The price penalty the industry pays on green hydrogen is set to fall over the next decade, according to a new study on hydrogen economics by IHS Markit.

This year will likely be remembered as a turning point for hydrogen. Policymakers have prioritized a range of project announcements, reports, and legislative packages to give impetus to the development of this new energy carrier. Rapidly falling costs for hydrogen are also driving this wave of announcements.

“Costs for producing green hydrogen have fallen 50% since 2015 and could be reduced by an additional 30% by 2025 due to the benefits of increased scale and more standardized manufacturing, among other factors,” said Simon Blakey, a senior adviser for global gas at IHS Markit.

Green hydrogen produced via renewables-powered electrolysis is the preferred hydrogen fuel, as the splitting of water does not release any carbon into the atmosphere. The International Energy Agency (IEA) states that 1 kilogram of green hydrogen, containing about 33.3 kWh, comes in at €3.50 to €5, which is anywhere between €0.10/kWh and 0.15/kWh.

Reforming methane from natural gas, meanwhile, releases carbon into the atmosphere, but is considerably cheaper. The IEA says that the natural gas-based form of hydrogen, grey hydrogen, costs €1.5/kg or €0.045/kWh. According to IHS Markit’s analysts that price delta is set to close over the next 10 years, due to economies of scale and renewable energy deployment.

“The work that we have done for the IHS Markit Hydrogen Forum, very much focuses on economies of scale as a way of reducing costs, developing dedicated renewables to get the load factor on the electrolyzer up and, of course, continued expectations of falling costs for renewables,” added Blakey.

The rapidly falling costs of wind and solar have already had a considerable impact on the price development of green hydrogen. With mammoth projects underway or in development, additional price reductions in all required technologies can be expected. Australian renewable energy producer Austrom Hydrogen announced plans just a few weeks ago for a 3.6 GW solar-powered hydrogen facility in Queensland.

Also, the European Commission recently presented its hydrogen strategy, which foresees the development of 40 GW of electrolyzer capacity, accompanied by up to 120 GW of wind and solar capacity, by 2030. The commission's hydrogen strategy also set a target price of €1-2/kg for green hydrogen as a critical objective for investments into the industry. Australia has also closed ranks in the race for affordable green hydrogen and launched its “H2 under 2” program, as it aims to unlock strategic investments to drive the costs for green hydrogen below AUS$2 ($1.40)/kg.

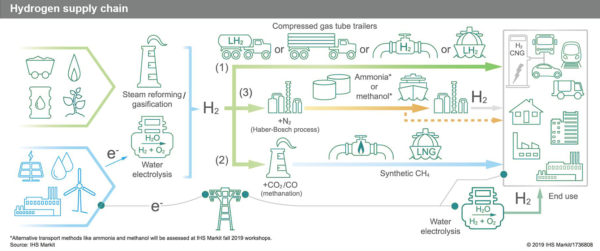

“In Europe, it is now widely agreed that electrification alone cannot deliver the level of emissions reduction that many countries aspire to,” said Catherine Robinson, IHS Markit's executive director, European power, hydrogen and renewable gas. “Hydrogen is a highly versatile fuel – both in terms of how it can be transported and the variety of its potential end-use applications. The greater the degree of decarbonization, the greater the likely role of hydrogen in the energy future.”

In Europe – currently one of the most active hydrogen markets – the new fuel could account for one-third of the power in the energy mix, if the continent wants to avoid 95% or more of its carbon emissions, IHS Markit said.

Large-scale investment is set to enable new power-to-x projects outsizing any currently existing ones. IHS Markit said that the average size of such projects is 100 MW for installations scheduled for completion by 2023, up from the current 10 MW average.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

7 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.