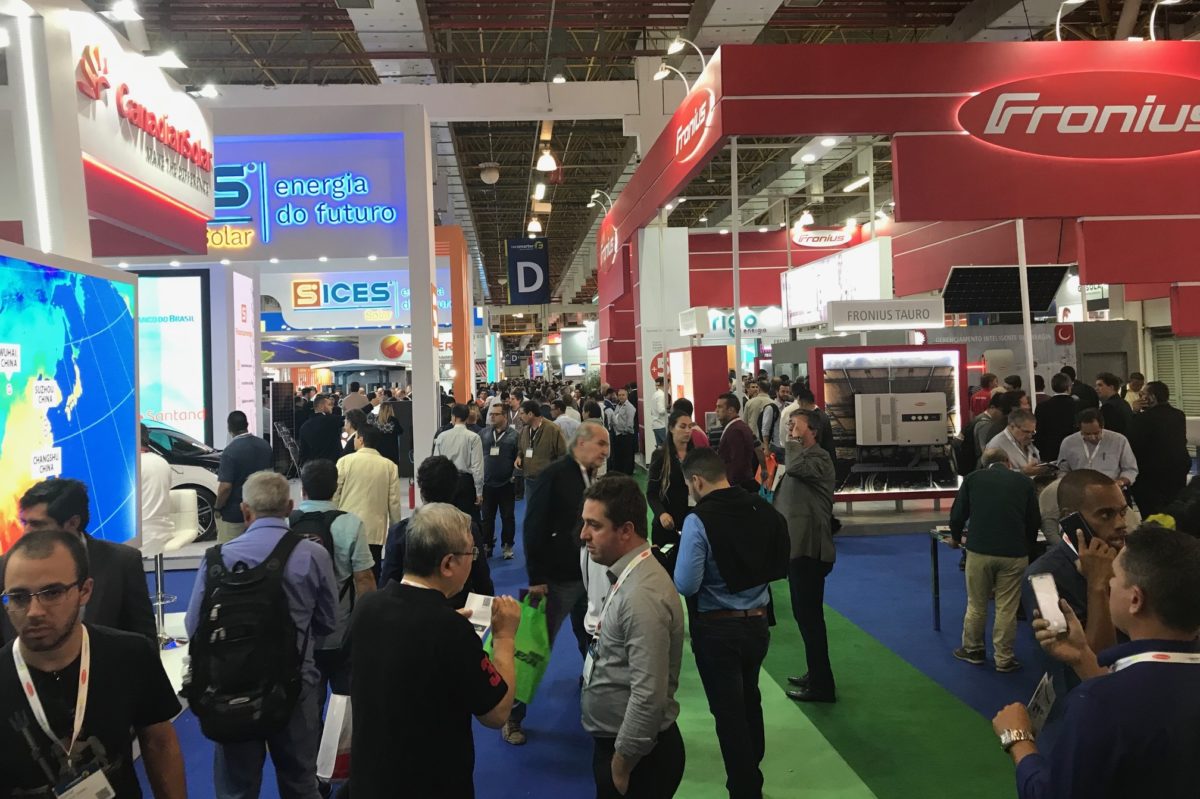

That Brazil is experiencing a solar boom was very much evident at Intersolar South America, held in Sao Paulo last week as part of the smarter E South America exhibition.

According to numbers released by event organizer Solar Promotion, the fair hosted 341 exhibitors and around 25,000 visitors from 39 countries. “We are overwhelmed by the outstanding resonance to our exhibitions and conference,” said MD Florian Wessendorf. “The industry’s dynamic and the enormous visitor numbers underline that Brazil is ready for the new energy world.”

The age of distributed generation

Although utility scale solar provides the largest generation capacity growth volume in the Brazilian PV market – thanks to the nation’s renewable energy auctions – distributed generation (DG) was creating the buzz at Intersolar. The small scale segment is experiencing its first end-of-year rally due to proposed changes including a net metering tariff reduction that could be introduced in the new year. As a result, a packed show saw uninterrupted activity from potential clients across crowded booths at the three-day event.

Marcelo Sousa, South America sales director at Chinese-Canadian manufacturer Canadian Solar, said the pending regulatory changes could affect the market but only for a short period of time.

“The market in Brazil is almost doubling every year and I believe that, regardless of regulatory changes, the market will keep growing as the energy prices are expected to keep rising,” he said. Sousa did concede, however, the behavior of the DG market – which includes all systems with a generation capacity below 5 MW – is changing. Since last year, commercial and industrial PV has claimed a rising share of the DG market from residential solar.

Whatever the dynamics at play, Canadian Solar is benefiting, according to Sousa, with its 350 MW module factory in Sao Paulo and a 2 GW Brazilian pipeline amassed since its arrival in 2014. “The invoice for this milestone will be issued this afternoon,” Sousa told pv magazine on day one of the show.

Ada Li, director for Latin America at Chinese inverter maker Sungrow, shared the enthusiasm. “The fair, which seems to have more than doubled its size from last year, is expanding and booming exactly like the market and our performance and revenue here confirm this trend,” she said. Sungrow claims to have achieved 50% DG market share in the first half of the year. “We believe that after the new regulations will be released a market slowdown may be possible, but we remain very positive in a long-term perspective,” she said. “This market needs solar as power consumers are paying too-high prices.”

Thais Zampieri Bitancourt, market manager at Austrian inverter maker Fronius, stressed how the professional level of exhibitors and attendees has increased. “We participated at this event over the past seven years and this year it seems more professional than ever,” she said. Bitancourt said the Brazilian solar market will keep growing next year too. “We have learnt that next year’s edition of Intersolar SA may be even better,” she added.

