South Korea’s Ministry of Trade, Industry and Energy (Motie) has fleshed out the rules which will see the carbon footprint of solar power projects taken into account when prioritizing new installations.

With the government having announced its intent to assess the carbon footprint of solar panels in March last year, and industry representatives consulted on the proposal in recent months, Motie has defined the new regulations, which are due to come into force from June 15.

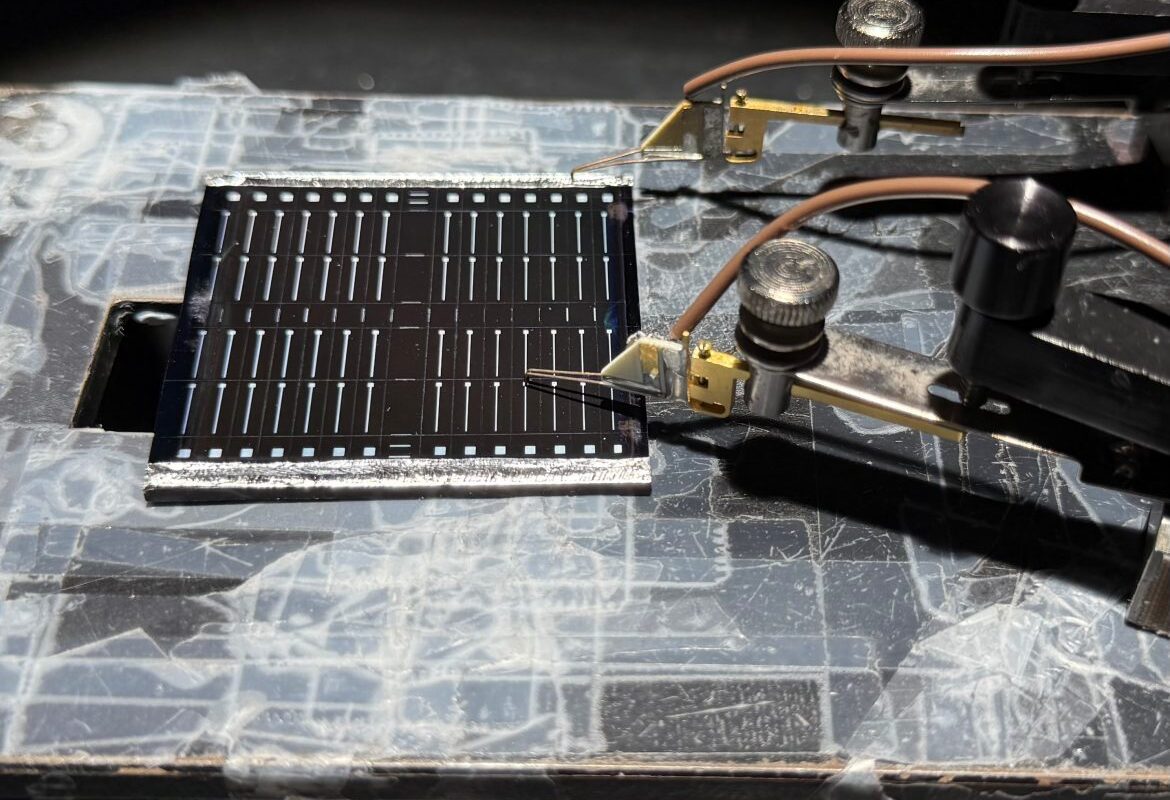

Crystalline silicon module carbon footprints – for Korean as well as imported products – will be estimated using a life cycle assessment (LCA) of their environmental impacts which complies with Korean standard KS I ISO 14040.

The new rules will echo those applied in France, where large scale solar tenders take low-carbon manufacturing into account, as well as the price developers agree to accept for the power generated. South Korea, like France, has an extensive nuclear power generation capacity which will aid the low-carbon efforts of domestic solar panel manufacturers.

Motie in January published figures which contradicted media claims Chinese panel makers had been aggressively eroding the market share of Korean solar manufacturers. According to the government department, Korean solar companies provided around 72% of the nation’s PV panels in 2016, 73.5% the following year, 72.5% in 2018 and 78.7% last year. During the same period, according to Motie, the proportion of Chinese panels on the Korean market fell from 28% to 26.5%, 27.5% and 21.3%, respectively.

“The report stating that Chinese companies dominate [the] Korean PV market is not true,” said the government at the time.

Sustainability in solar and storage

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hopefully these regulations can help emerging PV technologies get a foothold in the market. It takes a lot of energy to manufacture c-Si. On the other hand, the energy input for thin-film solar technologies like pervoskite, organic, etc. can be much lower. If these new regulations can give the emerging technologies a chance to compete, perhaps the market experience will bring the cost down so that they can eventually undercut silicon even without incentives.

Is the present methodology of evaluation in South Korea for their exported solar Panels on the basis of low carbon footprint, higher efficiencies and stricter industry standards or on Life Cycle Assessment or left to the exporting country on their specified methodology of evaluation in their bidding document.?

Is not a good practice to comply atleast minimum internalional methodology of evaluation but having superior preference is appreciable. The present race is to improve output, efficiency and life and outdo each other .