From pv magazine 01/2020

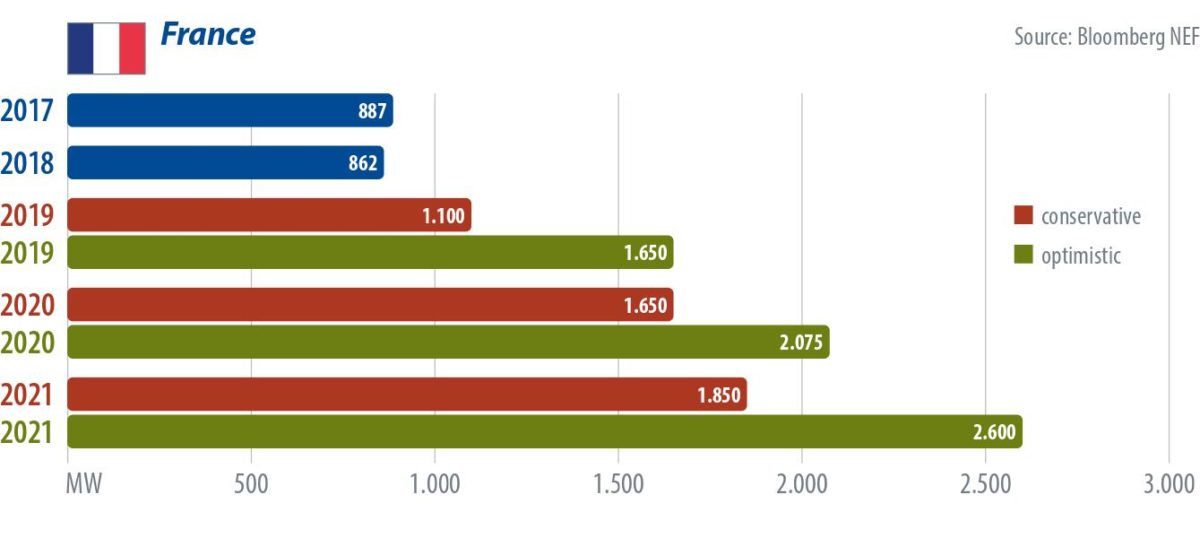

2018 tenders drive France

In 2020, France’s installed PV capacity will increase mostly thanks to solar parks tendered by regulator CRE in 2018, when around 1.25 GW of large-scale solar power with year-end grid-connection deadlines were allocated. These projects, along with many others, are struggling to secure land, and innovation is now needed to respond to this challenge.

Solutions such as agricultural PV, an ongoing source of controversy between food producers and the energy sector, or aggregated self-consumption, could help to create new room for larger deployment. Especially for the latter, regulatory improvements were achieved in 2019, but the solar sector wishes to go beyond the experimentation stage and create the conditions for a mature market.

In terms of technological innovation, bifacial projects are increasingly being introduced, and digital technologies such as energy management, data collection, and virtual batteries are now emerging.

From a regulatory point of view, the French solar sector has asked the government to uncap rooftop solar installations up to 500 kW in size, which would mean no more tenders would be held for smaller projects. If this occurs, current constraints that generate very long completion time frames would be removed.

More surprising this year may be the evolution of the nascent PPA market, with the first deals being signed last year by large-energy consumers such as railway operator SNCF, the Boulanger Group, and Crédit Mutuel.

“In addition to a volume connected in 2019 of around 1 GW, we expect to see confirmation in 2020 of this acceleration in order to exceed, if all goes well, 1.5 GW connected in the year,” said French PV association SER. This forecast is shared by another French solar trade body, Enerplan, which estimates that reaching 1.5 GW would already be “a big success.”

