Renewable energy continues to make its presence felt in global electricity production but its integration in the heating, cooling and transport sectors still lags the progress needed to stave off climate chaos. The sectoral imbalance is in large part due to insufficient or unstable policy support, according to a report published today by global renewable energy policy network REN21.

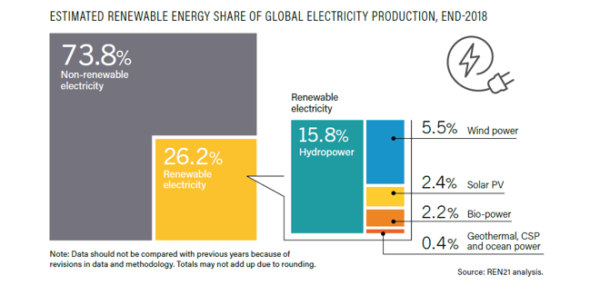

The Renewables 2019 Global Status Report said renewables accounted for 26.2% of electricity generation last year, the bulk of it still hydro, with 15.8%, followed by wind (5.5%) and solar (2.4%). Last year saw 181 GW of renewable power generation capacity added, for a cumulative 2,378 GW at year’s end. With 100 GW of the new renewables capacity solar, PV accounted for the lion’s share.

With costs on a downward trajectory, renewables have been established as a mainstream source of electricity for years, said REN21. Excluding hydro, 90 countries had more than 1 GW of installed clean power capacity and more than 30 countries had exceeded 10 GW. Nine countries produced more than 20% of their electricity from variable renewables: Denmark, Uruguay, Ireland, Germany, Portugal, Spain, Greece, Honduras and the U.K.

Solar

The decline of the Chinese PV market from 53 to 45 GW in 2018, offset by higher demand in emerging markets and Europe, resulted in a slight increase in the annual global solar market, which surpassed 100 GW for the first time. Chinese policy changes – aimed at reining in public solar subsidies – flooded the module marketplace to help open up new markets and competition and price pressure led to investment in more efficient production capacity and continued technological advances, the report stated.

According to REN21, cumulative PV capacity increased 25% to at least 505 GW, as 11 countries added more than 1 GW in 2018. Some 32 nations now have at least 1 GW of installed PV capacity.

Investment flows

However, after years of accelerating growth, renewable energy capacity additions leveled off and investment decreased, relative to 2017. Solar attracted much of the investment in renewables capacity – almost $140 billion – but that figure was down 22% on the previous year. Investment in wind power rose 2% to $134 billion while large scale hydro attracted $16 billion, down from $40 billion in 2017.

Last year saw a record number of renewable energy PPAs – double the amount recorded in 2017 – with U.S. companies out in front with 13.2 GW of utility scale solar power purchase agreements. Last year also saw governments turn to competitive auctions in lieu of fixed-price policies. According to REN21, 48 auctions were held in 2018, up from 29 the year before. Solar had a record number of PPAs and tenders, with winning bids securing an electricity price as low as $0.02/kWh.

Local initiatives and global political inaction

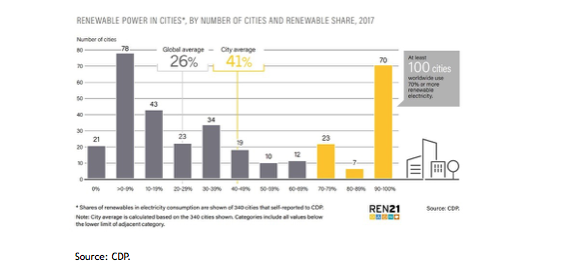

With renewables mainstream, global clean energy uptake no longer depends on a small number of countries. The number of states aiming for 100% renewable electricity is rising and cities are taking the initiative by adopting ambitious renewable energy targets – notably in the U.S. in opposition to a climate-change skeptical White House. REN21 found more than 100 cities use at least 70% renewable electricity, and at least 50 have put in place renewable energy targets covering power; heating and cooling; and transport.

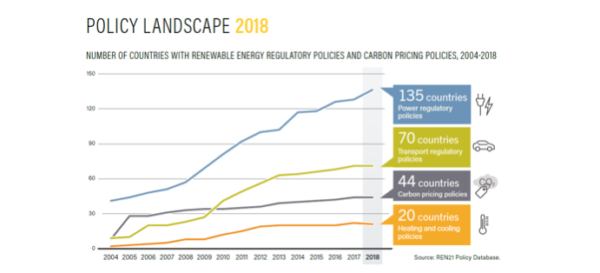

While the power sector received most policy attention, there remains a huge opportunity for countries to drive action by expanding the low carbon transition to the heating, cooling and transport sectors, the report stated. Renewables supply more than a quarter of global electricity but provide only 10% of the energy used for heating and cooling, and just over 3% for transport, REN21 found, noting the number of countries with a policy for renewables in heating actually declined last year.

“A key breakthrough could occur if countries cut their fossil fuel subsidies, which are propping up dirty energy” said Rana Adib, executive secretary of REN21. Some 40 countries have undertaken some level of fossil fuel subsidy reform since 2015, but such incentives remained in 112 countries in 2017, with at least 73 states subsidizing fossil fuels to the tune of more than $100 million each, the report found. REN21 estimated total global fossil fuel subsidies of $300 billion in 2017, an 11% increase from 2016.

Carbon pricing remains acutely under used as a policy tool, the report stated. By the end of last year only 44 national governments, 21 states or provinces and seven cities had implemented carbon pricing – accounting for just 13% of global CO2 emissions.

“With the countries needing to come back with more ambitious climate targets in 2020, this report shows there are an array of opportunities to scale up action and improve people’s lives by extending the benefits of the energy transition throughout the economy,” said REN21 chair Arthouros Zervos.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.