During the 2018 SNEC trade fair in Shanghai back in May, n-type technologies were among the hottest on show. However, after China announced the 31/5 policy shift, p-type cell prices plummeted, while the sale price of n-type cells remained high. And with barely any demand for Chinese heterojunction products, manufacturers’ expansion plans were postponed.

Top runner

Looking back at process improvements in Chinese cell manufacturing, the Top Runner Program was an important turning point. In order to encourage technology upgrades, PV plant demonstration projects were released, and only those achieving a set efficiency threshold can submit a tender. A capacity of 1 GW was released for the first phase in 2015, and it began to increase year by year – 5.5 GW for 2016 and 8 GW for 2017.

The Top Runner Program has certainly boosted the mass production efficiency of Chinese cells and modules. Looking back at the plans in the past, the first phase led to rapid growth in demand for monocrystalline products, the second phase drove actual demand of PERC cells, and the third phase standard for the ‘General’ Top Runner Program had manufacturers completing projects with 60 cell 310 W or 315 W modules.

In addition, the requirements of the General Top Runner Program can be achieved with mono or multi c-Si products in combination with PERC technology. Yet, the third phase saw the introduction of an additional program – the ‘Super’ Top Runner Program – which requires a higher threshold and more advanced technologies. Aside from module technologies, the cell has to achieve a conversion efficiency of 23%.

Driven by the Top Runner Program, not only have China’s cell manufacturing technology and research talents seen significant improvement, but China has also successfully promoted the localization of high efficiency cells, module materials, and equipment production. Aside from continuous improvement of technologies, the localization of materials and equipment supply is viewed as a key factor in when various n-type technologies can be promoted and developed at large scale.

Market driver of higher efficiency

Mono PERC has established a mainstream market position. Expansions in 2018 mostly focused on mono PERC, leading to a higher than forecast global PERC capacity, from 34.1 GW in late 2017 to

63.2 GW by late 2018. It’s projected that global PERC capacity will increase another 30 GW in 2019, boosting the world’s PERC capacity to 93 GW.

Selective emitter (SE) PERC is the product with the best cost effectiveness at the moment, with its market share expanding rapidly. Before 2020, SE PERC will be the most mainstream ‘high efficiency’ product. Overall, PERC will continue to dominate the mono market.

Because costs are higher and the price drop is limited for n-type products, it’s difficult for these to gain much profit, with a price slightly higher or flat from cost. As a result, n-type is likely to only maintain a market share of 4-6%.

However, after equipping with SE technology this year, mainstream mono PERC efficiencies have increased to 21.5-21.8%, limiting the future improvement of technology and efficiency for p-type multi/mono cells. Aside from the half-cut, multi busbar, and shingled technologies, leading manufacturers need to think about which technology will best maintain high efficiency cell competitiveness. This was also why many manufacturers announced HJT expansion plans during SNEC. Yet, following the rapid decline of p-type product prices in H2 2018, manufacturers need to re-examine the n-type road map. The future of n-type technology is unclear at the moment.