Catherine Rollet

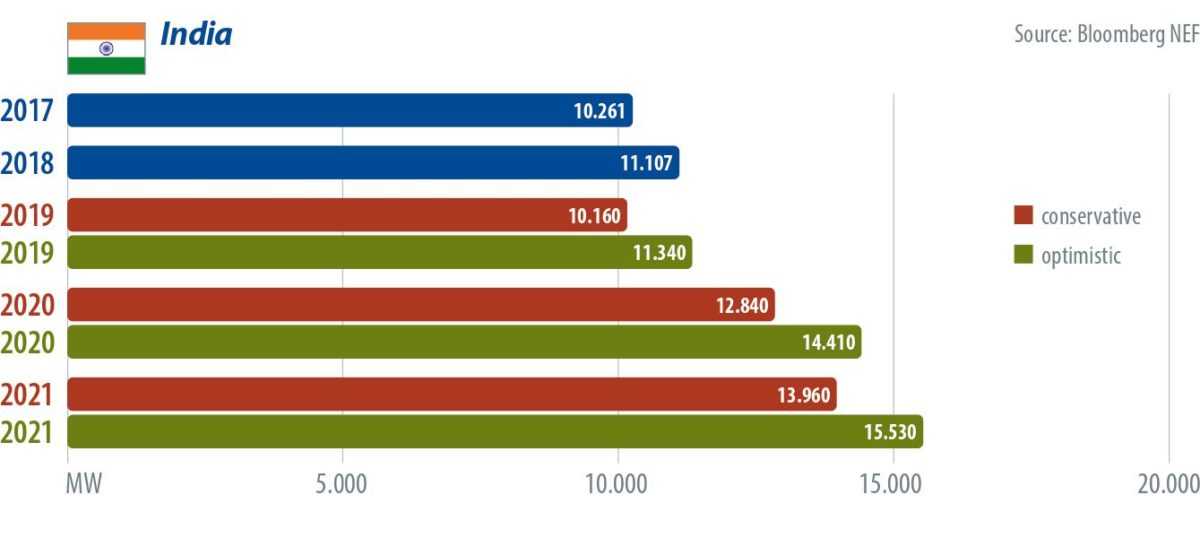

India smashes 10 GW

Lower module prices are driving the development of an established project pipeline. The central government is also making efforts to strengthen the sector.

Following subdued annual capacity additions, solar installations in India are set to touch 10 GW or even higher in 2020, primarily due to easing cost pressures.

The safeguard duty on solar cell and module imports – which has already come down to 20% – will further decline to 15% between February and July 2020. The resulting reduced module procurement costs will see installations pick up in the market, which has been held back by the high cost of imports.

“Module prices are expected to be below $0.20/W by December 2019 inclusive of safeguard duty, for shipments in Q1 and Q2 2020. Local suppliers are also offering modules on par with Chinese suppliers in terms of pricing,” says Dharmendra Kumar, senior analyst at IHS Markit. Kumar predicts an installation uptrend throughout 2020 as solar becomes more price competitive.

To allay fears among global investors, the government has assured them of a payment security mechanism to de-risk investments in renewables.

“Mandatory payment security compliance under power purchase agreements is evidence of the government’s resolve to boost the investor confidence,” observes Ajay Sawhney, a partner at legal consultancy firm Cyril Amarchand Mangaldas. “Also, given that the safeguard duty, which had significantly slowed down the imports, will come to an end next year and with the government not showing any interest to renew its imposition, the growth of the sector is evident.”

