From pv magazine, July edition

+A walk around any large trade show floor nowadays shows that all well-renowned inverter manufacturers have reached efficiency ratings of greater than 98%. “Efficiency is not really an issue anymore today — further cost reduction is what most manufacturers are after,” says Marco Jung, Head of Department Converter and Drive Technology with Fraunhofer IEE.

To lower the levelized cost of energy, some inverter manufacturers are looking for alternatives to the heart of an inverter — the transistors on its semiconductor power module. To date, the industry’s clear preference has been insulated-gate bipolar transistors (IGBTs) made from silicon. Metal-oxide-semiconductor field-effect transistors (MOSFETs) made from silicon-carbide offer a range of advantages, but their limited availability, price point and a requirement for a comprehensive redesign of the inverter’s power unit, as well as concerns over the semiconductor’s longevity, have been limiting factors to bringing the technology to full market maturity.

Since 2011, silicon carbide semiconductors have been available in a power class that is suitable for the inverter industry. A range of inverter suppliers have begun implementing silicon carbide in in prototype products or low volume production.

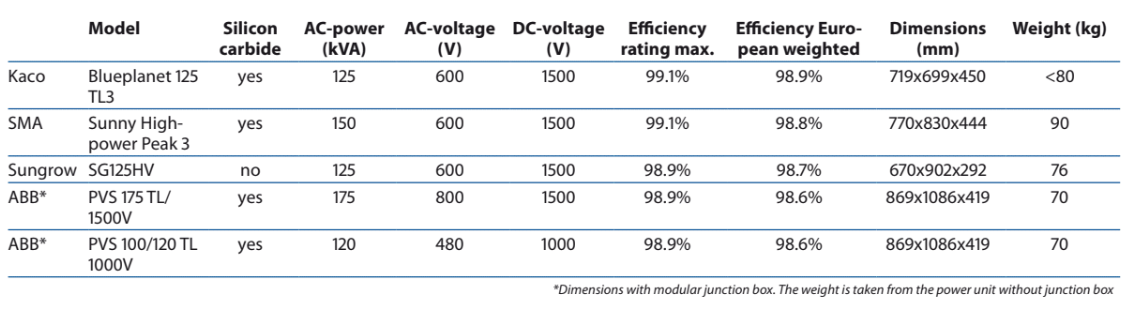

In November 2018, Kaco New Energy brought to the market its first silicon carbide MOSFET inverter in serial production, the Blueplanet 125 TL3. In the years leading up to the product launch, Kaco worked with Franhofer IEE and Infinion to lower the power density to less than 1kg/kW, resulting in a 30 kW demonstrator product. Kaco’s market-ready 125 kW inverter weighs in at just 80kg. SMA, as well, followed suit in early 2019 with its Sunny Highpower Peak 3, featuring silicon-carbide MOSFETs, in combination with silicon IGBTs like the Kaco product.

Higher power density

The main reason why inverter companies are trying to make a move on this technology is to achieve a higher power-to-weight ratio and more compact design for their devices. The weight and volume reductions play out rather well in the utility-scale application for string inverters, “because when you install it in remote regions, it should be possible for two people to carry it and mount it,” says Matthias Haag, CTO of Kaco New Energy.

In 2008, Kaco’s 100 kW inverter came in at 1129kg, towering 2.12m above the ground. The new Blueplanet 125 kW TL3 model weighs 80kg. The reasons for this weight reduction are less heat dissipation demand, and a considerable size reduction of passive and magnetic components, such as inductors, capacitors, boost converters, sinusoidal filters and eventually, the housing. Higher switching frequencies and lower inductances allow the downscaling in size for these elements.

Kaco has measured each component’s contribution to the final accumulated weight of the device, in a 25 kW demonstrator inverter featuring MOSFETs. In this demonstrator, the housing alone comprises 25% of the total weight, followed by the heat sink, which comprises another 9%. The inductances on the DC and the AC side, combined with their respective casings and soldering points, account for another 34% of the inverter’s weight. Allowing to reduce their weight has significant effects on the devices’ compactness then.

Passive magnetic elements

Silicon carbide semiconductors provide considerably higher switching frequencies. Compared to the around 16 kHz industry standard with IGBTs, the new MOSFET inverters switch at around 50 kHz, which allows the downsizing of an inverter’s passive magnetic components, says Jung of Fraunhofer IEE. An inverter’s main task is to convert direct current into an alternating current. The switches do not already generate a very grid-compliant sinusoidal alternating voltage. In an inverter’s configuration, a range of DC-linked capacitors, sinusoidal filters, must be arranged to generate a smooth sine wave. When using lower switching frequencies, these elements must be bigger. According to Haag, the real art is managing the high power over the printed circuit board.

