There are a good deal of misleading statistics surrounding lithium-battery recycling and China and South Korea have already emerged as the global hubs where most batteries end up at the end of their lifetime, a new report commissioned by the Swedish Energy Agency has found.

The study states one of the reasons lithium-ion recycling rates are consistently under-reported is that far too many researchers are using old, secondary data and rarely check references.

For instance, one oft-cited figure that “5% of lithium-ion batteries are recycled”, was taken originally taken from a Friends of the Earth report issued in 2010. That claim, ironically, has itself been extensively recycled and was cited in an editorial in Nature Energy in April.

Dissemination of unreliable or obsolete data is possible because no official statistics are available. However, London-based research and consulting group Circular Energy Storage has collected information from 50 or so global lithium-ion recycling companies and found as much as 97,000 tons were recycled last year, 67,000 in China and 18,000 in South Korea.

“We know from our data that about 100,000 tons of waste batteries were recycled last year, that’s about 50% of what reached end-of-life,” Hans Eric Melin, director of Circular Energy Storage, told pv magazine. “However, many of those batteries are more than three years old, which is the baseline [the] EU is using to calculate collection rate. That means that the material many believe was lost to landfill or illegal export may have rather been in the devices longer than expected and then legally exported, either as part of the devices or as batteries to recyclers in Asia with higher efficiencies and ability to pay higher prices. The batteries are recycled, only not here.”

Higher bids

The report also found overcapacity in the recycling industry of virtually every market – including China, with more than 30 companies – primarily because of a lack of solutions to efficiently collect batteries. When it comes to EVs and battery storage, many systems still have not entered the statistics due to long product life, or because they are being reused in new applications.