Uma Gupta

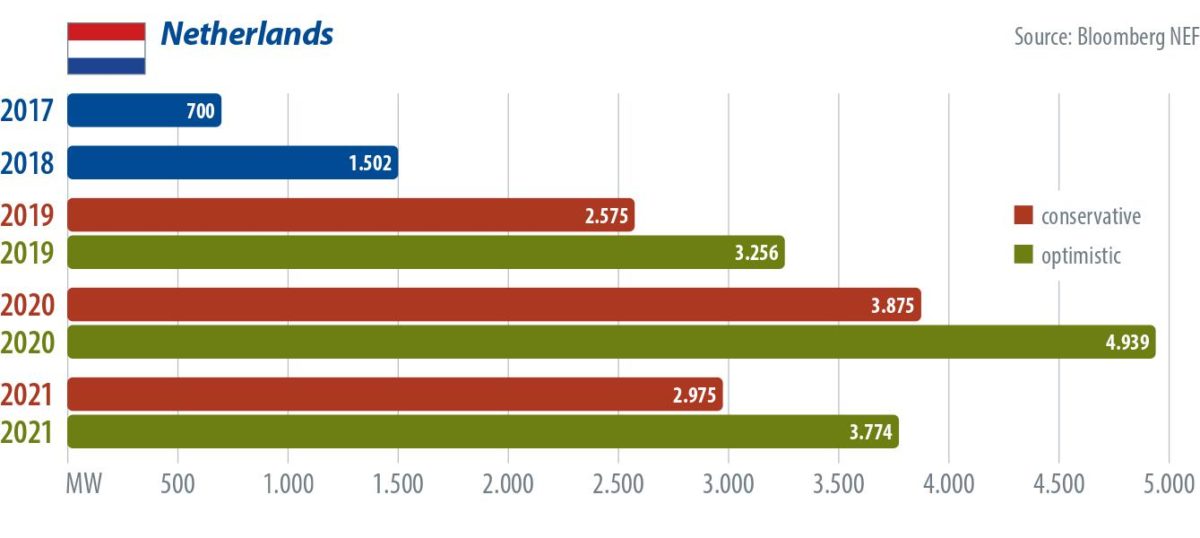

Holland booms, constraints loom

The Netherlands has been one of Europe’s most dynamic PV markets over the past three years and it now promises to become even bigger. With an estimated 2.2 GW of new solar power deployed last year, the country may see similar volumes installed this year and next, according to Dutch solar analyst Peter Segaar. He believes that 3 GW per year is technically plausible, but rapidly growing problems with grid constraints in a growing number of regions, including the northeastern part of the country, will probably hamper continued growth.

Projected growth will likely be driven by the rooftop segment under net metering, for which current rules were extended until 2023. The SDE program for large-scale renewables, under which around 12.5 GW of solar projects have so far been allocated, will continue to underpin large-scale additions. Of this allocated capacity, however, only 2.7 GW is currently online, according to Segaar. “If the grid-problems are not tackled soon, large volumes of SDE projects might lose their subsidy allocation,” he warned.

Emiliano Bellini

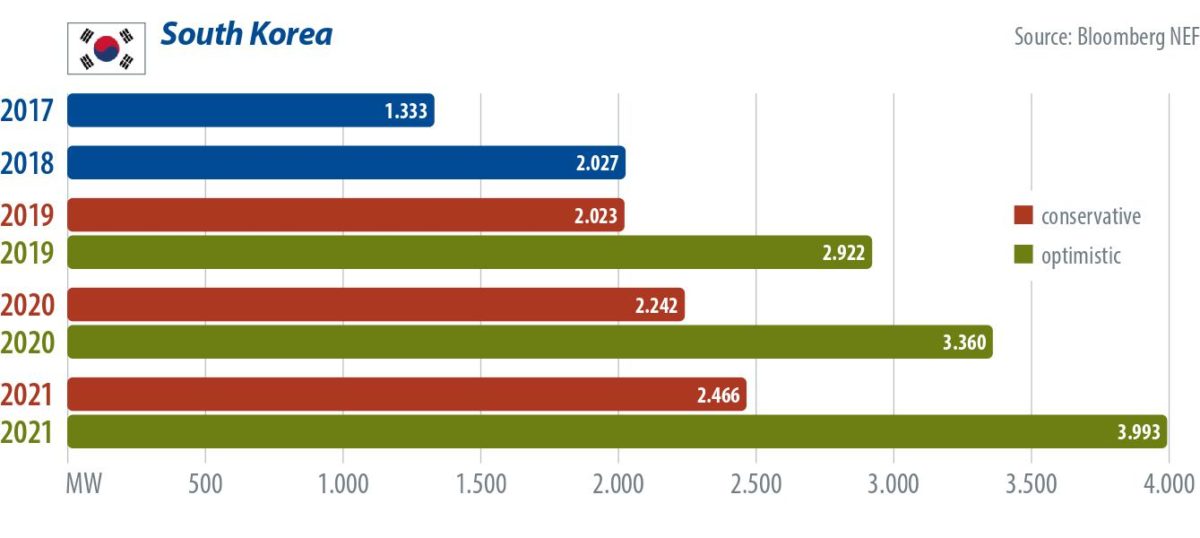

The tip of the Korean iceberg

South Korea’s government continues to push PV. In the second half of 2019 alone, the government moved forward with its multi-gigawatt ambitions on the Saemangeum tidal flats, while the Seoul municipal government unveiled further plans to install 1 GW of new rooftop PV capacity in the capital by the end of 2022.

That may just be the tip of the iceberg, with BloombergNEF anticipating 2.5 GW to 4 GW of new PV installations by 2021. Cumulative installations reached 8.09 GW by the end of 2018, according to the Korea New and Renewable Energy Association (KNREA), with full-year capacity additions on track to surpass 2 GW in 2019.

