Market prices for cells and modules are falling. Monocrystalline high-efficiency modules and cells on the Chinese market experienced more pronounced falls than multicrystalline products. While overseas market prices remained unchanged, analysts at Taiwanese outfit Energytrend expect a ripple effect next week.

High mono demand drives polysilicon prices

As the market continues to focus on monosilicon modules, the effects of increased mono demand are rippling upstream to the polysilicon market.

The market analyst team at Energytrend wrote polysilicon prices for monosilicon-grade material have increased overseas and in Chinese markets. According to the analysts, capacities for multi silicon material reduced over the last week.

With Chinese mono-grade polysilicon demand on the rise, global price ramifications could be detected. The overseas price for the material has been clocked at $9.53-10.05/kg, with average rates rising to $9.69/kg. The global average price stayed flat at $9.43/kg.

In China, the market for multi-Si material generated prices of $8.58-9.3/kg, with the average price dropping to $9.16/kg. Monosilicon-grade material on the Chinese market was priced at $10.76-11.19/kg, for an average of $11.05/kg.

Wafer thin wafer changes

Changing exchange rates and varying demand saw wafer makers make price adjustments, according to Energytrend’s latest update. Those changes happened in Chinese marketplaces although two manufacturers adjusted only their overseas prices. Adjustments for multi wafers were reportedly minor and foreseeable.

Prices for mono wafers in foreign markets this week came in at $0.405-0.415/pc with prices for large wafer sizes $0.465. Overseas prices for multi-Si wafers were $0.246-0.255/pc. According to Energytrend, black silicon products dropped to $0.277/pc.

In China, prices for mono-Si wafers remained at $0.439-0.461/pc, with a large size price of $0.487/pc. Multi-Si wafers in China were sold for $0.269-0.284/pc with the average price dropping to $0.276/pc. Black silicon products remained at $0.311/pc.

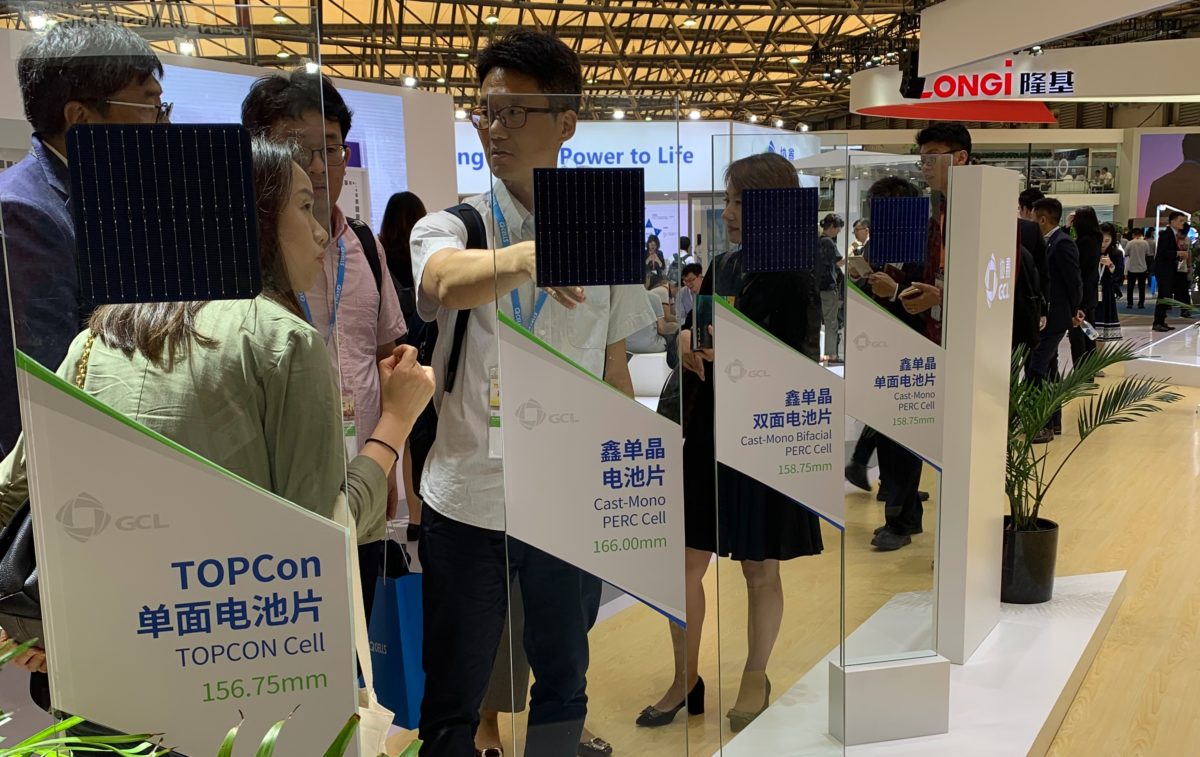

Cheap Chinese cells set tone overseas

While further upstream prices hadn’t changed dramatically, the cost for PV cells fell noticably, Energytrend observed. Cell prices in China retreated due to downstream manufacturers’ levelized cost of energy calculation of conductivity for high-power and bifacial products. While the effects could be felt on the Chinese PV cell market, overseas markets remained stable. The analysts, however, expect cell prices to change overseas next week.

In foreign markets, standard multi-Si cells traded for $0.113-0.129/W. With a marginal price difference standard, mono-Si cells changed hands for around $0.118-0.160/W. The high-efficiency mono-Si price was unchanged at $0.155-0.170/W. The prices for ultra-high efficiency mono-Si cells (more than 21.5% efficiency) remained unchanged at $0.157-0.178/W.

In China, however, general multi-Si cell prices came in at $0.12-0.13/W, with the average price dropping to $0.13/W. The cost of high-efficiency multi-Si cells was $0.159/W. The general mono-Si price fell to $0.127-0.134/W so the average price came down to $0.132/W.

The price for high-efficiency mono-Si cells fell to $0.166-0.175/W with the average price as low as $0.169/W. Ultra-high efficiency mono-Si cells were not spared the fall as trading prices in China came in at $0.172-0.177/W, with the average price now $0.176/W. The bifacial high-efficiency mono-Si cell price was $0.175-0.179/W with the average falling to $0.177/W. The bifacial ultra-high efficiency mono-Si price notched $0.179-0.186/W for a new average price that fell to $0.180/W.

High-efficiency module costs falling

According to Energytrend, the overseas module market was mostly unchanged this week. However, the price chill on the Chinese PV cell market has shown effects on the Chinese module market too. Standard multi-modules (270-275 W) traded unchanged at $0.205/W. Similarly, flat price developments were seen in high-efficiency multi-Si modules (280-285 W) with costs staying at $0.218-0.237/W.

On the mono side, standard modules (290-295 W) sold for $0.231-0.251/W. High efficiency (300-305 W) and ultra high efficiency (more than 310 W) remained unchanged at $0.268-0.34/W and $0.270-0.385/W, respectively.

The Chinese market, on the other hand, showed more activity, with multi and high-efficiency multi-modules flat at $0.244-0.254/W and $0.266/W, respectively. Price developments were detected in the mono market, as standard mono module prices were $0.266-0.276/W for a new average price that fell to $0.270/W. High-efficiency mono modules were seen on the market for $0.284-0.305/W, with the average clocking $0.301/W. Lastly, ultra-high efficiency mono modules prices were $0.298-0.313/W with the new average price for such products down to $0.310/W.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.