The shape of Vietnam’s solar policy after its FIT regime expires in June will be one of the most hotly anticipated PV developments in Southeast Asia.

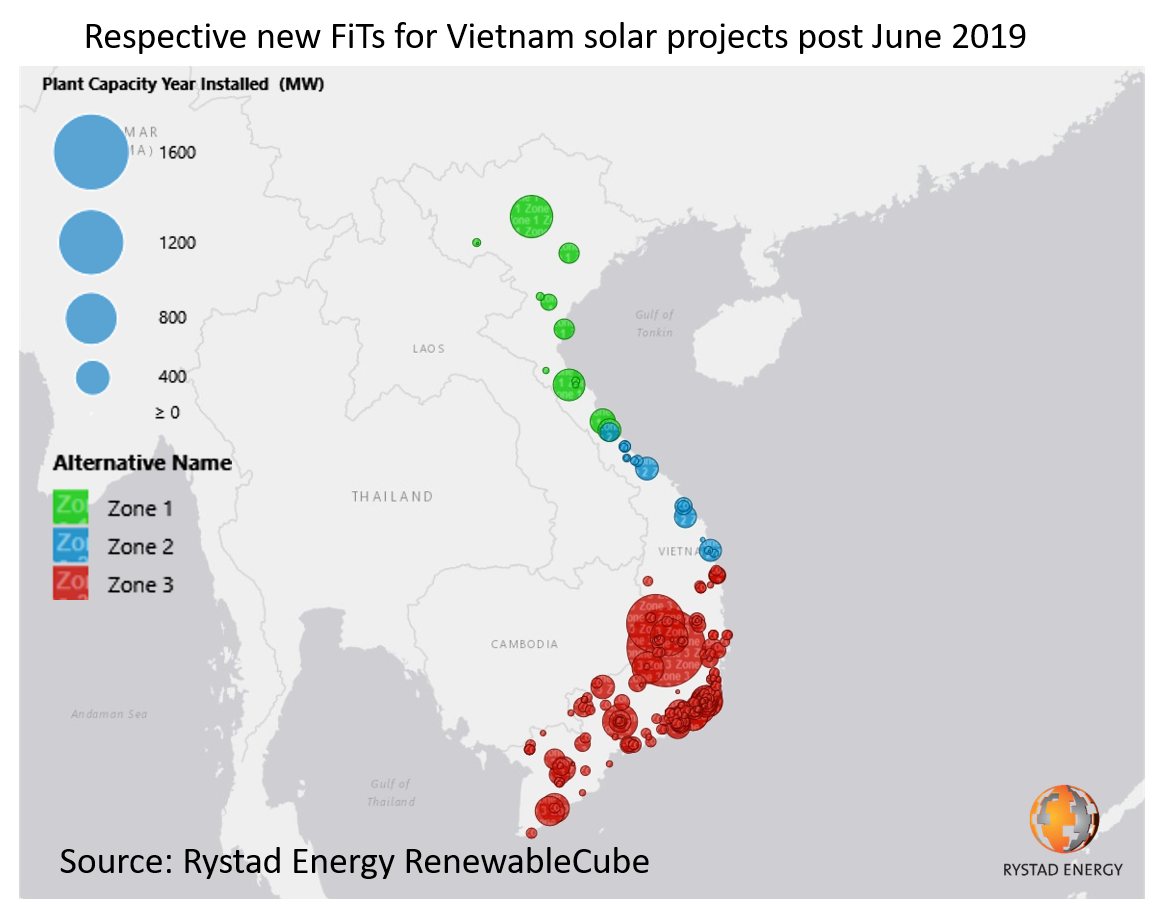

According to a draft decision released by the Ministry of Industry and Trade, the 20-year FIT of $0.0935/kWh introduced in April 2017, and valid for projects that achieve commercial operation before June 30, could be replaced with a two-year solar tariff, which would take into consideration various irradiation levels.

With the exception of the rooftop solar FIT in the cloudy north – which would be set at $0.0985/kWh in the first year and $0.0886/kWh thereafter – the proposed new tariffs are lower than the current ones.

“Overall, from July 2019 to June 2020, the southern region will get 25% less FIT, the central region 15% less and the FIT for the northern region remains approximately the same,” said Rystad Energy analyst Minh Khoi Le. “The FIT will reduce by 5% across all regions for the same period in 2020-2021.”

