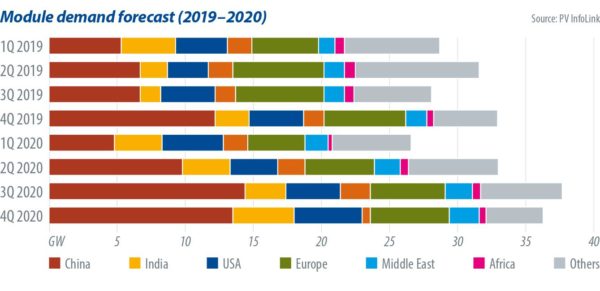

Postponed Chinese market openings and restricted domestic transport due to the coronavirus outbreak have delayed PV project commissioning in China. It appears that scheduled projects will probably not be installed by the end of March as the coronavirus continues to wreak havoc. In response, the Chinese government might adjust commissioning deadlines. Although demand is now considered deferred to the second and third quarters, projected demand for 2020 remains unchanged at 42.5 GW, accounting for 30% of global module demand.

The effects of dwindling transport links and logistics disruptions sent ripples to overseas markets, hampering the supply of modules. Given the traditional low season declines in the first quarter in marketplaces outside of the United States, Japan, and India, module inventory draw showed no marked change. At present, the supply of modules is running a bit short in overseas markets, with the distribution and retail sectors experiencing a shortage at the beginning of February. PV InfoLink thus predicts a delay in overseas demand, from the first quarter to the second and third quarters.

Supply chain disruptions aside, the changes to Chinese demand will determine whether it’s high or low season in each quarter, as demand will remain stable overseas throughout the year. If the outbreak can be contained in March, global demand will remain weak through the first half of the year and rebound to a level higher than earlier predicted in the second half.

Supply chain

Although manufacturers resumed production in February, workers needed to be quarantined before starting work, while transport links in some areas remain paralyzed. These issues led to a shortage of polysilicon supply in the upstream sector and forced mono-Si wafer manufacturers to scale down production, thereby causing supply shortages for the short term.

The module sector was hit hardest, with junction boxes and aluminum frames in serious shortage and shipments crippled. As a result, Tier-1 module manufacturers are operating at 50-80% capacity at the most. This means estimated global module production in February is only around 7.5-8 GW – significantly lower compared to the average monthly output of 10-10.9 GW. The impacts of low mono-Si module manufacturing activity have rippled through the cell segment, which saw stock of mono-Si cells piling up in mid-February and prices trending downward from late February onward.

On the multi-Si side, wafer and cell manufacturers either lowered utilization rates or closed facilities in January, as overall demand has been declining since the second half of 2019. With staff shortages, delayed openings, and production hiccups to deal with, multi-Si manufacturing activity slowed further in February, hindering multi-Si module manufacturers from ramping up capacity utilization rates in the short term.

With China’s industrial production interrupted by the outbreak, some overseas module manufacturers that depend on China for EVA films, junction boxes, and PV glass have halted production. Overall, suppliers are running low in overseas markets. India, the biggest market for multi-Si products, will face significant undersupply. Major issues revolving around supply, production, and shipments of modules will continue to haunt Chinese suppliers and other manufacturers throughout the world.

Module prices

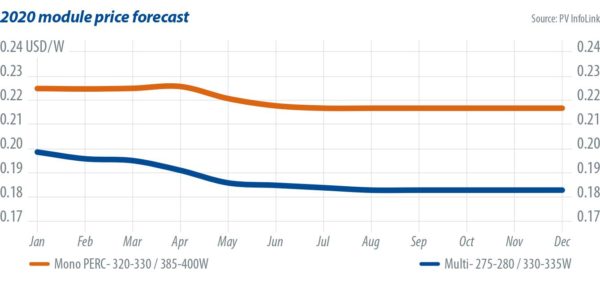

While manufacturers remained closed at the start of February, overseas demand was unchanged and the number of transactions is low, with prices sitting at the previous level – $0.225/W for mono-Si modules and $0.196/W for multi-Si modules.

The unprecedented crisis in China has put global module manufacturers in turmoil and this may persist into April, delaying the timing of Chinese demand as a result. While a few end users have doubts over module inventory draw, overseas demand has not changed much thus far in 2020. As module supply in China and abroad is unable to catch up with demand due to the shipment standstill and shortages of materials, module prices will likely rise in the short term. Once the outbreak is contained, prices will then decline steadily in the May-June period amid surplus capacity.

Hit by decreased production of multi-Si wafers and cells, the supply of multi-Si modules will be running short, especially in the Indian market, where the fiscal year-end rush is underway. Therefore, some Chinese module makers are considering raising quoted prices for overseas markets.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.