China has embraced renewables and solar more than any other country in the world over the past two decades, especially in the production of the large number of components the industry needs.

This is part of the long movement of manufacturing activities of all kinds into China since the early 1990s, and it may turn out to be a long-term benefit for the country, according to Indra Overland, the head of the Center for Energy Research and a research panel member for the Global Commission on the Geopolitics of the Energy Transition at the International Renewable Energy Agency (IRENA).

Chinese dominance in solar

In the latest in a series of interviews about the geopolitics of renewable energy, Overland explains that China has already built up a leading position in key technologies and manufacturing, especially in solar. “A few other countries like Denmark and the U.K. have moved pretty fast and far on renewables, but China’s lead is impressive,” he told pv magazine.

The Chinese solar industry — and by extension, the global PV manufacturing business, like that of mobile phone production — may come to be dominated by a few “techemoths,” or large manufacturers who are able to leverage lower production costs, early-mover advantages and economies of scale to achieve quasi-monopoly positions, Overland said. This may cause China and the European Union to gravitate toward each other, especially as the United States under President Donald Trump falls behind on renewable energy, he argued.

“If Trump’s trade war is not successful in either breaking down the Chinese or bringing them to heel, their dominance may be very long-lasting,” Overland stated. “China has an immense discipline and vigor, and now that it has refound itself after the Maoist years, it may keep going for a long time, also in solar power.”

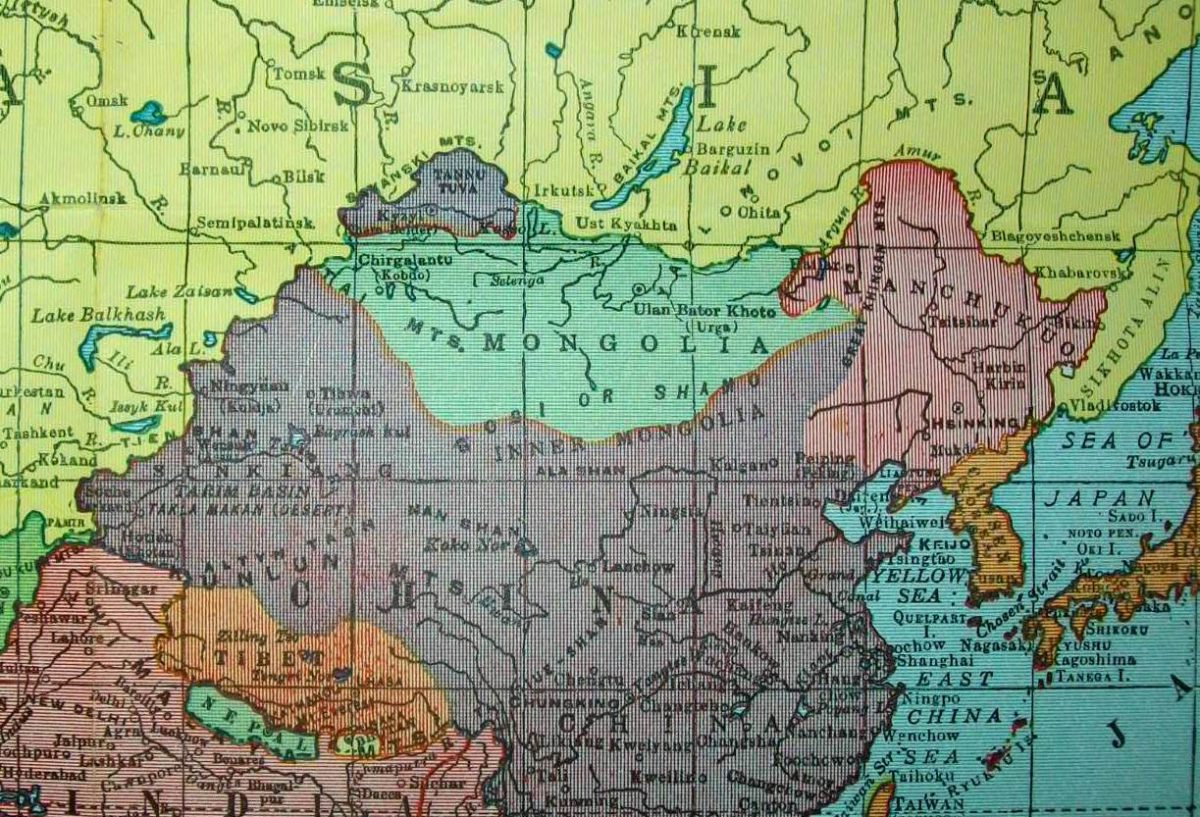

Image: Norsk Utenrikspolitisk Institutt (NUPI)