The country is determined to accelerate the energy transition under President Moon Jae-in, who has vowed to shift away from coal. The government is aiming for renewables to account for 20% of the nation’s power supply by 2030, with PV and wind set to comprise the lion’s share.

National policy support is already strong, with feed-in tariffs, a renewable portfolio standard, and a healthy market for renewable energy certificates, on top of subsidies for residential PV arrays below 3 kW and a PV leasing program for homeowners, among other measures.

Korea’s solar market has grown steadily over the past decade – roughly 2.36 GW was installed last year – but a measure of skepticism may be warranted for now. Wood Mackenzie has expressed doubt that the country can hit its 2030 target, noting concerns about the economic and environmental feasibility of Saemangeum projects, among other issues.

Brian Publicover

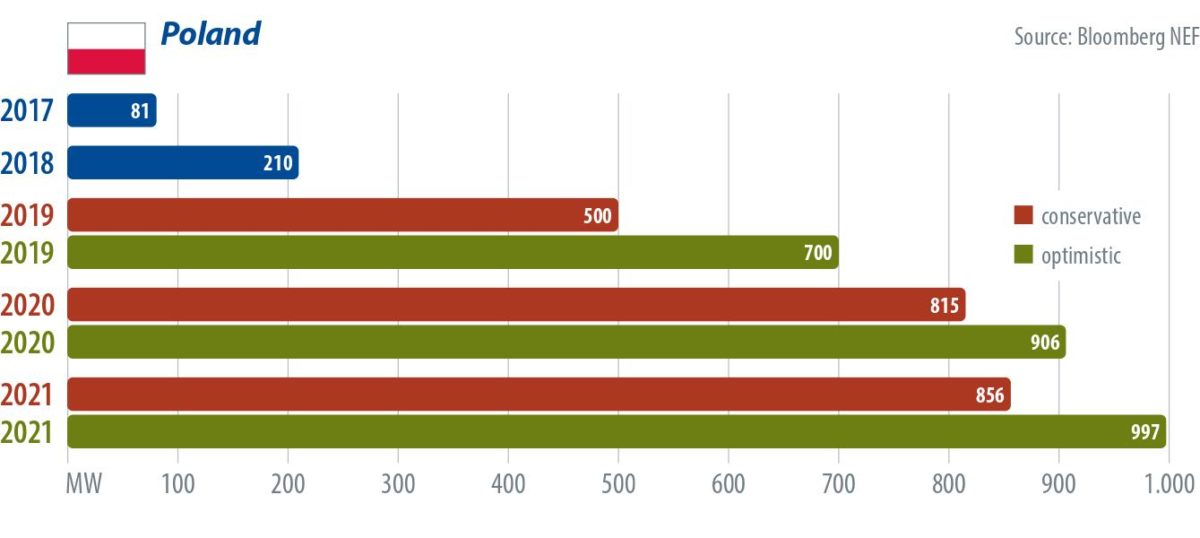

Poland: the next big European market

Coal-dominated Poland can no longer be considered the black sheep of European solar development. The country, which has seen moderate growth in installed PV capacity in recent years, experienced its first real big market growth last year, and is now preparing to grow to gigawatt-scale in 2020.

According to Grzegorz Wisniewski, president of the board of Poland’s Institute for Renewable Energy, the country added around 800 MW of new PV systems in 2019, with cumulative capacity reaching around 1.3 GW. “We expected around 1.5 GW, but the Polish government has recently postponed grid-connection deadlines for projects selected in auctions, and most of them will likely be finalized next year,” explains Wisniewski. As a result, projects will be grid connected this year. Wisniewski expects 1 GW of new solar to be added in 2020. And for 2021, he is even more optimistic, with an outlook of at least 1.3 GW.

Major market drivers will be auctions for projects up to 1 MW, in which solar has always had a good share in the past, and also auctions for larger projects, which have traditionally been dominated by wind. PV will take advantage of newly introduced regulatory limitations for wind farms. 170 projects with a total capacity of 850 MW that already have grid connection conditions could likely win the 2020 auction.