Julian Rau, from alternative energies global sales at Swiss cable and connector company Stäubli, was also struck by the popularity of the fair. “We are planning to have a bigger booth for the 2020 edition,” he said. Rau said the Brazilian market is already moving forward without strong incentives and even if changes are made to the DG rules he won’t be concerned. “There are so many private citizens that want photovoltaics, so I am convinced that the future of distributed generation won’t depend on decisions coming from the government,” he said.

Technology trend

Álvaro García Maltrás, MD for Latin America and Caribe at Chinese module maker Trina, said the fair’s momentum was obvious. “We have been in this fair over the past four years but this year it really grew in terms of space and visitors,” he said. “We have seen a lot of people in all of the three days of the event and we have also seen their professional level is higher.” In previous years, enquiries from attendees lacked technical knowledge and concerned small scale projects, said Maltrás, who added: “Now we are seeing much larger volumes and, of course, their technical concerns are also increasing.”

Maltrás believes improvements in PV technology and lower costs, combined with Brazil’s high solar radiation will make it possible to have further growth in the years ahead. He added, Brazil is one of the last major markets where polycrystalline technology is yet to be supplanted by mono products. “We are still seeing many projects relying on multicrystalline panels in both the large scale and distributed generation segments,” he said. “Compared to the U.S., Japan or Europe, where polycrystalline modules are simply disappearing, Brazil still shows interest for poly products.” That could soon change, however, with the Trina rep adding: “Actually, almost all of the modules we are showing here at our booth are monocrystalline devices.”

New opportunities for storage

Apollo Chai, international marketing manager for Chinese inverter manufacturer Goodwe also noted the rising sophistication of visitors to his company’s booth. “We are here for the second time and we see numerous visitors coming,” he said. “I am personally surprised and shocked, as we have seen all knowledgeable customers while last year we still saw people asking us what an inverter is. Now they know what they are looking for.”

Goodwe is planning to bring a bigger booth next year with Chai pointing out any net metering policy change could bring an opportunity for storage. “I heard from customers here that [the] power price is almost as high as in Australia, where people are now buying storage even without incentives,” he added. Falling battery prices could make storage a viable option in Brazil within a couple of years, he added.

Brazilian players optimistic

Rodolfo Meyer, CEO of local solar company Portal Solar, said the size of the show reflected the scale of the Brazilian market. “I have known that next year the size of the fair will be doubled,” he said, noting the importance of the energy market embracing solar. “We have, instead, extremely high power tariffs and dropping panel prices.”

“As for the upcoming regulatory changes, the indication we have is that there should be a charge for the cost of distribution lines and that would be about 27%.” That percentage, he believes, will be applied only on what is fed into the grid and in Brazil, according to Meyer’s data, around 59% of the solar power generated by DG installations is self-consumed. “Even assuming you inject only 50% of the generated power, the grid fee would become only 13.5%,” he said.

“The government, however, gave us the guarantee that this fee will not be retroactive and that the 3.5 GW cap will be maintained. We have now around 1 GW of installed capacity and my feeling is that when the government will confirm the cap we will have a gold rush and people will keep running and install solar panels.”

With solar offering a sound economic case Meyer believes the government’s estimate that the 3.5 GW cap will be reached during 2022 is underestimating the rate of installations by a couple of years. “By the end of 2020, however, PV system, module and BoS [balance-of-system] costs should drop another 5-10% and determine another market push,” he said. “This may also drive the sale of batteries.”

Gradual change may be better

According to Marcio Takata, CEO of Brazilian consultancy Greener, the distributed generation segment remains the best source of business in the Brazilian solar market. “We hope that the new changes in the rules for distributed generation will provide a clear framework for the further development of the segment,” he said. “The market depends on growth volumes, an efficient supply chain and well prepared entrepreneurs, and it can now improve its learning curve, which is crucial to bring the benefits of the solar technology to final consumers.”

His consultancy provides market data and reports so policymakers can make the right choices, said Takata. “I hope that our energy regulator, ANEEL, will introduce changes that are sustainable and without a strong impact on the sector’s development,” he said. “The benefits for the consumers that solar is bringing cannot be ignored.”

Image: PV magazine

Takata said energy demand is expected to rise over the next four to five years. “The tax and pension reforms implemented by the current government may help the Brazilian economy recover after several years of recession,” he added. “This may trigger energy demand and, as a consequence, demand for cheap and easy-to-deploy solar power.”

Lucas Troia, business development director of Brazil’s largest PV system installer, Sices Solar, said the DG segment is exploding. “We know there is a rush now until the end of December but we are also very optimistic that the regulatory change will not be so abrupt,” he said. “In our opinion, it is going to be a smooth change and the market is going to kind of absorb the change.” With electricity prices going up and PV system costs going down, the impact of regulatory change on system pay-back times may be minimal, according to Troia. Next year will also be a good one for distributed generation, he predicted, adding: “Brazil needs energy and solar is the cheapest and fastest way to generate it.”

Bolsonaro announcement

As if the euphoria of a teeming trade show was not enough, controversial Brazilian president Jair Bolsonara yesterday made his second official statement about solar energy.

Governo prepara projetos para reduzir gasto com energia elétrica no setor público. Revisão de contratos e geração de energia solar diminuirão custos em até 90%. A ideia é mudar o consumo com instalação de micro usinas fotovoltaicas nos prédios anexos da Esplanada dos Ministérios.

— Jair M. Bolsonaro (@jairbolsonaro) September 5, 2019

In a tweet published on his personal account, Bolsonaro said the government is preparing projects to reduce public sector energy bills. “Contract reviews and solar power generation will reduce costs by up to 90%,” he wrote. “The idea is to change consumption by installing micro photovoltaic plants in the ministerial buildings.”

Inevitably the rationale was entirely economic, but it offered hope as the Amazon burns nevertheless.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.