Also, Jung and his colleague at Fraunhofer IEE Fabian Schnabel who worked with him on the PV LEO project point to the complication of arranging the components to keep parasitic inductance as low as possible on the printed circuit board. The MOSFETs exposure to EMC would reduce the switching speed and delude the steepness of the switching edges.

Additionally, high inductivity will create top peaks in the switching process, which if not appropriately managed can blow the MOSFETs, says Jung. If done correctly using silicon carbide semiconductors, you can reduce the weight of choke coils and capacitors by 30-50%. Sven Bremicker, Head of the Technology Development Center at SMA, pointed to a choke coil used in SMA’s 150 kW Highpower Peak 3, and when told that it was the size of a cooking pot, swiftly responded, that “it would be the size of a 10-liter bucket if we didn’t use silicon carbide.”

However, there are additional benefits that make the use of MOSFETs attractive. According to Jung and Schnabel, the higher switching frequency of MOSFETs makes it easier to provide grid ancillary services with the inverter. Hitherto, the inverter always attempted to generate a sine wave as perfectly as possible. However, a modulation to damp the harmonics content above 50 Hz more efficiently is likely something that can help improve grid quality at more competitive costs.

Temperature sensitivity

Silicon carbide offers another advantage in terms of heat. The semiconductor can operate safely at temperatures of about 150-175°C. The problems are the soldering points and printed circuit boards, as Schnabel points out. Here the materials are likely to suffer earlier from heat damage. SMA has extensively tested its inverter, ensuring that a temperature of 130°C on the MOSFET is not exceeded, to ensure reliable operation over the 20-year service life, as Bremicker explains.

Silicon IGBTs develop more pronounced peak and trailing currents, especially when the semiconductor reaches high temperatures. Silicon carbide products, on the other hand, have a better switching behavior with steeper switching flanks, lower peak currents and shorter trailing currents.

As the MOSFETs maintain these properties throughout a bigger temperature range, the inverter can avoid derating longer. Kaco’s Blueplanet 125 TL3, for example, starts derating at 50°C ambient temperature. Haag points out that this could provide additional efficiency gains if the inverter is placed in desert climates for example, where the inverter can continue to operate at full blast throughout the year.

So long, so long IGBTs?

Manufacturers of the power semiconductors, such as Infineon and Cree, recently announced plans to ramp up their production volumes of SiC MOSFETs significantly. With that development, the cost of the components will likely further drop, and inverters using such materials, will undercut traditional IGBT inverters in price. Kaco, as well as SMA, has made the use of MOSFETs in its high-power string inverters economical by combining them with IGBTs. In this way, Bremicker of SMA says, “we can ensure to use the full potential of MOSFETs where they make the most sense.”

SMA CEO Jürgen Reinert believes that soon their field of application will also expand into smaller -scale string inverters and for the smallest power classes the use of gallium nitride switches will go to market. Here, Reinert explains, “customers could be interested in the reduced noise level and compactness of the design.” In terms of the cost reduction outlook, SMA’s CEO points to how the EV industry has consistently reduced the cost of power train inverters, at a rate of 2.6% per year. The PV inverter industry could reduce the cost of MOSFET inverters by a bigger margin over the last years, but he does expect that the PV industry will align its cost-reduction pace with that of the EV industry, as the latter had moved earlier on the technology — but the development lead is closing.

“In the meantime, we have a break-even between silicon-based inverters and silicon carbide models, depending on the power class and field of application, but in the future, this is likely to develop further in favor of silicon carbide,” the chief executive explains.

The effort to reduce the costs of inverters is mutually shared across the industry. Also, the approach to achieving that goal by increasing the devices’ power density appears to be a common strategy. However, some manufacturers accomplish this without the use of silicon-carbide semiconductors. Sungrow has brought to the market a high-power string inverter with comparable weight and volume specs. The trick had been pulled off using a five-level topology, the company says.

“While silicon semiconductors have undergone numerous optimization steps over the past 30 years, the learning curve for silicon carbide is still in its infancy, and the cost reduction potential is greater. In addition, the higher electric strength of silicon carbide compared to silicon semiconductors is more important for 1,500-volt systems, and their market share is likely to increase in the coming years. There are now many reliable supply sources for silicon carbide MOSFETs in Europe, the U.S. and Asia,” writes Andreas Hensel, head of the medium voltage power electronics team at Fraunhofer ISE.

His colleagues at Fraunhofer IEE are somewhat more cautious about the outlook for MOSFETs. They see that IGBTs will continue to be around for some years to come. “Yes, economies of scale will play in silicon carbides’ favor, but I expect the cost of production of the material to always be higher,” says Schnabel. “IGBTs are more robust devices; after all, both have their place in the industry.” Jung adds that “gallium nitride has great potential to establish itself in the PV semiconductor market in the years to come.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.