Distributed generation under net metering will also see sustained growth in the coming years, despite subsidized grid electricity for residential customers. Wisniewski believes that growth will be particularly strong in the C&I segment because of very high power prices, but also because of new rules enabling owners of PV systems exceeding 50 kW in size to sell excess power to offtakers. One potentially critical issue that Wisniewski notes, among others, is the lack of a qualified workforce and the absence of clear rules for the PPA segment, for which excessively high grid fees must still be paid.

Emiliano Bellini

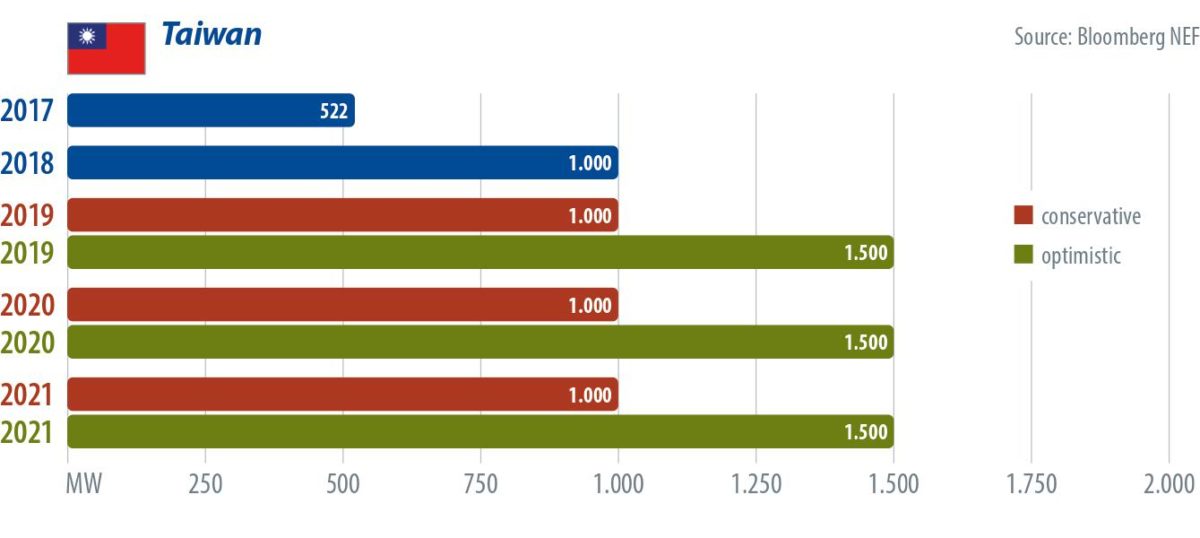

Taiwan’s ground-mount year

With its ambitious goal of reaching 20 GW of PV capacity by 2025, Taiwan’s current administration stands firm that it will meet its targets. But with a struggling manufacturing sector, potential incentive changes, and land challenges, Taiwan’s PV market doesn’t come without uncertainties.

Taiwan’s PV manufacturers are supported by the government’s Voluntary Product Certification (VPC) policy, which currently provides a 6% higher FIT for locally produced high-efficiency modules and cells. But this year, the VPC policy could be reduced to 3-4%

“The government wants to protect Taiwan manufacturers,” says Corinne Lin of PV InfoLink. “If they continue the VPC policy, then suppliers can still ship to the local market. But if it is canceled, then other Southeast Asian manufacturers could cause serious problems.”

Manufacturers are also continuing to ramp their project development work and are preparing for domestic PV deployment to ramp up. Local manufacturer Motech says that 40% of its business came from EPC work in Taiwan in 2019, and it is now gearing up for an even larger boom in 2020.

With limited roof space remaining on government buildings, development is moving to the ground level. Taiwan is releasing state-owned land for project development and 2020 has been deemed “the year of ground-mount” by developers.

Developers, landowners, and the government will need to collaborate to realize 1.5 GW of capacity this year – and a significant, rapid ramp-up will be required to achieve 20 GW by 2025.

