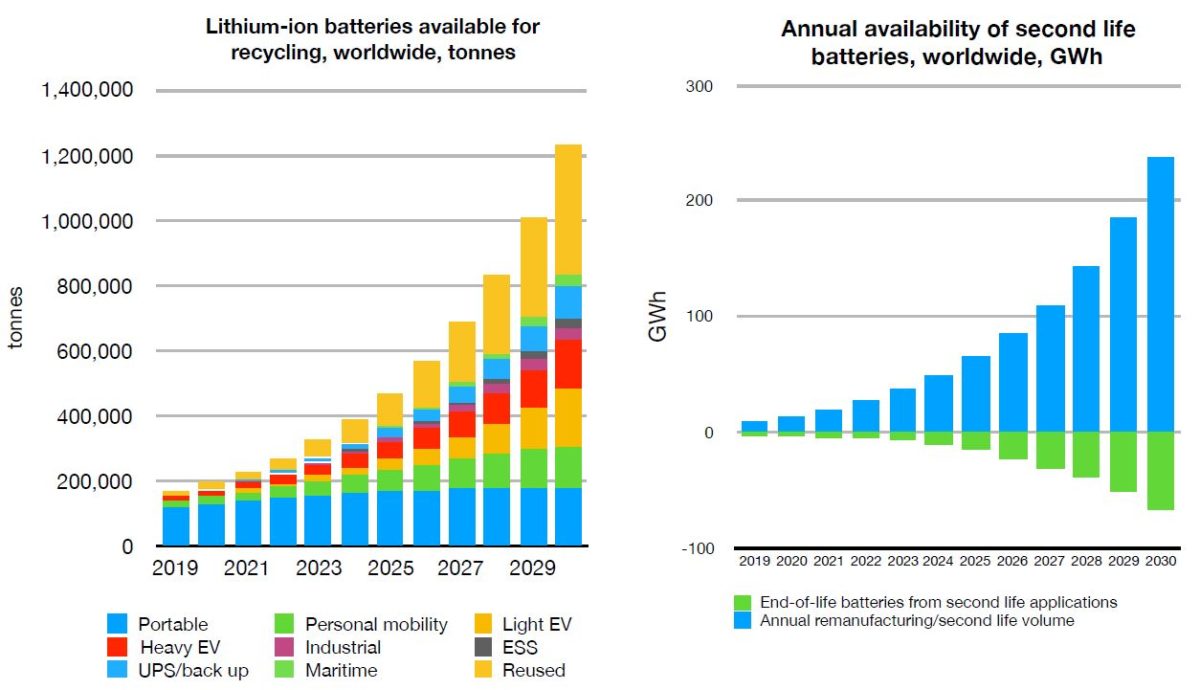

In just over ten years’ time, 1.2 million tons of lithium-ion batteries will have reached end-of-life, according to data published by London-based storage recycling research group Circular Energy Storage.

The analysts considered batteries sold across different sectors and their varying expected life cycles and second life applications to make forecasts about the volume of materials which could be recovered.

Circular Energy Storage estimated that in 2030, recycling facilities could recover 125,000 tons of lithium, 35,000 tons of cobalt and 86,000 tons of nickel. Based on current prices for those materials, that would add up to a $6 billion market. On top of that, between 400,000 and 1 million tons of production scrap could be recovered, according to the researchers.

Prolific use of lithium-ion storage in portable electronics, transport and energy applications continues to accumulate scale for the eventual recycling industry for such products. The market volume for such batteries will likely have expanded tenfold between 2018 and 2030.

China – the world’s largest battery manufacturer – is its own best customer as the country will generate 57% of all battery waste by 2030. And the business community is not ignorant of the fact, with 30 of the world’s 50 lithium-ion battery recycling specialists headquartered in China.

A second life

Circular Energy Storage also predicts a 1 TWh market in 2030 for the reuse of batteries whose life span precludes their use for their original purpose but which can still be used to provide back-up grid power, stationery energy storage and EV charging.

“One thousand gigawatt-hours might sound like an enormous volume, far beyond the expected installed capacity of, for instance, energy storage systems,” said Hans Eric Melin, MD of Circular Energy Storage, “but again it’s really important to look at the numbers for each market and when the batteries, in fact, are available.”

The net market value for such second-life battery applications was estimated at $45 billion up to 2030, a figure arrived at based on an assumption of $45/kWh. The authors of the recycling study added, half of that value would be generated in 2027-30.

“In the U.S., which is one of the fastest growing energy storage markets and where there is a significant re-manufacturing activity, we expect only 2 GWh to become available in 2022 and 8 GWh as late as in 2025,” said Melin,” adding: “China can produce more than 41 GWh of second-life batteries. We have already started to see repurposed batteries from China … used in several overseas markets, not least for back-up power, which shows how dynamic [this] market is. It’s not only about delaying recycling but about capturing market shares on the battery market.”

“While the industry tends to focus on the electric cars, we expect more batteries from heavy use applications such as electric buses, trucks, lifts, e-bikes and scooters,” said Melin. “However, the geographical differences are huge, both regarding the volume and the characteristics of the waste stream.”

The rise of battery-based energy storage has prompted fresh concerns related to the environmental and social impacts of lithium mining, particularly in light of technical challenges to recovering battery-grade lithium from used devices. However, recent process developments suggest the material can be recovered to a high enough standard for reuse in batteries.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.