Although it is not clear to what extent the Chinese really care about climate change and to what degree they are rather driven by a combination of concerns about local air pollution and global business opportunities, Overland believes that it could be an interesting option for China to join forces with the EU in a more proactive climate alliance in the trade area, for example. “That is not wholly impossible and could really be a game changer,” he said.

How much the Chinese will be able to take advantage of this situation remains unclear. The more the U.S. isolates itself, the more likely alliances such as the tie-up between Japan’s Panasonic and Chinese heterojunction module provider GS-Solar will develop and become successful, according to Overland.

“Many other people are also not sure about the degree to which the Chinese are inventing and creating entirely new things and how important the element of Soviet-style copying may still be in their industrial policy,” he added.

For such alliances to become truly interesting and effective, however, the Chinese will have to be a truly strong scientific and innovative force. But it still has some way to go before achieving that.

“There are many Chinese scientists who would love to work at American universities, not so many American scientists who would like to go to China,” he said, while also reaffirming that this is a race between two different ideological and sociopolitical systems. The West has always assumed that a premise for its strength is its open societies, freedom of speech and democracy. “But through its immense success, China is challenging that to a degree that on a level that no other country has done before. The question is whether they can ultimately be successful in this challenge. Thus, what one thinks about this depends on one’s self-confidence in the Western political system and whether it is superior or not. If it is, China will ultimately either start stagnating, or will have to change its system fundamentally,” Overland asserted.

Increasing influence in Southeast Asia

Overland also believes that the growing Chinese photovoltaic industry may increase the country’s geopolitical influence in Southeast Asia. “China’s Southeast Asian neighbors are importing rising numbers of Chinese solar panels, and the Chinese are also taking on engineering, financing and constructor roles in solar parks and hydropower projects,” he said, while also noting that China’s dominance in Southeast Asia is relatively new, even though it has been building for some time now.

Until now, China and most Southeast Asian countries have needed to import oil from the Middle East, but the Southeast Asians are instead increasingly importing solar panels from China. “This is certainly a trade advantage for China, as it may somehow also increase Southeast Asian dependency on China, or, alternatively, it may create a backlash, as many Southeast Asians are skeptical of Chinese economic and political influence in the region, and there is a long history of crackdowns on the Chinese diaspora in Southeast Asia,” Overland explained.

The eventuality of a trans-national super-grid enabling large flows of renewable energy across Southeast Asia seems quite remote to Overland. “Many countries in Asia are sufficiently large to build their own diversified and stable grids,” he said. “It is therefore not clear to me that there is such a great need for an Asian super-grid, although some interconnectors may be helpful for security of supply in emergency situations.”

There are some smaller countries within Southeast Asia for which it could make sense to integrate their grids, he acknowledged, and China could be involved in this, but not necessarily. “It is also worth noting that China is at odds with very many of its neighbors over territorial and other issues, including Japan, Myanmar, the Philippines, South Korea, and Vietnam. That is not the best starting point for building a super-grid,” Overland pointed out.

China’s internal balance

When asked if the rise of solar and renewables may also reshape China’s internal geopolitical balance, Overland stressed, as he did in previous interviews, that the potential effect of renewables on center-periphery relations within countries should not be exaggerated. “Former national utilities and oil companies will likely be weakened, but I don’t see it affecting the state structure, federalism, or the degree of autonomy of provinces,” he stated.

When asked about the reason for China to build new nuclear plants, despite challenges with their profitability, Overland said the country is large and has many different actors, stakeholders and incumbents. “It seems like either the central leadership does not have complete control, or there is a time lag before policy becomes consistent, or it is a lack of genuine interest in climate change that is shining through. Which one of these applies is difficult to say,” he said.

In his previous interviews for this series, Overland discussed geopolitical issues related to Russia, Saudi Arabia, storage, super-grids, and the geopolitics of the energy transition.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.