supplied a third of the market. This market that grew from close to nothing to install 6 GW last year, attracted a mix of Chinese, Japanese, European and Indian EPC providers.

On the other end of the spectrum, Germany is consistently a local and fragmented market. Small system sizes, generally below 10 MW, contribute to a market where the ten largest EPCs do not exceed a fifth of the 3.5 GW market. Only one company, Enerparc, has succeeded in gaining significant market share, installing 9% of Germany’s non-residential PV systems in 2019. The company thrives on its success as a developer, including winning a large portion of Germany’s PV tenders.

As far as 2020 is concerned, in a normal year, by the fourth quarter we already have an idea of the global EPC rankings for the current year. We know if the large projects are being completed as planned. Some less transparent markets or companies may surprise us, but the general picture is usually rather clear. 2020 is, as you know, somewhat different. From the supply chain hiccups in the first quarters, to lockdowns and safety measures, many projects have been delayed. Projects are still at risk of delays depending on the evolution of the pandemic. Additionally, the recent increase in module prices complicates procurement for EPCs that build projects with tight margins. Overall, we project close to 100 GW of non-residential PV systems to be added in 2020, down from 107 GW in 2019, which is more optimistic than we initially thought back in April. The question is how market shares will be distributed among the EPC providers. Who will meet deadlines, and who has renegotiated terms? As companies keep quiet, we eagerly await 2021 to dig into the details on projects completed in 2020.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.