China, Europe and the U.S. were the largest markets for electric cars last year, according to the International Energy Agency’s Global EV Outlook 2019 report.

Last year, more than 2 million new electric car registrations were made, taking the global fleet to 5.1 million. The IEA report said at the end of last year 260 million electric two-wheelers were on the roads, along with 460,000 electric buses. Electric vehicles (EVs) are being recharged by 5.2 billion light-duty vehicle (LDV) chargers plus 157,000 bus fast chargers, according to the report.

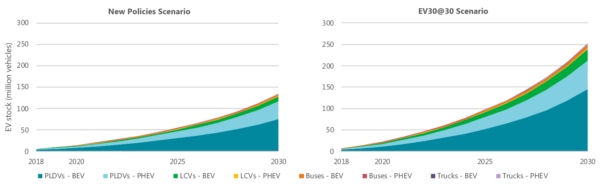

Looking ahead, the IEA made separate forecasts based on current electromobility policy and on expected EV take-up if the EV30@30 campaign demands are realized. The campaign, which aims for EVs to make up at least 30% of new vehicle sales by 2030, was announced in mid 2017 by the Clean Energy Ministerial (CEM), a forum promoting the transition to a clean energy economy.

250 million EVs by 2030

According to the IEA’s more conservative ‘new policies’ scenario, sales of electric cars could reach 23 million in 2030, with the global stock – excluding two and three-wheelers – topping 130 million. Under the EV30@30 scenario, sales could reach 43 million to take the global fleet to 250 million. In both scenarios, China would remain the largest market, with shares of 57% or 70% in 2030, respectively.

Electricity demand for EVs in the first scenario would be around 640 TWh in 2030. The more optimistic outlook envisages demand of 1.11 PWh, with LDVs as the largest EV consumers. “Slow chargers, which can provide flexibility services to power systems, [would be] estimated to account for more than 60% of the total electricity consumed globally to charge EVs in both scenarios in 2030,” the report states.

Policies and market frameworks, according to the report’s authors, should enable the provision of ancillary services such as grid balancing that are suitable for EV participation, while opening the market for small loads through the aggregation of generated power.

Source: IEA analysis developed with the IEA Mobility Model.

EV market needs clear targets and economic incentives

The IEA says favorable policies and regulatory frameworks are needed to spur EV growth. The most important steps are establishing electric vehicle and charging standards and clear deployment targets, according to the report. “Another useful policy measure is to provide economic incentives, particularly to bridge the cost gap between EVs and less expensive internal combustion engine (ICE) vehicles as well as to spur the early deployment of charging infrastructure,” the study states.

Waivers to access restrictions, lower toll or parking fees, fuel economy standards, zero-emission vehicle mandates and dedicated procurement programs are other measures which could support EV adoption.

The report adds, the current rate of cost reduction for battery storage systems is not only likely continue over the next decade, but will also be strongly linked to the growth of electromobility. “It is expected that by 2025 batteries will increasingly use cathode chemistries that are less dependent on cobalt, such as NMC 811*, NMC 622 or NMC 532 cathodes in the NMC family, or advanced NCA batteries,” the report states.

That would mean the scale of manufacturing plants increasing considerably, from annual production capacities of 3-8 GWh today to an average 20 GWh in 2023.

EV manufacturing technology continues to make advances, to avoid the “oversizing” of batteries and chargers, said the report. Standards for high-power chargers with a capacity of up to 600 kW have been developed, added the IEA, with growing interest in 1 MW “mega-chargers”.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.