Erica Johnson

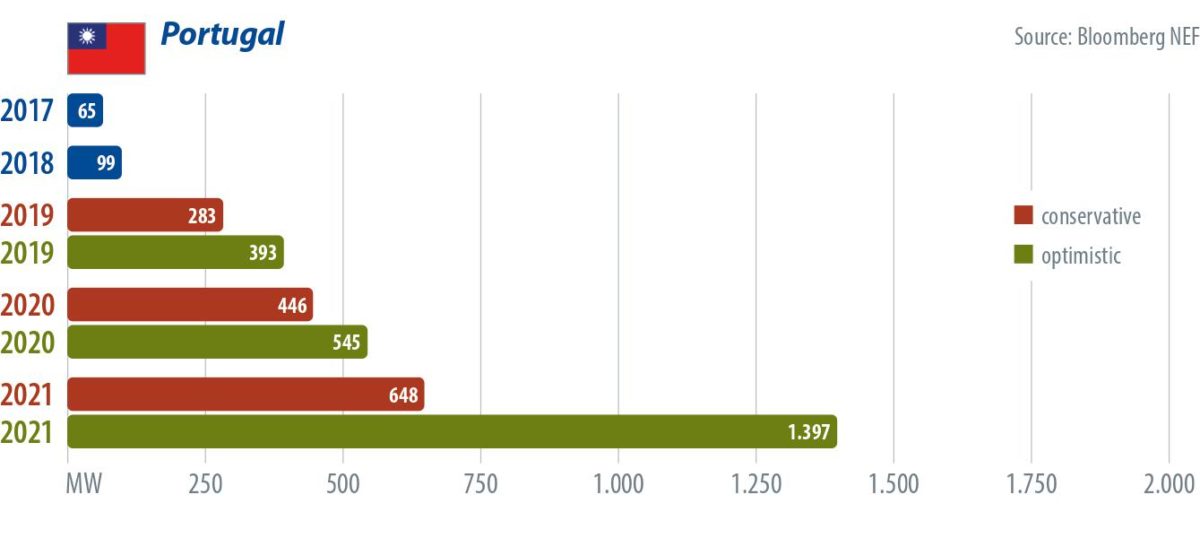

Portuguese promise

Last year, Portugal laid the foundations for a mature solar market. It held a successful PV auction, which delivered the world’s lowest bid and 1.15 GW of assigned capacity.

On top of this, Portugal defined new rules for distributed generation systems, including provisions for energy communities and storage. The size of the Portuguese solar market is still quite limited, with around 784 MW of registered PV capacity online by the end of September 2019, according to the latest statistics released by the Directorate General for Energy and Geology (DGEG).

In 2020, however, we may see a few hundred megawatts of new PV being deployed, as a result of increasing activity in the rooftop PV space and the large-scale PPA segment, which saw several deals being signed in 2019.

Another 700 MW solar auction is also expected to be held in the first months of this year. But projects coming from this and the above-mentioned procurement exercise will not come online this year.

Emiliano Bellini

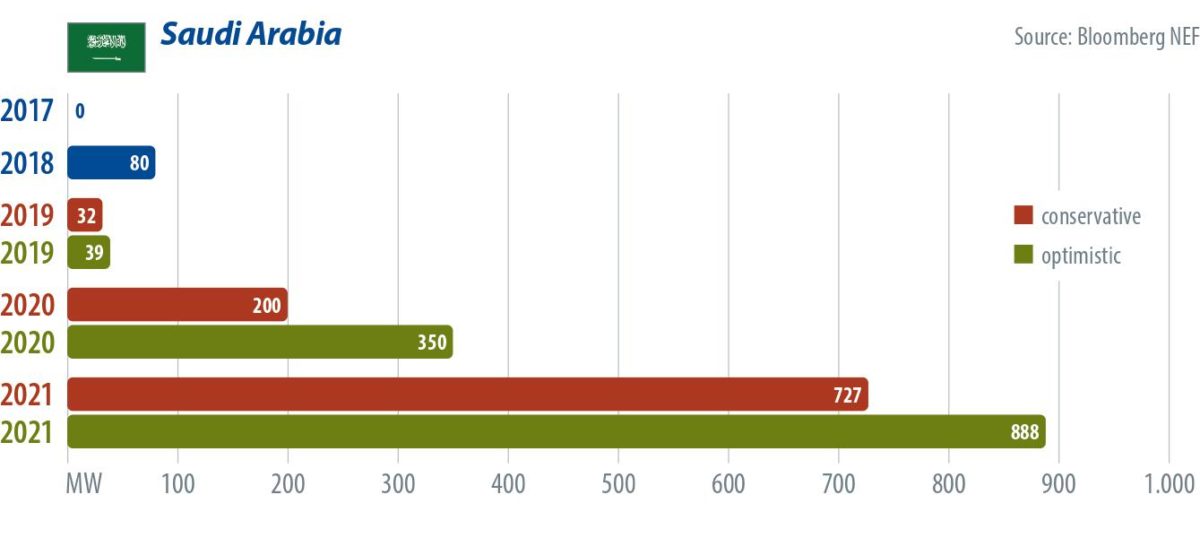

First strides for Saudi Arabia

Saudi Arabia has struggled with an oil-first legacy, which hasn’t been aided by previously empty promises to venture into the renewable energy sector. However, the kingdom is now taking strides toward a more diversified economy, which includes solar power.

