From pv magazine Germany.

With Germany’s Federal Network Agency confirming 2.96 GW of new solar capacity was added in the country last year, analysts at business intelligence company EuPD Research are predicting continued growth until the national 52 GW subsidized PV limit is reached.

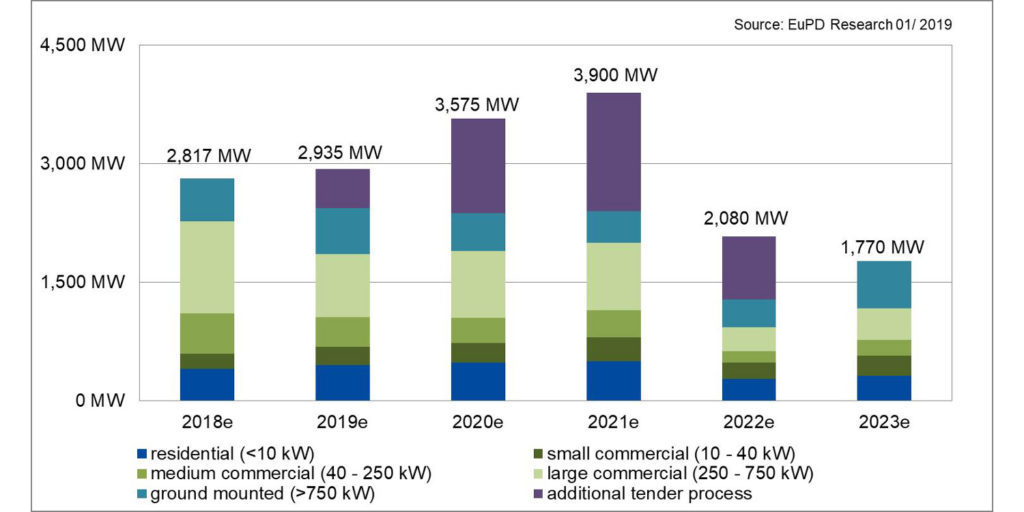

EuPD Research is anticipating a slight rise in new capacity this year, to 2.93 GW, with a surge to 3.57 GW next year and 3.9 GW in 2021, helped by the extraordinary tenders for large-scale solar and wind enabled by November’s Energy Act.

Martin Ammon, head of energy management at EuPD Research, said the effect of falling feed-in tariffs driven by November’s legislation would be counterbalanced by rising electricity prices, which will make self-consumption more attractive. He has predicted a 3-5% fall in PV system costs this year and a marginal decline next year, and said the capacity expansion expected from 2021 would drive stronger price reductions.

The Energy Act introduced FIT reductions for rooftop solar systems with a capacity of 40-750 kW that took effect on Friday. However the policy also ushered in new renewable energy auctions, with two 500 MW procurement exercises for solar projects larger than 750 kW in capacity to be held this year. A further 3 GW of PV capacity will be sought in further tenders next year and in 2021.

Electricity price will drive self-consumption

EuPD’s Ammon does not anticipate rising tender prices in Germany. “The price development of tenders is less dependent on the volume … than on the global market,” he said. “All in all, stable tender prices are expected in 2019.” The special tenders are expected to have little influence on new capacity additions this year. In the next two years, however, they could contribute significantly to market growth, with EuPD anticipating 3.57 GW and around 3.9 GW of new solar.

The cost of integrating all that new capacity into the grid is expected to drive up electricity prices, something Ammon says would pormpt further household and commercial self-consumption installations. “Self-consumption systems are, in our view, the dominant business model,” he said.

E-mobility and the Building Energy Act – which mandates PV use in residential and public structures – will also have positive, if initially “niche” effects, according to the analyst.

Under the current regulatory framework, however, the solar market could almost halve in 2022 if, as expected, Germany passes 52 GW of installed capacity in 2021, triggering the expiry of its feed-in-tariff regime for new projects, under the terms of the Renewable Energy Law (EEG).

Will 52 GW limit remain?

“This will result in a significant reduction in plant size for new installations for self-consumption,” said Ammon, explaining the lack of tariff payments for energy exported to the grid would prompt system operators to install arrays only large enough to meet their own needs, probably incorporating storage.

If the feed-in-tariff cliff-edge occurs, EuPD expects 2.08 GW of new solar capacity in Germany in 2022 as the special RE tenders would continue to drive installation at the same time as the rooftop segment retreated. The figure would fall to 1.77 GW of new capacity in 2023, say the analysts, at which point commercial rooftop systems would be the main driver of German solar.

Were the 52 GW ceiling to be abolished, said Ammon, the results would be mixed. “Abolition of the cap would, therefore, not induce a pull-forward effect, but the plant sizes in private photovoltaic systems would continue to increase,” he said. “In addition, it would be the right signal for the photovoltaic market that Germany needs significantly more than 52 GW of additional solar power to [continue] the energy transition.”

This article has been amended on 05/02/19 in response to James Wimberley’s comment below, to emphasize the 52 GW cap on granting new FIT payments would apply only to new solar projects after that point.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The gloom on residential solar after 2022 is not convincing. German residential rates are some of the highest in the world, around 28c/kwh. The current FIT is about 12c/kwh. The wholesale rate is about 5c/kwh; presumably households will still get this for surplus electricity, apart from occasional forced curtailment. (There needs to be a neutral smoothing régime to keep things simple, as decided in principle in Spain.) With rooftop PV systems under €2/watt all in today, under €1.5/kwh in 2022, it doesn’t take much self-consumption to make solar pay. Batteries will get cheaper, under €100/kwh at scale: don’t take my word for it, that’s why VW and other German carmakers are placing multi-billion-euro bets on EVs, which use the same batteries. With cheap batteries, self-consumption can be economically increased to 100% of a household’s trough summer demand.

” ….triggering the expiry of its feed-in-tariff regime under the terms of the Renewable Energy Law (EEG).” Surely legacy FITs continue. The expiry is only looking forward. Germans know this, but a good my foreigners don’t.

Dear Mr Wimberley,

Prices for residential PV systems are already far below the two numbers you mention. At this moment the average price is 1.28 euro/W. Note that these are average prices. For price aware customers lower prices are obtainable.

https://www.google.com/search?q=bsw+pv+preisindex&client=firefox-b-m&biw=414&bih=656&tbm=isch&ei=s1paXKmQL47IwQL8ypjQAg&start=20&sa=N#mhpiv=2&spf=1549425340893