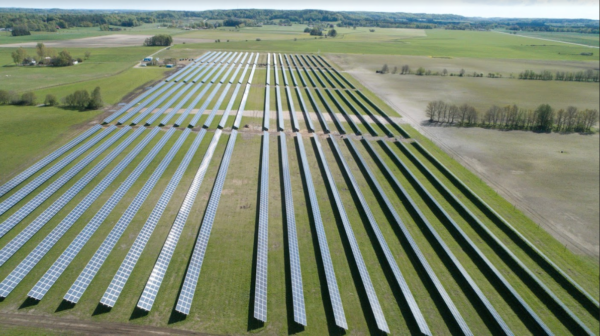

Swedish solar developer SVEA Renewable Solar AB commissioned a 5.8 MW solar power plant in the Sjöbo Kommun, in the Skåne region of southern Sweden in mid-June.

SVEA utility project manager Pontus Skog said development of the plant – Sweden’s largest operational PV project – started two years ago. “At the time there were no solar parks of this size in Sweden and we wanted to show with this project that it is possible to build in Sweden a large scale commercial solar project and at a good price,” he said to pv magazine.

The Sparbanken Skåne Solar Park is selling around a third of its power under a 10-year power purchase agreement (PPA) to Swedish bank Sparbanken Skåne. More than half of the project’s output will be sold on the spot market and the remainder will be traded on the common electricity certificate market for renewable energy in Sweden and Norway. “A small portion of the project’s revenue stream comes from the joint electricity certificate market and it will be less and less important over time,” said Skog. “This is just a small bonus and it is not the variable making the entire project feasible or not. It makes the financial case a little bit stronger but projects like these can make sense even without getting these certificates.”

Swedish and Norwegian electricity certificates are traded on the Nord Pool exchange at a  price agreed between purchasers and sellers. The two countries release certificates to renewable energy producers for every megawatt-hour they generate for the first 15 years of a power generator’s lifetime and the documents can then be traded.

price agreed between purchasers and sellers. The two countries release certificates to renewable energy producers for every megawatt-hour they generate for the first 15 years of a power generator’s lifetime and the documents can then be traded.

As for the PPA, Skog said its level was a little higher than the spot price. “It is not so much higher, you can consider the price difference a sort of premium tariff that is being given to the project,” said the chief executive, adding the buyer of the energy generated, as well as increasing its commitment to green investments and CO2 reduction, has secured a stable power price for ten years. “When a bank such as Sparbanken Skåne decides to implement similar projects it helps the market move forward,” said Skog. “We are planning several more projects like these, as we are seeing a market growth in this segment. One hundred per cent merchant projects may also be viable in the spot market in a couple of years, although I think it still makes sense to have PPAs in order to have stability in the plants, but these PPAs will be more in line with market prices.”

At the beginning of the month, fellow Swedish solar company Eneo Solutions AB announced it had signed a letter of intent for a 20-year PPA linked to a 10 MW solar park it will start building in November. That plant will also sell power to a bank – Swedish financial group Swedbank.

Last year around 17 MW of small solar parks were commissioned in Sweden, according to the latest figures released by energy agency the Energimyndigheten. The figures showed 2018 was the country’s best year in terms of solar deployment, with 180 MW of generation capacity added to the grid for a cumulative installed figure of 411 MW.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.