BloombergNEF estimates that Saudi Arabia could add from 200 MW to 350 MW of solar PV this year.

And if the past two years have been any indicator, the Saudi leadership is committed to following through on economic diversification plans.

This includes a focus on tourism, adding new resorts and entertainment venues, as well as increasing manufacturing capabilities in various industries, all driving a greater demand for electricity. By 2021, nearly 1 GW of solar PV could come online.

LeAnne Graves

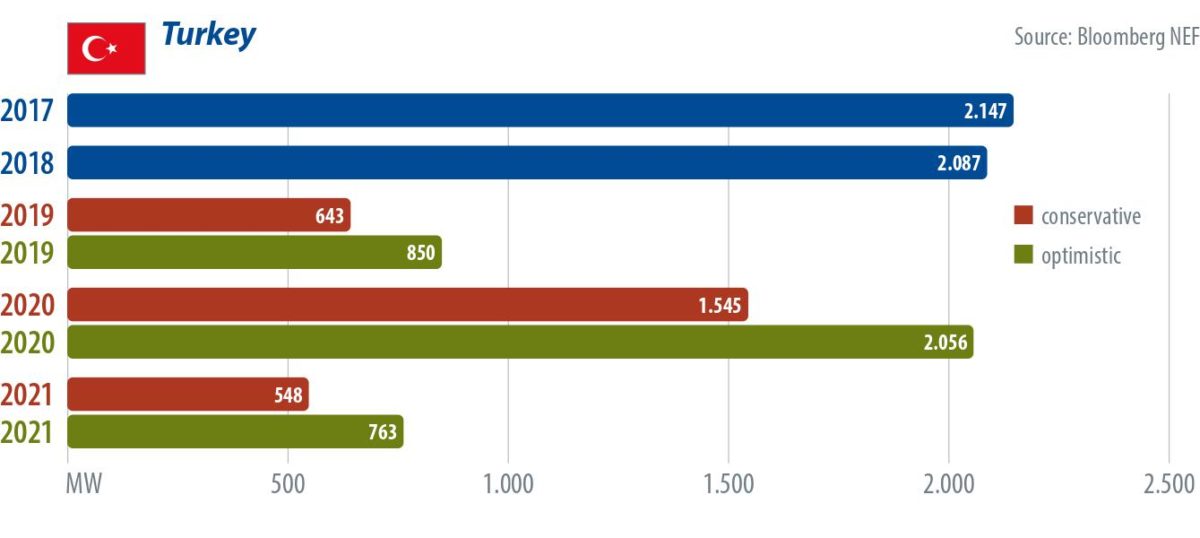

Turkey set for (re)growth

Turkey has growing electricity demand and a climate and geography suited to PV deployment. A 2019 report by the Investment Office of the Turkish Presidency found that Turkey has undergone the greatest surge in demand for energy out of all OECD countries, and that energy use is set to double within the next 10 years.

Coupled with the government’s stated desire to reduce energy import dependency, it is apparent that, with the right management, Turkey’s solar sector has significant potential for growth – despite already being the largest European PV market in 2017 and the second largest in 2018.

A number of recent legislative developments are pointing in the right direction. In new laws introduced in 2019, arrays up to 5 MW in size, increased from 1 MW, can be developed without a license, resulting in a clear opportunity for growth in the small-scale (rooftop and ground-mounted) segment.

Turkey’s state news agency Anadolu Agency reported that since the introduction of this reform, unlicensed solar electricity generation has increased by 23.8% from 2018. Furthermore, a system of net metering was introduced in May 2019.

The greatest challenge to Turkey’s solar energy sector would appear to be the ongoing economic downturn, including the collapse of the Turkish lira last year. A lack of available financing has seen a number of significant projects delayed. However, according to Eren Engür, founder of Icarus Energy, the impact of Turkey’s economic woes on its PV market shouldn’t be overstated.

