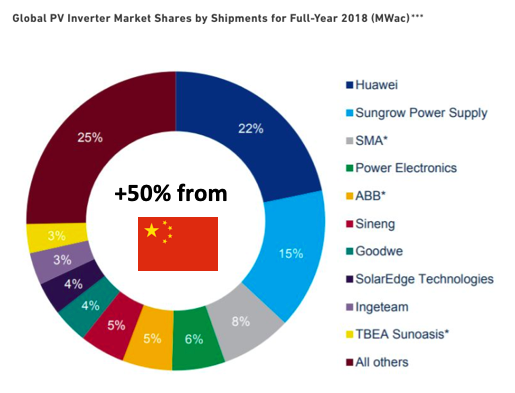

The rise of Huawei, Sungrow and others cannot be stopped simply by adding R&D hardware spending or supply-chain optimization, and we have seen a few negative impacts already: Solarworld, ABB, Schneider Electric and Kaco. Following the press, global technology leader SMA is now under pressure.

But what will be next? Another European branch? Data logger companies? Leading inverter companies are closing the data-gap and integrating all relevant functionalities, byte by byte.

Hardware revenues and margins will continue to have a hard time throughout Europe. Perhaps it is time for a new strategy to surf in front of the digital wave?

The platform strategy

The answer must be an open platform-strategy to join forces and build a single interface for customers to receive everything they need from a single source. A horizontal layer connected to all PV plants as first-level-support, identifying potentials, informing users about economically reasonable actions. Then directly linking the actions to vertical specialists who will execute the job in cleaning, direct marketing, insurance, storage and others. Just like Amazon, only for solar.

A solar (IoT) platform has a key advantage towards common platforms: It enables us to proactively inform users about potentials since the solar platform is always connected to the PV plant via monitoring, while identifying potentials via AI data analytics. Common platforms need users to identify needs, go online and get informed, shortlist options and decide. A solar platform is always connected to the asset, identifies needs and shortlists actions for users sorted by price and quality, so users just have to give the final go through a single click.

Competitive landscape

Europe, especially Germany as the birthplace of solar, has a unique chance to come up with a platform strategy to interconnect millions of PV plants using data. The data part is especially useful since it can be translated into needs and therefore potentials so users learn how to get additional euros from their PV plants. Due to our head start, we currently have pretty good chances and it would be great to not lose another platform business to the United States or China. And please do not forget, the platform business is usually a winner takes it all business. Global competition is on its way.

Coming from the east is Huawei, the world's leading inverter manufacturer which spent a total of US$15 billion on R&D throughout the entire holding in 2018, has already released “AI BOOST FusionSolar”, a digital platform for the solar industry to connect every PV plant to every renewable energy enterprise. Let's see how European players will benefit from a digital platform, built by their hardware competitor number one.

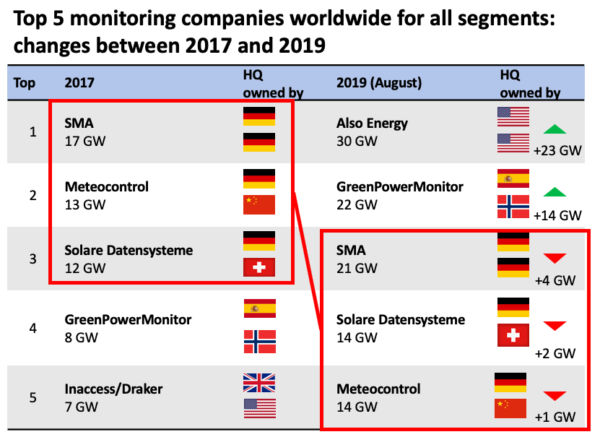

Coming from the west, U.S.-companies, such as AlsoEnergy, now global number one in terms of monitored GW, after taking control of Skytron, Locus and Deck, with 30 GW across 193,000 PV plants, supplies monitoring for residential + commercial & industrial + the utility/SCADA segment. A one-stop-shop for anyone with a mixed PV portfolio. AlsoEnergy might need another two to three years to merge portals and clean up, but once it is done, we will have a tough cookie to crack.

Coming from the west, U.S.-companies, such as AlsoEnergy, now global number one in terms of monitored GW, after taking control of Skytron, Locus and Deck, with 30 GW across 193,000 PV plants, supplies monitoring for residential + commercial & industrial + the utility/SCADA segment. A one-stop-shop for anyone with a mixed PV portfolio. AlsoEnergy might need another two to three years to merge portals and clean up, but once it is done, we will have a tough cookie to crack.

