Wood Mackenzie and the American Wind Energy Association (AWEA) have released a new report, “Analysis of Commercial and Industrial Wind Energy Demand in the United States,” that outlines the impending corporate renewable procurement boom we are facing and how wind and solar fit into it.

The report starts off by noting that in 2018, corporations contracted more than 6 GW of power purchase agreements (PPAs) – more than ever before. It estimates that up to 85 GW of renewable energy demand exists through 2030 within the largest U.S. companies.

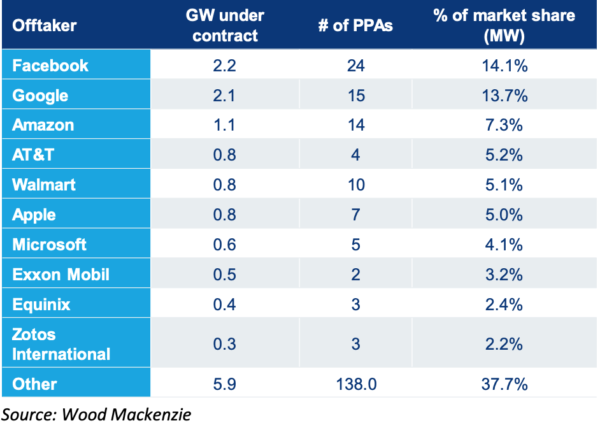

Surprise, surprise – the same companies we saw as top dogs in last month’s 2018 “Solar Means Business Report” are tops all time in terms of renewable procurement. The only exception here is Target, as the company’s 229 MW come from a vast portfolio of 464 installations, mostly on the rooftops of retail stores. This report just tracks PPAs, so Target is sitting it out.

Corporate renewable generation is expected to rise every year, barring an anticipated two-year dip when the ITC runs out, so the question of why big companies are moving toward renewables is becoming increasingly important. To answer that question, AWEA and WoodMac have identified four key factors that accelerate adoption: branding, investor pressure, peer pressure, and the utilization of corporate social responsibility programs to mitigate future business risks.

However, the most interesting part of the report is at the very end. Starting in 2021, corporate adoption of solar is expected to overtake that of wind, and as far as the report projects (2030), it will never look back. In fact, forget looking back – the gap between solar and wind adoption is set to grow dramatically year over year and will reach its peak in 2027, when WoodMackenzie predicts that companies will contract more than 12.5 GW of solar energy, compared to only 1.3 GW of wind.

In fact, wind’s drop-off will be a dramatic one, as it will be overshadowed by the frenzied climb of solar. It’s an ungodly number to think about now, but the report predicts total corporate solar adoption through 2030 to come in at 97 GW. This is compared to 22 GW over the same period for wind. Through 2030, wind adoption is never expected to reach half of the 4.2 GW mark anticipated for 2020, with a low of 966 MW predicted for 2024.

It’s not that wind as a resource is doomed by any means, and it is not this writer’s intent to put down wind as a generation source. Wind, like solar, just cant do it all on its own. As the report puts it: “Absent of a step change in turbine performance or cost reductions, it is increasingly obvious that for wind to compete amidst ever increasing renewables penetration, a long-term energy storage solution must be developed to cope with wind’s weekly and seasonal boom/bust cycle.”

In short, solar’s biggest advantage over wind is that it’s more predictable, so it's easier to forecast generation figures. However, as is also the case with solar, wind farms will be best served by becoming wind+storage projects. For these intermittent sources, the ability to store generation will be just as valuable as the sun and wind moving into the next decade and beyond.

By Tim Sylvia

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.