“Turkey has installed 5 GW in the last two-and-half years – a period which has witnessed several economical, political and social turmoil. In my 16 years of solar experience I’ve witnessed similarly problematic scenarios in Africa, Middle-East and Central Asia as well, but solar has always made its way.”

Hugh Hutchinson

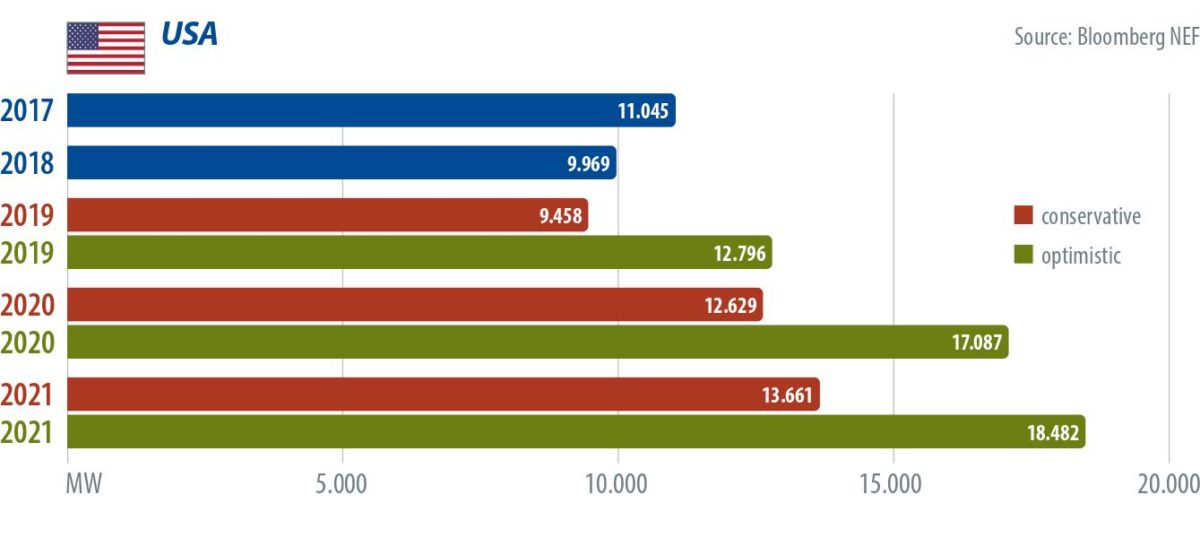

Blazing growth in the USA

2019 was be the best year for solar in the United States since the ITC-distorted year of 2016. It’s a solid annual growth rate of about 21% that gets the United States to 12.7 GW in 2019.

The American market seems to have absorbed the tariffs on solar modules and the resultant higher prices. Nevertheless, the United States still has some of the highest solar costs in the world.

It’s the utility and residential sectors that drive the blazing growth, while the non-residential sector continues to be a laggard, hobbled by policy reform. Residential solar had a record 712 MW third quarter, driven by consumers looking for resilience in the face of grid outages with solar paired with storage, according to Wood Mackenzie. Mandated new-build solar is also a factor.

The contracted utility-scale solar pipeline is 45.5 GW – the highest it has ever been in the history of U.S. utility-scale solar, according to WoodMackenzie, driven by “utilities and developers looking to safe-harbor enough equipment for as much capacity as possible under the 30% ITC.”

There’s also more geographical diversity in solar’s U.S. deployment, led by California, Florida and Texas.

BloombergNEF’s conservative forecast is a modest 9.5 GW in 2019, growing to 12.6 GW in 2020, and 13.6 GW in 2021. Wood Mackenzie is sticking with its previous 2019 U.S. solar forecast of 13 GW (a 23% annual growth rate), very much in line with the optimistic BloombergNEF forecast.

Eric Wesoff

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I always follow PV magazine and particularly Emiliano Bellini’s articles.

Thank you for the great work.

I am Portuguese, living abroad, but as far as I know we still are an independent country. We were not conquered by Taiwan, as the graph inidicates. Just a joke on a detail of the article.

Hi Joao, I’m sorry that it’s us to break the news to you! Didn’t you get the memo?

Unfortunately we have limited technical capability to edit the graphics used with online articles at present.