From pv magazine USA.

Energy storage is increasingly finding its place in the sun. As a technology it offers simply too many advantages and meets too many needs to be overlooked: it can be ramped up faster than a gas plant, it can stabilize voltage and frequency and it can carry electrons from solar generation to deliver power after dark.

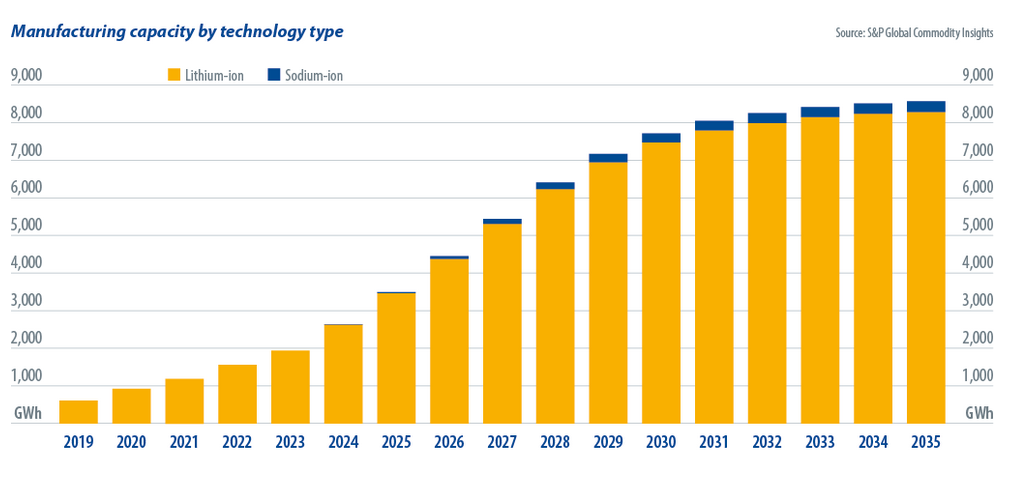

When the dramatic cost declines seen for lithium-ion batteries are factored in, the combination becomes unstoppable.

Regulators, utilities and state governments in the U.S. are beginning to understand that and the Federal Energy Regulatory Commission’s order 841 is opening up wholesale markets to energy storage. Add in the tax advantages of coupling energy storage with solar under the Investment Tax Credit (ITC) and the combination makes for the perfect storm for rival technologies.

According to IHS Markit, the U.S. grid-tied energy storage market is poised to nearly double this year, to 712 MW from 376 MW last year (note: This forecast does not include behind-the-meter storage). The market research company says that will see the United States overtake South Korea, the world’s largest grid-tied energy storage market in 2017 and 2018.

And that is just the beginning. IHS expects almost 5 GW of energy storage – 90% of it lithium-ion batteries – to be deployed in the United States up to 2023.

ITC retreat to drive growth

The consultancy says a big driver in the growth of energy storage deployment over the next four years will be batteries coupled with utility scale solar, a combination it expects to account for more than 40% of battery deployments – roughly 2 GW.

That advance is being made possible by multiple factors including falling costs. Another big stimulus over the period will be the narrowing window of opportunity presented by the ITC, which will fall to 10% at the end of 2022 and can be used for paired solar-plus-storage if the batteries are mostly charged using solar.

With the full 30% ITC only available for projects starting construction this year, the completion of many large scale solar facilities is expected to be stretched out over four years, and it is likely solar-plus-storage will follow the same pattern.

The rise of the solar-plus-storage peaker

While IHS Markit identified pending expiry of the ITC as the biggest single impetus for the coupling of solar and storage over the next four years, it will nevertheless be only a supporting factor and will not drive the need for the solar-storage combination.

Instead, in states such as Hawaii and California that have an high deployment of solar, the supply of midday electricity is reaching saturation and there is a need for power during evening hours. That is resulting not only in deflated returns on solar projects as midday power prices crash, but also in curtailment.

Adding batteries to a PV system directly addresses the problem, and the markets in such states are the farthest ahead in this respect. As documented by pv magazine USA, the state of Hawaii recently approved contracts for six utility scale solar projects coupled with batteries of the same equivalent capacity, at prices of $80-100/MWh.

Such solar-plus-storage “peakers”, where the capacity of generation is fully backed by battery capacity, are still the exception rather than the rule. Overall, IHS Markit expects the 2 GW of batteries that will be deployed with solar up to 2023 to be paired with 10 GWdc of PV capacity – for a 5:1 ration of solar to storage capacity. That keeps costs low, and even at a 4:1 ratio IHS Markit estimates costs of under $40/MWh could be achieved – assuming the full ITC were claimed.

And it is not only California and Hawaii where solar-plus-storage projects are being built. pv magazine recently covered a 180 MW solar plus 60 MW battery project approved by the state siting board in Ohio, with even larger projects sitting in the interconnection queue of Texas’ grid operator.

Of course, much larger opportunities are on the horizon. IHS Markit predicts that by the time the ITC falls to 10%, in 2023, solar-plus-storage will be cost competitive with new gas plants. From there on out, it will be a very different market.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“Regulators, utilities and state governments in the U.S. are beginning to understand that and the Federal Energy Regulatory Commission’s order 841 is opening up wholesale markets to energy storage. Add in the tax advantages of coupling energy storage with solar under the Investment Tax Credit (ITC) and the combination makes for the perfect storm for rival technologies.”

That IS the question for the future. After the 2020 (WWF series) will Congress pass a new energy bill that will set the ITC at 25% forever? Will the ITC disappear and see what happens in the market place? The other posited option is to reset the ITC and ramp it down again? With FERC 841, it seems to be the time to bring online distributed energy storage systems both regionally and locally. Peaker plants and spinning reserve is an old concept who’s retirement point has come and gone and come and gone again. An instantaneous bi-directional distributed grid, not a centralized generation with distribution over power corridors unidirectional grid.