With the FIT varying regionally – in a country where the sunny south hosts more than 85% of utility-scale solar – tariffs will also differ based on the solar technology used, whether floating PV; ground-mounted; projects collocated with storage; or rooftop solar.

And the proposed FIT level will further depend on whether projects reach commercial operation before or after June 30 next year – with lower tariffs applying to later projects. An exception will be made in the case of Ninh Thuan province, where the current FIT system has been extended by 12 months after the June deadline, despite calculations its 2 GW quota has almost been filled.

Potential impacts

While lower tariffs may displease project developers, the proposed scheme could see more balanced solar deployment and mitigate grid bottlenecks in the south.

“In general, the new solar FIT draft will not only spread out the solar deployment across the country but also refine the market participants to only the committed serious players,” Minh told pv magazine. “When we compare the irradiance, the highest region in the south has 25% more solar irradiance yearly than the highest region in the north, which is the same as [the] reduction percentage in [the] FIT. Hence, the attraction for this region should still remain.”

While the rush to finish large-scale projects in the south will intensify before June, Rystad Energy expects all approved projects in the north to go ahead, including three planned projects with capacities of more than 130 MWac each.

“However, factoring in the land cost in certain areas and the experience from the first phase of solar farms construction, we can expect some projects to go ahead in the southern region, especially from serious developers,” added Minh.

Regardless, the draft FITs are far below the $0.15/kWh proposed in a report published by the Asian Development Bank (ADB) which aimed to improve bankability of projects against the backdrop of a lightly regulated electricity price and uncertainty about the creditworthiness of Vietnam’s state-owned utility EVN.

Banner year

Looking to shift away from fossil fuels and reduce its greenhouse gas emissions by 25% in 2030, and by 45% in 2050, Vietnam is planning to increase the share of renewables to 7% of its energy mix next year and 10% in 2030, up from around 4% last year. Solar is expected to increase from a capacity of 368 MW at the end of 2017 to 850 MW – 0.5% of overall electricity generation – next year, 4 GW in 2025 (1.6%) and 12 GW (3.3%) in 2030, as noted in the ADB report.

Market research company IHS Markit has tipped Vietnam to be one of the most promising PV markets this year. Predicting a record 123 GW of solar will be installed worldwide – up 80% on last year – analysts foresee a shift away from China with two-thirds of new capacity located elsewhere, including in Argentina, Egypt, South Africa, Spain and Vietnam, which between them are set to account for 7% of the 2019 market – 7 GW of new capacity.

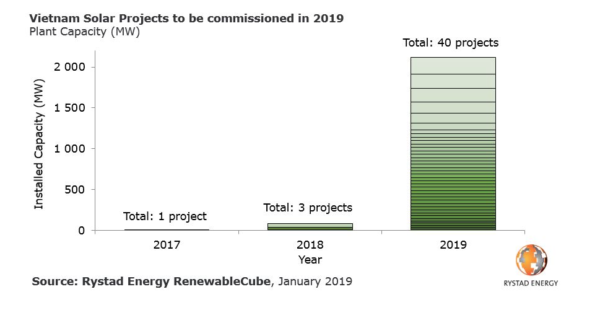

According to Rystad Energy, 40 projects totaling 2 GW of capacity are due to come online in Vietnam this year, a big leap from only two large-scale solar projects – the 49 MW Krong Pa and 35 MW Duc Hue solar farms – commissioned last year.

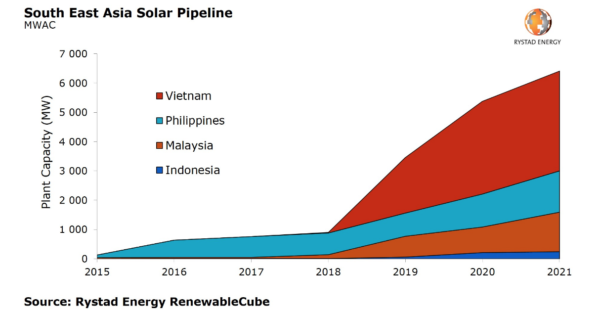

Noting government incentives introduced in 2017 attracted 20 GW of large-scale solar developments to the regional pipeline, Rystad has predicted Vietnam will lead the way as Southeast Asia’s installed PV capacity triples this year.

“The main concern in Vietnam is the risk of grid overload once these plants are completed,” added Rystad’s Minh. “EVN, the country’s only utility company, will need to find more free space in the grid or these plants will not be producing to their designed capacity.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.