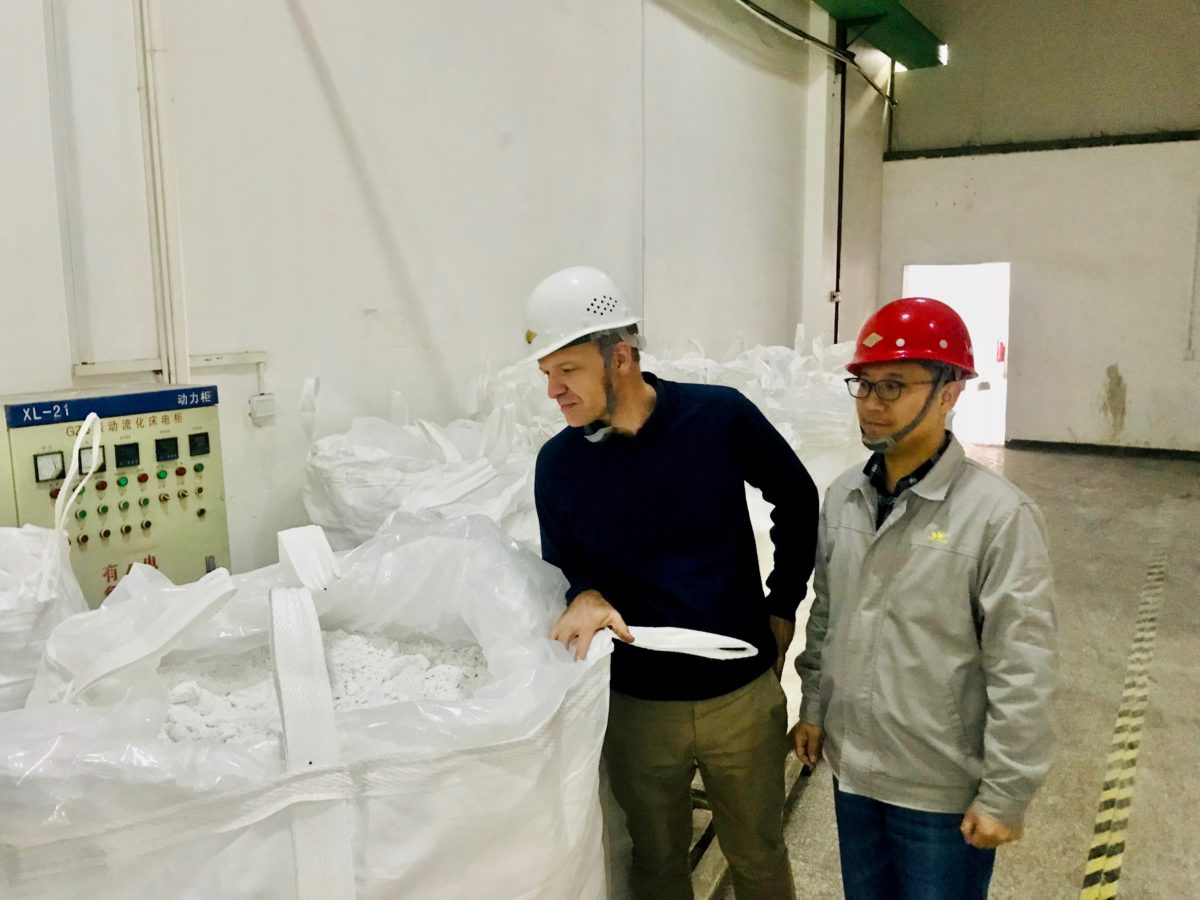

There are more than 50 companies worldwide which recycle lithium-ion batteries at some scale, from small laboratory plants to full-scale factories. Most are in China, with significant numbers also in South Korea, the EU, Japan, Canada and the U.S. China and South Korea have emerged as preferred destinations for battery waste as companies pay much higher prices than businesses in Europe or the U.S.

“Today there are several recyclers with efficient processes through which batteries are recycled to new battery materials – completely in accordance with what is desirable in a circular economy,” stated the Circular Energy Storage report. “What is missing, however – especially in Europe – is batteries to recycle.”

Melin said the reason is clear: the highest bidder gets the batteries. “What can prevent this is export and import bans, too expensive or complicated transportation and ignorance. The latter can explain why everybody isn’t so vocal about why much more batteries are recycled than what we believe,” he said, adding: “You can pay more if you will reuse the batteries than if you recycle them.”

A closed loop?

A circular economy for lithium-ion batteries would not only ensure responsible disposal of hazardous waste but also reduce battery manufacturers’ dependence on traditional raw material supply chains which are often exposed to price spikes.

For the battery recyclers which use a smelting process – such as Belgian recycler and supplier of cobalt Umicore and British-Swiss commodity heavyweight Glencore – it is fairly easy to recover more than 90% of the cobalt, nickel and copper from batteries, but things get trickier with lithium. In Asia, hydrometallurgical processes are the preferred recycling method. Copper is separated and, together with aluminum, efficiently processed. The recovery rates for other materials are said to be very high, starting from 98%. Recovery rate, however, is not the same as purity. In the case of nickel and cobalt the purity is usually very high as the materials are recovered as sulphates. For lithium to be sold as battery grade, the purity requirements are very high and, according to Circular Energy Storage’s Melin, not everybody is able to sell the material as such even if many can.

“Most Chinese and South Korean recyclers have the ability to recover lithium through hydrometallurgical processes ’ many times with pyrolysis as a pre-step ’ but that doesn’t mean everybody is recycling lithium,” the director added. “It all depends on what their main end-products are and what the current prices are. However, the interest for lithium is on the increase with several players focusing on lithium only, not least with an increasing number of LFP [lithium iron phosphate] batteries in the stream.”

In its overview of the available research on recycling, the consultancy found more than 300 studies had been conducted into separating materials in waste batteries and reproducing cathode materials or their precursors. More than 75% of the studies considered hydrometallurgical processes and 70% were carried out by scientists in China or South Korea. Most of those focused on the treatment of LCO [lithium cobalt] and NCM [nickel, cobalt, manganese] batteries and only on LFP, LMO [lithium ion manganese oxide] and NCA [lithium nickel cobalt aluminum oxide] batteries. The results showed all active materials, including lithium, could be recycled with high efficiency.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Where does the lithium go if its not recyclable or reusable, Ive read it costs 5 times as much to recycle lithium as to get it from new, no market based economy company not even China would do that.

If only 50% of it is recycled is the other 50% dumped in the ocean?

Link the study, please.