From pv magazine USA.

By and large, the United States is being left behind in the global battery manufacturing boom. However, the new factory German manufacturer Akasol announced yesterday for a site near Detroit will bring modest capacity as well as 200 jobs to Michigan.

Akasol plans to begin production at the facility next year, and to reach 400 MWh of annual production the year after, in three shifts. That will require investment in the “mid two-digit million-euro range” over five years and the battery maker noted the factory will benefit from a Michigan state grant.

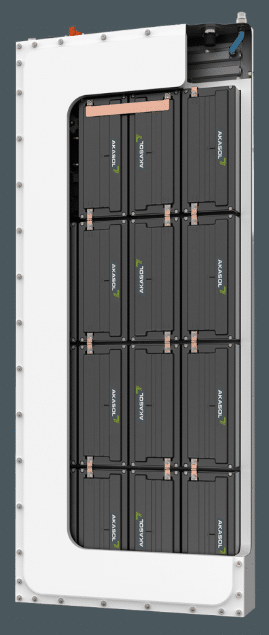

The facility will initially produce the AKASystem OEM PRC battery for commercial vehicles, based on lithium-ion technology and which Akasol says is the first system compatible with standard plug-in hybrid electric vehicle (PHEV) modules of all major manufacturers. The system comes in 25 kWh and 33 kWh versions.

Akasol said it will then focus on “battery systems with high energy density”. The company estimated a third of its production output would go to existing customers, including “a well-known Swedish manufacturer of trucks and buses”, but added it is seeking North American customers.

“[The new factory] is also a central component of our international expansion strategy,” said Akasol CEO Sven Schulz. “With our unique battery expertise, from module to system level, and the fact that we are already mass-producing for market-leading companies, we are well on the way to becoming the European market leader in commercial vehicle battery systems. Our new Michigan site will accelerate business development and activities with new and existing North American customers.”

Chemical supplies

Michigan officials quoted in Akasol’s press release cited the sate’s “modern manufacturing industry” and “robust supply chain”. However, while Akasol did not say where its components would come from, China is increasingly dominating the market for lithium-ion battery manufacturing as well as the supply of chemicals needed to make them.

According to estimates from Benchmark Mineral Intelligence, China accounted for 51% of lithium chemical supply last year, 62% of cobalt chemical supply and all of the spherical graphite used in lithium-ion battery manufacturing. Those market shares were obtained despite the nation representing a minority share in the world’s lithium and cobalt production. The U.S. represented 7% of the lithium chemical supply and does not produce meaningful amounts of the other materials.

With more lithium-ion battery manufacturing, it is possible chemical and other supply chains would be incentivized to move to the States. However, the 400 MWh of manufacturing Akasol’s facility will represent is a drop in the bucket when measured against more than 200 GWh of global capacity, the largest portion of which is in China, or the volume of battery factories in the pipeline.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

6 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.