Another example: Meteocontrol, one of the leading monitoring providers with its HQ in Augsburg, Germany, was acquired by Shunfeng International Clean Energy from China in 2014.

So what's the status in Europe?

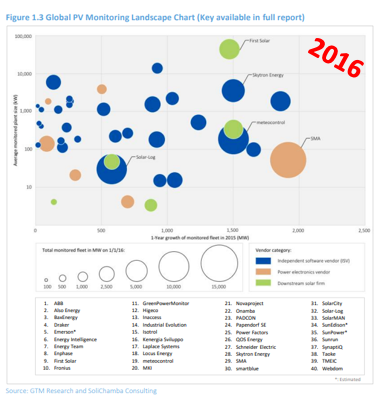

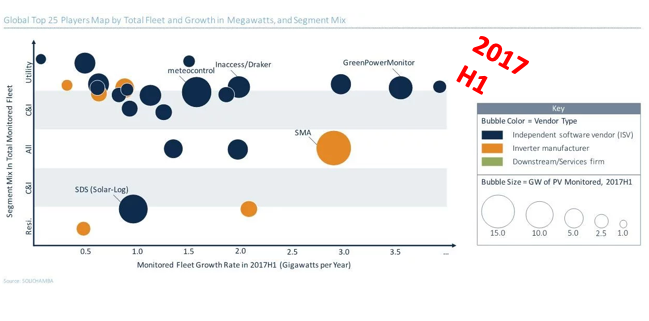

Europe has SMA with 20 GW on 330,000 PV plants. Europe has Solare Datensysteme (Solar-Log) with 14 GW on 300.000 PV plants. Europe has Siemens/Kaco, Schneider Electric, Fimer/ABB, Kostal, Fronius, Danfoss, Delta, REFU and many more. GreenPowerMonitor had amazing success jumping from 8 to 22 GW within 2 years, focusing on utility/SCADA, which leads to “only” 3,500 PV plants under management.

Linking all portfolios to a single open platform means having access to a large number of PV plants through a single interface. And remember, at the end of the day, every PV plant transforms sunlight into energy, shares data, needs cleaning, insurance, financing, repowering, direct marketing, O&M: A total of more than 35 services during its lifetime.

Linking all portfolios to a single open platform means having access to a large number of PV plants through a single interface. And remember, at the end of the day, every PV plant transforms sunlight into energy, shares data, needs cleaning, insurance, financing, repowering, direct marketing, O&M: A total of more than 35 services during its lifetime.

Europe needs an Amazon for solar PV

At this point, it would be comparably easy for us to develop the next Amazon / Airbnb / Alibaba for our PV market, as long as we are still in the lead in terms of directly connected PV plants to European servers.

Time is running, because the world keeps installing more and more foreign inverters, which means losing the customer interface (monitoring portal). Joining forces now to build a strong demand-side (network of millions of PV plants) and link it to the supply-side (every PV product & service out there) needs to be our answer to global competition.

Single bilateral partnerships are a positive sign, but not enough to build a modern ecosystem that will make users fall in love on a global scale.

Other industries have been through this painful process and it is happening in solar. “We need an Amazon” in the market, says one architect in a GreenTechMedia article, a platform telling the user what to do and when to do it, all data-driven with full price transparency, because “cost is the biggest barrier” of scaling PV.

The only question is: Will we lead or follow? We invite everyone to join forces and build an open platform for solar users fall in love with.

About the author

Konrad Perényi is the founder and managing director of Solytic, an independent VC-backed tech startup founded 2017 in Berlin, Germany, which is building the first European interconnected platform for solar.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Interesting perspective, the loss of market leadership in the solar data pool.

A look at the top 5 monitoring companies shows a clear winner, the US company AlsoEnegry.

I bet the 23 GW growth in the portfolio will not come from unique technology, hardware or software, but probably from good distribution, communication and marketing. Congratulations to AlsoEnergy.

“At this point, it would be comparably easy for us to develop the next Amazon / Airbnb / Alibaba for our PV market, as long as we are still in the lead in terms of directly connected PV plants to European servers.”

Alibaba is a Chinese Company and AirBnb is not profitable. Interesting examples.

It’s unlikely. Europe doesn’t have the infrastructure to support these kind of ventures. Just look at the lack of large tech companies. They may at times have good starts, but European tech companies have almost always failed when they try to scale.