From pv magazine, November 2019 issue

The Americas was the largest regional market, accounting for more than half of global PV tracker demand. However, the growth rate was strongest in the Middle East and North Africa. PV trackers accounted for more than 25% of global ground-mount shipments for the first time in 2018.

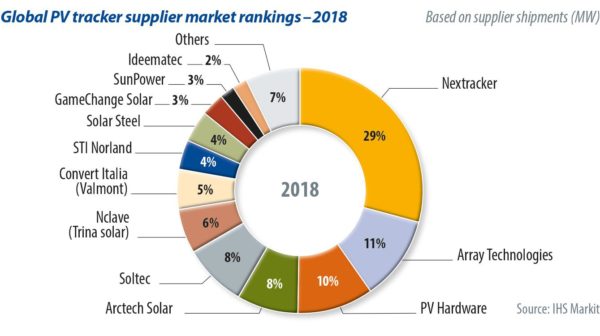

The top 10 suppliers continued to benefit from greater adoption of PV tracker technology, and all of them achieved higher year-on-year shipment volumes in 2018. Nextracker continued to lead the market for the fourth year in a row, accounting for 29% of global PV tracker shipments. As was the case last year, Array Technologies was the second-largest supplier in the market, followed by PV Hardware, Arctech Solar and Soltec.

Americas key, EMEA growing

Following a record year of shipments for PV tracking systems globally in 2018, IHS Markit forecasts that more than 150 GW of PV tracking systems will be deployed from 2019 to 2023, accounting for approximately one third of ground-mounted PV installations during the period, according to its recent Global PV Tracker Market Report. The Americas will remain the largest region for PV tracker demand, accounting for more than 40% of the global tracker market over the next five years. Key markets in this region will include the U.S., which is projected to be the largest individual market for PV trackers globally during the forecast period, along with Mexico, due to a near-term surge in utility-scale PV deployments after recent capacity auction awards.

While the Americas may be the largest market, growth in demand will be strongest across Europe, the Middle East and Africa (EMEA), led by surging demand for utility-scale PV in markets such as Spain, the United Arab Emirates, Saudi Arabia and Egypt. The EMEA region has historically been dominated by Spanish suppliers such as PV Hardware and Soltec, which collectively accounted for more than 50% of PV tracker shipments to the region in 2018. Competition in the region is expected to increase significantly in the coming years due to the persistence of other European suppliers such as Convert Italia, Ideematec and Nclave, in addition to the entrance of U.S. players such as Nextracker and Array Technologies.

Though Asia will be the largest regional market for PV installations during the forecast period, demand for PV trackers will be weaker than other regions relative to the size and scale of the market, primarily due to stronger price competition with fixed-tilt systems and high competition for suitable land. Even so, Australia, China and India are projected to be among the top 10 largest markets for PV trackers from 2019 to 2023, collectively representing a market opportunity of more than 30 GW during the period.

Global leaders Nextracker and Array Technologies are poised to continue capturing market share in emerging markets outside of their home turf in the Americas, though competition from other international players such as Soltec, Arctech Solar, PV Hardware and Convert Italia will serve as key challengers to further expansion.

Bifacial boost

Over the next five years, IHS Markit sees the primary drivers of tracker adoption being: 1) incremental cost reductions driven by continued product innovation; 2) growing demand for utility-scale PV in emerging markets; and 3) the increased adoption of bifacial modules, which will lead to higher efficiencies and lower costs for trackers and installation.

Greater efficiency gains and higher wattage for PV modules have been a primary driver of $/W cost reductions for PV mounting and tracking products in recent years. However, surging demand for bifacial modules will help further incentivize the use of solar trackers globally. Compared to standard monofacial modules, bifacial modules are generally expected to generate 5-20% more energy under optimal albedo conditions, with even greater gains reported for some case studies utilizing PV trackers. The cost delta between bifacial and monofacial modules has narrowed rapidly in recent years and by 2020/2021, IHS Markit forecasts the price gap will become relatively insignificant compared to the efficiency gains. Diverse field studies have clearly demonstrated the potential performance gains and lower LCOE of installations using single-axis trackers together with bifacial, and this is a value proposition being used now for both module producers as well as tracker manufacturers. Manufacturers claim that when installed together with a tracker, the rear side of a bifacial module could generate up to 30% additional output. There are still some uncertainties regarding the exact level of extra gain associated to the combination of bifacial modules with trackers depending on project type, location, and how to model such additional output (see pp.46-48). The industry is, in fact, still waiting for the highly anticipated publication of IEC standards for bifaciality factor that could be published before the end of 2019 and set a baseline that facilitates modeling and financing of utility-scale projects using this technology.

According to IHS Markit, the best markets for bifacial PV systems will be those with vast areas of reflective terrain, such as arid desert regions and strong demand for ground-mounted utility-scale PV. While China may be the largest market initially, the United States is rapidly becoming a key market for bifacial products, in addition to growing demand across Latin America, the Middle East and North Africa.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.