Turkey’s installed PV capacity has passed 5 GW, with the lion’s share made up of ‘unlicensed’ PV projects – systems up to 1 MW in size or clusters of such systems that amount to larger solar farms.

The licensed market consists of just 600 MW of projects tendered in 2014 and 2015 but with most permits for unlicensed projects expiring and no new applications being accepted, investors are taking a closer look at the prospects of larger schemes.

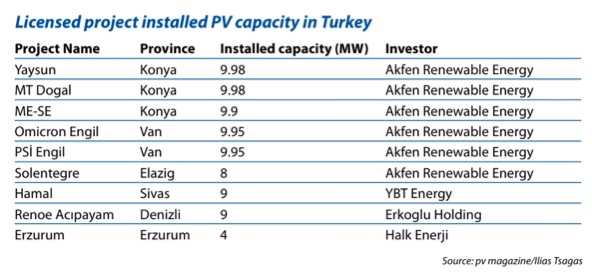

Of the 600 MW of licensed capacity, only 80 MW has been installed, with around 51 MW added last year, reflecting the increasing interest of investors.

pv magazine has compiled the following list of Turkey’s installed, licensed PV projects:

Akfen Renewable Energies

The dominance of Akfen Renewable Energies – the renewables arm of Akfen Holding – is obvious and the Turkish developer made headlines last year when it secured a $363 million loan to build 327 MW of new solar and wind power capacity in Turkey.

A spokesperson for the firm told pv magazine the loan will partly finance seven licensed PV farms and two unlicensed projects. Of those facilities, five parks have already been installed and are included in pv magazine’s list. The loan will also support another two licensed projects – the Omicron Ercis project in Van and the Iota SPP scheme in Malatya, each with a 9.95 MW capacity – as well as 15.44 MW of unlicensed capacity: 5 MW in Tokat and 10.44 MW in Amasya.

The Akfen Renewables spokesperson added, the firm holds licenses for 78 MW of the licensed capacity awarded in the tenders of 2014 and 2015. Akfen said $210 million of the $363 million loan had come from Germany’s state-owned KfW development bank for wind power projects, with $51.5 million each from the European Bank for Reconstruction and Development (EBRD) and Turkey’s İşbankası for PV and the EBRD providing a further $50 million for wind power.

Racing against time

Although there is renewed interest in larger projects, investors in Turkish solar are racing against the clock and an unfolding economic crisis.

Licensed PV plants must be developed this year, although investors may be able to extend that deadline due to changing terrain, according to Andreas Schuenhoff, director of Asunim Group, an EPC firm active in Turkey. Umut Gurbuz, of Asunim Turkey, told pv magazine around 100 MW of projects have applied for terrain changes, with some approved by regulator the EMRA.

Red tape, however, remains a substantial hurdle for PV investors. Yusuf Bahadir Turhan, founder of YBT Energy – which has a 20 MW installed portfolio in the country – said: “Acquiring the necessary permits from countless local and central governmental authorities is rather too difficult. It takes too much time, and people working for government [and] responsible [for] the necessary permits have little knowledge about what to do. Since they do not know much, they are not very eager to do anything, to sign anything.”

…and an economic crisis

Asunim’s Gurbuz appeared hopeful about financing licensed solar projects, and told pv magazine “the capital requirements [for the projects] are clarified in the electricity market law. You need to increase the capital to a certain level of the system value and this is it. The capital of the project remains fixed and the money generated is paid to the banks as credit payments.”

Developer Turhan was more skeptical, and said YBT Energy “definitely has plans to develop more licensed PV plants in Turkey. Not now, but when [the] investment atmosphere becomes better and the government decides to open more capacity for bidding.”

Turhan argued there are two main financial problems when developing the 600 MW of tendered, licensed PV capacity. The first concerns a one-off contribution fee per installed megawatt that arose from the tender process. Turhan argued the fee is often prohibitively high. YBT Energy is paying TRY1,888,008 ($325,000) per MW for its 9 MW Sivas Project. “There are projects which were tendered for [a contribution fee of] TRY2,960,000 per megawatt,” he said.

Upfront fees

The second problem concerns a regulatory decision six months after the last tender for licensed projects, which set the requirements for bank guarantees with regards to the contribution fee. Before that, said Turhan, the regulation concerning bank guarantees was vague and investors assumed they needed to provide guarantees for 10-20% of the contribution fee tendered for each project. The regulator instead asked for the entire amount to be underwritten.

As a result, said Turhan, “most investors who applied and won the bid had to resign, since they did not take into account that they needed to have such a line of credit in the banks … They thought: ‘we can build the plant first, then the PV plant can pay this contribution fee with the funds it self-generates’. However, you need to find both the necessary capital to build the plant and the necessary line of credit in the banks to secure the bank letter at [the] very beginning of the process.” EMRA’s regulation means investors need to find 30-40% more capital than that needed to build the plant, said Turhan.

Add in the fact Turkey’s trade deficit has deteriorated, inflation has escalated and the currency has fallen sharply, and it is not hard to understand why developing licensed PV in the country is not straightforward.

Headaches for domestic investors, however, could provide a golden opportunity for foreign investors to take advantage of cheap equipment to develop Turkish projects. But they will have to be fast.

This article was published a second time on 16/04/19 after a problem with the graphic a day earlier.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.