In Ukraine, the fall in electricity demand has also been caused by a decrease in the volume of industrial production, caused mainly by Covid-19 (the largest consumers of electricity are industrial enterprises). Drop in electricity consumption amounts to approximately 8% compared to the same period of the last year. Due to the decrease of consumption the import of electricity from Belarus and Russia has been curtailed, planned maintenance works have been delayed.

Significant increase in electricity production from renewables

A key factor causing the current excess of electricity is a significant increase in the production of electricity from renewable energy sources (RES), as their production schedule remains poorly forecasted, and the total share of solar and wind power plants in the daily balance of electricity production commonly exceeds 8%.

Due to the significant surplus of electricity, NPC Ukrenergo (the transmission system operator) frequently issues dispatching commands to limit output electricity production by certain RES electricity producers in order to balance the power system. However, several renewable energy electricity producers do not follow dispatching commands and do not limit electricity production. It is anticipated that the issue will be resolved once the compensation mechanism for RES electricity producers is put in place.

Increase in the volume of non-payments and debts, including mass non-payment by consumers

The existing problem of non-payment is further aggravated by Covid-19 implications. According to the NEURC, the average level of payments for housing and utilities services by consumers is as follows:

- Heating – 70%;

- Water – 80%;

- Electricity – 70%;

- Natural gas – 70%.

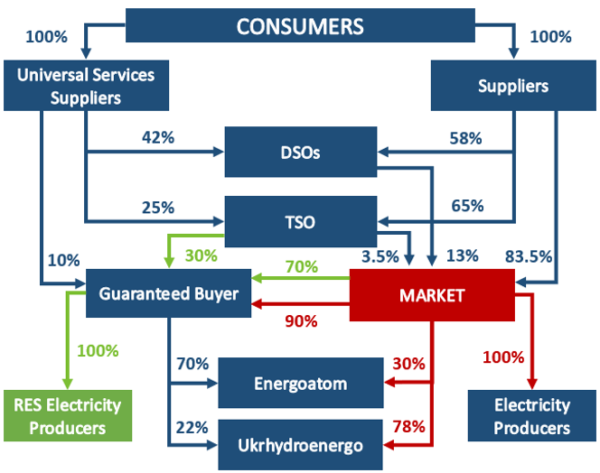

Universal services suppliers (USSs) supply electricity to residential and small non-residential consumers under the tariffs fixed by the National Energy and Utilities Regulatory Commission of Ukraine (NEURC). A decrease in bills paid by consumers causes a cash deficit in USSs and, by virtue of the cascade effect, this impacts the financial health of other market players in the chain as depicted below.

Cash inflows to electricity suppliers have been significantly reduced, which has affected their ability to fulfill contractual obligations to other market participants, in particular DSOs and the TSO.

On April 11, 2020, the price for electricity in the day-ahead market reached a historic low of UAH 606.26 (€20.46) per MWh, which is lower than the cost of electricity production for most types of generation. Consequently, the Guaranteed Buyer lacks the funds (which it receives from the sale of electricity on market segments) to fulfill its contractual obligations to RES producers. The overdue debt of the Guaranteed Buyer to RES producers has increased rapidly and in April 2020 constituted UAH 4.7 billion (€162 million). At the same time, the debt of NPC Ukrenergo to the Guaranteed Buyer constitutes UAH 5.7 billion (€197 million), and the debt of the Guaranteed Buyer to the SE NNEGC Energoatom is UAH 4.2 billion (€145 million).

Green projects at risk

The quarantine period is extremely unfavorable for the implementation of RES projects. There is a significant risk that companies with concluded pre-PPAs will not be able to complete the construction of RES projects on time and be eligible for the feed-in tariff.

Prohibition of entry to the territory of Ukraine for foreigners and stateless persons. This prohibition came into effect on March 16, 2020. Many RES projects involve participation of foreign companies and specialists. Consequently, due to the force-majeure situation and restrictions on entry into Ukraine, many companies are forced to temporarily suspend their activities in Ukraine.

Delays of equipment supply for power plants. Considering that countries producing equipment for power plants (e.g., China, Germany) are under quarantine measures, there is also an issue with delays in the supply of equipment. Thus, extending of cut-off dates for RES power plant commissioning should be considered by policymakers. Similar measures have already been implemented in a few countries including Poland and India.

Response of policymakers and regulator

In order to ensure the proper functioning of the power system, as well as to stabilize its financial situation, the Parliament has adopted the Law “On Amendments to Certain Legislative Acts of Ukraine Aimed at Preventing the Occurrence and Spread of Coronavirus (Covid-19)” No. 530-IX of March 17, 2020.

The law stipulates that for the duration of the quarantine, or any other restrictive measures imposed to curb the spread of coronavirus, and for 30 calendar days after the suspension of such measures, the following actions are prohibited:

- Application and collection of fines and other penalties for delayed payments for housing and utilities services;

- Termination or suspension of housing and utilities services to citizens in case of non-payment or incomplete payment; and

- Forced eviction and forfeiture of housing during enforcement of court decisions regarding debt collection for housing and utilities services.

The NEURC has issued its Resolution “On Actions of Electricity Market Participants During the Quarantine Period and Restrictive Measures Related to the Spread of Coronavirus (COVID-19)” No. 766 of April 8, 2020

The Resolution temporarily introduced restrictions and obligations on electricity market participants. Such special measures are imposed for the duration of the quarantine or any other restrictions imposed to curb the spread of coronavirus, and for 30 calendar days after the suspension of such measures. In particular, it enacts:

- Suspension of the enforcement of administrative measures stipulated by NEURC regulatory acts to electricity suppliers and DSOs in the case of delayed payment of their financial obligations to the TSO;

- Organization of a number of measures by electricity suppliers to ensure the possibility for consumers to pay for electricity; and

- Measures setting restrictions on imports of electricity from countries that are not members of the Energy Community.

On April 15, 2020, the NEURC amended its Resolution No. 766 of April 8, 2020, and allowed the Guaranteed Buyer to sell electricity produced from RES in the day-ahead market not at the minimum price (UAH 10 per MWh), but at a higher price of up to UAH 566.7 per MWh (the cost of nuclear generation under the PSO mechanism). This should normalize the situation in the day-ahead market and increase short-term liquidity of the Guaranteed Buyer.

Conclusion

Covid-19 has further deepened the existing crisis in the energy sector of Ukraine. The whole range of consequences for the energy sector is yet to be revealed and is difficult to predict, however it is already clear that demand for energy resources has dropped, prices have plummeted and non-payment of utilities bills by end-consumers will have a detrimental effect along the supply chain (DSOs, TSOs, suppliers and producers).

Special measures preventing negative impacts on the energy sector should be expanded further. This concerns, inter alia, the need to extend the cut-off dates for RES power plant commissioning in view of delays to the supply of equipment, suspension of activities of foreign companies in Ukraine involved in the implementation of RES projects and other negative consequences caused by the pandemic.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.