From pv magazine 01/2020

While the European region is forecast to grow over the next five years, headwinds do exist, such as grid connection and planning permission issues due to the large installed base of PV in some local areas, and shortening PPA terms as financial market drivers move toward merchant deals. However, the European solar market is moving toward a new level of maturity and growth beyond rich subsidies. Increasingly, it will be driven by market fundamentals such as growing interest from corporates, utilities, and offtakers that see solar as a cost-competitive energy generation source.

China’s loss, Europe’s gain

The global solar market is highly interconnected in 2019 and sensitive to big changes in demand, such as the decline of a large market like China. The solar supply chain has now reached a scale where suppliers will seek new growth opportunities instantly if key markets fail to install expected demand. The past year has been a prime example, as the failure of China to reach the same heights as 2018 meant that module and inverter suppliers swiftly expanded internationally and rapidly lowered prices in order to fill their order books.

Among the beneficiaries are European EPCs and developers who were actively installing during the lull in Chinese demand throughout the first nine months of 2019. European installations are forecast to have surged to account for 18% of total global additions – an increase of six percentage points over 2018. Several Chinese module manufacturers are expected to increase capacity in the next few years, with the mantra of scale being their strategy to maintain profitability. As a result, PV system prices are expected to fall in 2020, mainly due to PV module price decreases arising from excess module capacity, which will help drive Europe to install more cost competitive solar.

Super-charged growth

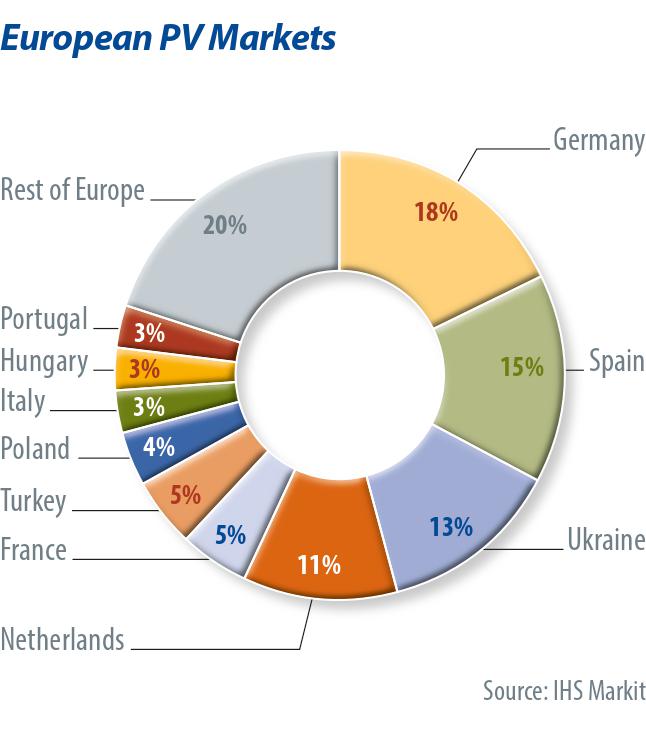

The past year saw a large resurgence in solar demand across multiple markets in Europe, following several years of modest growth. Some of the major solar players, such as Germany, Spain, Italy, France and the Netherlands, have long been stalwarts of the European solar industry and are expected to remain in the top 10. But growth markets such as Ukraine, Poland, Hungary, Turkey, and Portugal are expected to flourish. Demand is forecast to be quite concentrated within the top four markets of Germany, Spain, Ukraine, and the Netherlands. At 13 GW of installations, they are collectively forecast to account for almost 60% of European demand in 2019.

Utility-scale installations are forecast to surge across key markets such as Spain, Portugal, Ukraine, and the Netherlands in 2019. And the trend is expected to continue into 2020 with other markets such as France, Italy, and the United Kingdom adding to the list of utility-scale markets that are expected to grow as result of tenders, PPAs, and unsubsidized projects. This rapid rate of utility-scale growth will push ground-mount installations past rooftop installations in 2019 for the first time in four years. However, while utility-scale installations will grow strongly in some of these booming markets, issues associated with large solar deployment still exist. In some markets such as Spain, grid connection issues can delay solar installations. Other markets may decrease as they change market drivers. One example of the latter is Ukraine, which is pivoting from a feed-in tariff to a tender-driven market.

Utility-scale installations are expected to account for 43% of total European installations in 2019, but distributed PV (both residential and commercial) is forecast to remain a large and growing segment, as self-consumption becomes increasingly important. Many key markets such as the Netherlands, Germany, Poland, Belgium, and Italy are forecast to increase their residential installations in 2019, and markets such as Germany, the Netherlands, Turkey, France, and Hungary are set to be key markets for commercial installations.

Sustainable solar?

The European PV market, like other key solar markets, is not immune to the vagaries of changing market drivers and policies that can cause individual markets to boom or bust. PV installations in Europe have now reached a new level of critical mass, with more than 19 markets expected to have an installed base above 1 GW by the end of 2019 – compared to a decade ago, when only Germany, Italy and Spain had reached that mark.

The industry has survived the initial market collapses and is now more resilient and educated, and is able to compete more effectively with other energy generation resources such as coal. Solar is now in a new era of cost competitiveness, thanks to the scale of an industry that produces well over 100 GW globally per year.

In Europe, self-consumption is a major market driver, and merchant and/or PPAs are rapidly emerging as significant market segments. However, for the time being, tenders will be seen as necessary by many European governments to be able to push large-scale installations in a controlled way. New tenders have been announced this year in markets such as Germany, France, Italy, Portugal, Poland, Hungary, and even Ukraine.

The development of the large-scale unsubsidized PV segment will crucially depend on the regulatory environment and overall power market developments in order to allow solar installations to prosper in Europe for the next five years.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

A good magazine about solar, the green power generation.

Curious that IHS-Markit don’t see battery storage as a driver of PV deployment. Surely this will make a difference? If batteries get cheaper, the overall LCOG drops, for a given LCOE. The growth should be higher in countries like Germany where consumers pay high electricity taxes, and the gap between the retail price of grid electricity ad the FIT or other export price is wide.

Batteries are a wild card. Nobody knows how fast their prices will fall, and whether they will be available in volume for stationary uses after the carmakers have met their priority demand.

Looking five years ahead, large-scale PV growth will start hitting balancing roadblocks unless action is taken now to increase pumped hydro storage capacity. This is cheap but takes a long time to build, and policymakers have to be active and determined to sideline NIMBY opposition.