Chinese solar cell manufacturers are feeling the pinch after prices fell for a tenth week in succession to sit more than 20% lower since early June.

The uncertainty surrounding China’s new solar policy caused a collapse in demand in the world’s biggest PV marketplace in June and July, forcing down the price of high efficiency mono as well as multicrystalline cells over the summer, according to figures cited by Chinese analyst PV InfoLink,

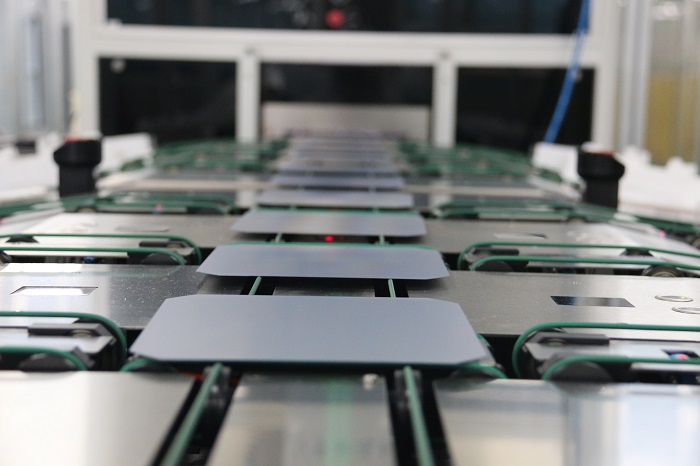

In fact it was monocrystalline products which suffered the steepest falls, exacerbated by an explosion in mono manufacturing capacity, to close the price gap on cheaper multicrystalline products. Analysts are expecting the 60 GW of monocrystalline solar cell production capacity installed in China at the end of last year, according to China Photovoltaic Industry Association figures, to become as much as 100 GW by the end of this year with many of the new production lines coming into operation this quarter.

Price woes

The cell price quoted by the world’s largest manufacturer, Tongwei Solar, illustrates how quickly prices have fallen of late.

This month alone, the price for most of Tongwei’s PERC (passivated-emitter rear contact) cells has fallen 10%. M2-sized (156.75mm×156.75mm) mono PERC cells are now quoted at just RMB1/W ($0.14), marking a 13.8% decline from July. G1-sized (158.75mm×158.75mm) products have experienced price falls of 13.4% in the same period, to RMB1.03/W, and actual transaction prices are likely to be even lower than the quoted level.

A price of around RMB0.82/W is being quoted for multicrystalline cells which are now only around RMB0.10/W cheaper than mono products, the price gap having come in from RMB0.31/W in June.

The bad news for cell makers such as Tongwei is that they are unable to pass on the price pressures up or down the supply chain as the market widely expects an anticipated boom in Chinese PV demand next month to drive a rebound in cell prices.

Although the price of polysilicon this month dropped below $8/kg for the first time, it is expect to rebound as China rushes to complete PV projects in time to qualify for state subsidies this year. With the poly price expected to recover, wafer manufacturers are not bowing to price pressure from cell makers. The same can be said for module makers, who are also refusing to lower prices in anticipation of a solar gold rush that is expected to begin shortly.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.