SunPower has established a track record in several areas. Foremost is its production of the highest-efficiency rooftop solar panels available on the mass market, but it has also set a pattern of stubbornly losing money every quarter. And based on the information presented in the company’s first quarter 2019 earnings call, the former may well be resolving the latter.

The company posted an operating loss of $117 million in Q1 2019, a substantial sum, but smaller than it was at the end of the first quarter of 2018 ($134 million) and smaller still than the Q4 2018 losses ($156 million). This trend towards profitability would be an exciting prospect in its own right, but it’s more impressive given what the company accomplished during the quarter.

In February, SunPower began making its 19% efficient P-19 shingled crystalline silicon module at the former SolarWorld factory in Oregon. And while ramping up one factory is a big task on its own, less than a month later the company’s A-Series — the first product to incorporate its New Generation Technology (NGT) cells — hit the U.S. market.

Ramping

Demand for both new products has been strong. Despite seasonal issues in its residential business, SunPower still managed to ship 455 MW of modules during the quarter, while only producing 294 MW. The P-Series output is fully booked through the end of the year, and all of SunPower’s products are sold out through the end of the second quarter, with all lines that are ramped running at 100% capacity utilization.

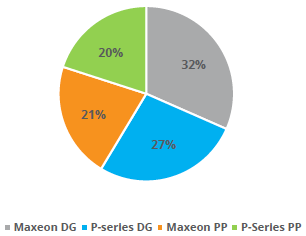

SunPower Q1 2019 shipments, by product and market end-segment.

Graphic: SunPower

SunPower is bringing on substantial new capacity, and reports that during the first quarter it ramped up a new 2 GW P-Series factory in China that it is running through a joint venture. Even though SunPower does not appear to be claiming the output of this factory in its numbers, P-Series now makes up nearly half of the company’s shipments, with a roughly equal split for both P-Series and Maxeon between distributed and power plant applications.

The company’s NGT production is also ramping, with a second 150 MW line expected to come online by the end of the second quarter to support the launch of its A-Series in more markets.

SunPower says that it is still looking for a “manufacturing partner” for its Oregon factory, as announced in its first-quarter results, and says that after narrowing its choices to three different options, it will be making an announcement this summer.

Hiccups towards profitability

Despite substantial restructuring over the past few years, including layoffs, shedding its share of yieldco 8point3, quitting utility-scale project development, and selling off its microinverter line, SunPower has struggled to get back into the black after years of losing money.

It has been difficult to determine how much progress SunPower has made in this regard. The main advantage of each of its two new products — both the P-Series and the A-Series/NGT — is lower costs compared to its highly efficient and very expensive E-Series and X-Series. In the case of NGT and the A-Series, SunPower is achieving similar or better efficiencies to its legacy Maxeon technology, at what it says is a significantly lower cost, through streamlining the manufacturing process.

However, there are a number of other factors that affect SunPower’s business. While Sunpower is no longer developing and building new utility-scale solar power projects, it still has projects to sell, and the lumpy timing of recognizing revenues from utility-scale solar project development makes the quarterly results of any company engaged in this business uneven.

The irony of SunPower’s first-quarter results is that this unevenness did not stop when the company decided to focus on the residential and commercial and industrial (C&I) market segments. Through its installer network, SunPower has become the second-largest company in the U.S. residential sector, and CEO Tom Werner told pv magazine that its results were affected by bad weather affecting solar installations in California, the largest residential market.

With this seasonability over and more capacity online, SunPower is predicting a positing operating result and $0-20 million in profit in the second quarter of 2019, which translates into the company officially breaking into the black for the first time in years. And starting in the second half of 2019 CEO Tom Werner is predicting that SunPower will achieve the long-elusive target of “sustainable profitability.”

Storage arrives

SunPower was also the largest C&I solar developer in the United States again in 2018, and as such its results give insights into the what the market will look like in the future.

The company reports very high storage attachment rates in key C&I markets, at 50% in California and 75% in Massachusetts. SunPower is also getting in on the trend of increasingly coupling solar + storage in residential markets, and will be launching an energy option as part of its Equinox residential solution in the second half of the year.

Overall, SunPower has shown a remarkable transformation over the past few years, and the second quarter will be the period where we see if this transformation validates itself in the form of sustained quarterly profits.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.