Selection of n-type products

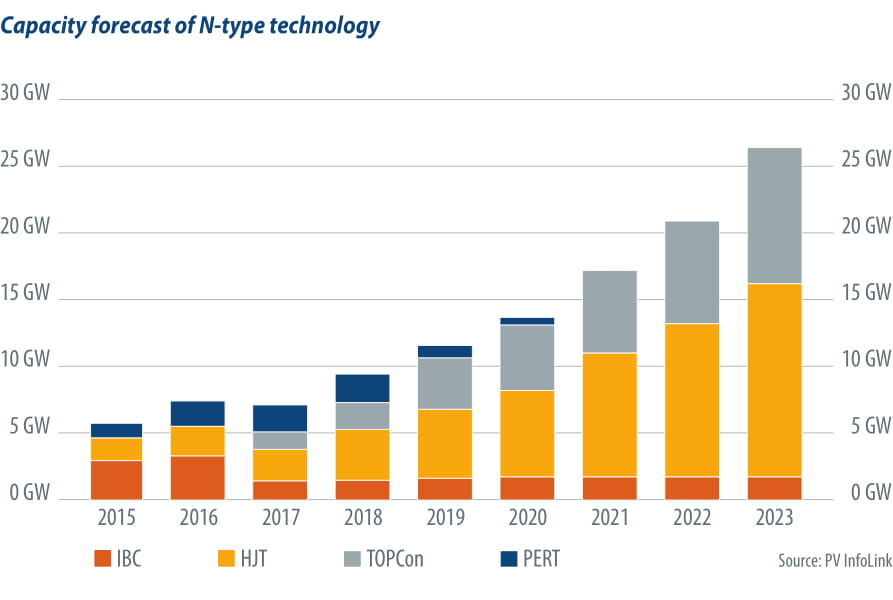

Among n-type technologies, there are four major branches: PERT, HJT, IBC, and TOPCon upgrade by PERT.

However, the efficiency of front side n-PERT is almost the same as PERC. In addition, bifacial PERC is available in the market too this year, which has left n-PERT, with higher costs, in a more difficult position with regard to profitability. Therefore, manufacturers that plan to expand new capacities won’t choose n-PERT, while existing manufacturers will have to consider upgrading n-PERT to TOPCon. As for IBC, it has many production processes, and thus the difficulties and costs are far higher than other technologies. Consequently, HJT and TOPCon are expected to be the two major n-type technologies in the next two years.

Mass production efficiency is very close between TOPCon and HJT technologies, reaching 22.5-23% for China and 23-24% for the non-Chinese makers. However, the compatibility of n-type TOPCon with the existing production lines is high. Manufacturers can upgrade to TOPCon not only through n-PERT production lines, but also through p-PERC after changing three to five production processes. Currently though, Jolywood is the only player to have successfully mass produced TOPCon cells in China, hence the technology is not as mature as HJT. It still needs some more time to emerge.

HJT is almost entirely incompatible with existing production lines, but it only has four to five production processes. The process is not as complicated as TOPCon. In addition, more than eight manufacturers in the world can already mass produce HJT modules. Future growth potential in efficiency should also be higher for HJT, and thus it appears that many manufacturers will still move toward HJT.

Looking to the future

Because costs are higher and the price drop is so far limited for n-type cells, it’s difficult for these products to gain too many profits, with a price slightly higher or flat from cost. So the next primary goal is to reduce cost, and then to reduce cost further!

On the other hand, if n-type cells can’t achieve an efficiency of 23.5% or higher it’s difficult to widen the wattage gap compared with p-type modules. As a result, 2019 will be a year for n-type TOPCon and HJT to compete with each other. The two technologies’ equipment maturity and potential for cost reduction are likely to become clearer during this year. It’s likely that new entrants or manufacturers that plan to expand capacities will go with HJT, while the existing PERT and vertically-integrated manufacturers may prefer to adopt TOPCon.

Judging from now, 2019 won’t be a year with one n-type technology only. In the initial development stage of China’s n-type technologies, TOPCon and HJT will coexist in the market. It took only three to four years for PERC to rise, and PERC efficiency can still go up.

Meanwhile, many vertically-integrated manufacturers are trying to push up p-type mono wafer size to

158.75 × 158.75 mm, and almost full square. With the help of module technologies, the power output of PERC module can still increase to 60 cell 320-325 W in 2020. Therefore, n-type cell needs to continuously work on increasing efficiency and lowering cost, as well as finding ways to equip with module technologies.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Dear Corrine,

According to ITRPV estimations in 2025 efficiency of p-PERC should be exactly in the same range of n-PERT on the 23 % mark for cells. IBC and HTJ are the only cell technologies with higher expected efficiencies. There seem to be this anticipation in the industry of n-type taking over but according to ITRPV p-type manufactures have not much to fear really. Where is the discrepency?

Also, when you write “the efficiency of front side n-PERT is almost the same as PERC” or any other time when you mentoin PERC, do you mean p-PERC or n-PERC?

Regards

Wojciech