From pv magazine, April edition

In a new white paper, IHS Markit has shown how technology can help drive the energy efficiency measures needed to change consumer behavior. From smart metering, energy storage, switchgears, and motors, the potential exists for global savings of 14% in energy demand and for some consumers to reduce their energy cost by around 10%. If even half of those savings can be realized, it becomes a huge offset against the growing global energy demand of the future.

Technology as an efficiency driver

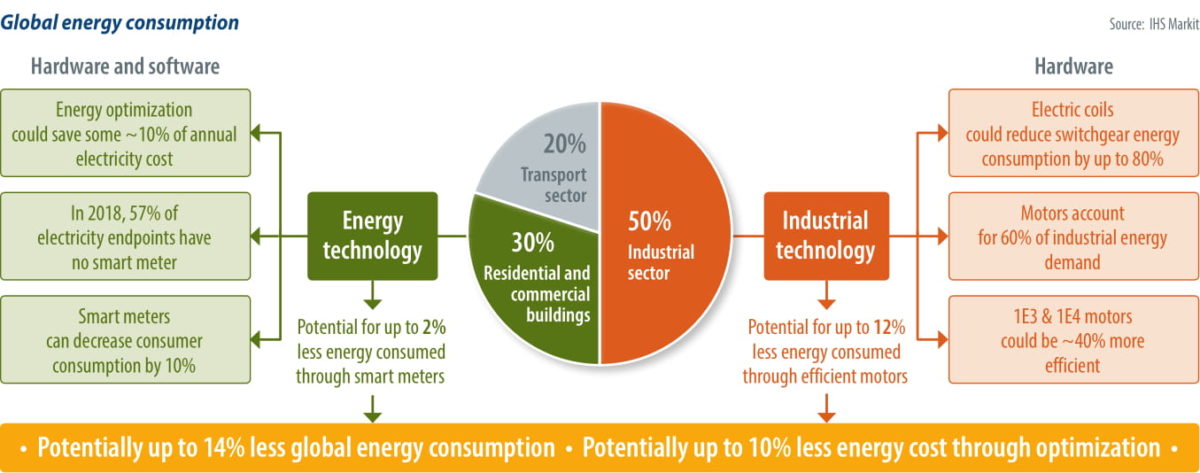

Depending on the industry, energy efficiency strategies and investment varies. While residential and commercial buildings consume around 30% of global energy, the industrial sector consumes 50%. With just two examples of technological change from each, the four case studies can sum to create meaningful energy efficiency savings worldwide:

- Advanced metering infrastructure gives greater visibility into energy consumption, which is shown to reduce demand. More than 100 million communicating meters now ship each year, in addition to the 700 million smart meters installed worldwide.

- Storage alone does not reduce demand on the grid, but it allows better flexibility for consumers and utilities to decide whether to use the energy from their storage systems or from the grid itself – potentially reducing their energy cost.

- Motors account for 60% of industrial energy consumption – in fact, the single largest area of improvement for energy efficiency that can be made is by upgrading from international efficiency class-one and class-two (IE1 and IE2) motors to IE3 and IE4 motors.

- Redesigning switchgears through size, weight, and power (SWaP) can lead to reductions in energy use and heat loss by up to 80% versus traditional designs.

Each piece of the puzzle is moving at its own rate and it’s highly unlikely that even half of the savings will be realized in the next 10 years. However, the potential is clear for consumer and industry and will become a necessity through increased legislation and growing energy demand placing strain on generation.

Different approaches

A clear difference exists between energy utilities as infrastructure (and power) providers, and industrial companies as energy consumers. Efficiency measures have differing incentives for the two, despite the same core legislation forcing action from both, and this is reflected in their approach to investment.

The result is a clear difference in technological trends within the two industries: The Industrial Revolution 4.0 shows how technology and the Internet of Things (IoT) is driving change in manufacturing, but much can still be achieved in energy efficiency through hardware improvements and replacement. Power consumption is one of the biggest costs for industrial automation. There is therefore a significant incentive for energy efficiency.

While the focus of industrial automation companies is on cost savings created through investing in hardware improvements, energy technology companies are increasingly focused on software. The energy industry is undergoing a fundamental shift as the three D’s of transition take hold: decarbonization, decentralization, and digitalization. The addition of scalable renewable solutions (e.g. solar) are changing the supply side of the grid, while technology changes such as electric vehicles place new demands on infrastructure. New hardware continues to ship quickly: IHS Markit forecasts that the U.S. alone will install over 850 MW of residential storage from 2018 to 2022. However, it is a combination of new hardware and software solutions that will help to reduce energy consumption and optimize demand cycles to reduce costs.

Energy efficiency goals will only increase as more legislation comes to fruition, and as the business case for improved hardware and software continues to grow. There will be even more focus on legislation in the coming years, as the EU Energy Strategy, China’s 13th Five-Year Plan and other regional legislative efforts reach major milestones in 2020 and 2030.

The financial incentives of energy efficiency differ, but the same core legislation packages are forcing action in all industries, which is reflected in their varied investment approaches.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.