Analysts at BloombergNEF have investigated the potential for commercial and industrial (C&I) solar installations in sub-Saharan Africa, in a new report, commissioned by responsAbility Investments AG.

Of the 15 countries examined for the report, nearly all showed booming demand for C&I solar, and in seven of them, analysts found a viable business case.

Solar for Businesses in Sub-Saharan Africa found the C&I market in the region is not growing because of regulatory support – as is usually the case – but because of a solid business case. The analysts cited a combination of high electricity tariffs, falling PV prices and frequent power outages as contributory factors to strong market growth. Nigeria, Kenya and Ghana lead the charge of C&I solar-plus-storage operations in Africa.

Limping utility-scale market spurs C&I

Exempting South Africa, sub-Saharan nations had only 420 MW of solar plants selling power to the grid by November. That equated to less than 0.5% of global installed solar capacity in 2017.

What capacity there is was also concentrated in a few markets that enjoyed extensive development support. Utility-scale projects often struggle with administrative delays, unbankable PPAs and difficulties arising from lack of political will, unclear regulation and challenges in securing grid connections and land.

Developers hope such challenges can be avoided as direct C&I booms in the region. The World Bank’s Scaling Solar program saw nearly a quarter of its installations directly connected to an end-customer, thus avoiding regulatory burdens.

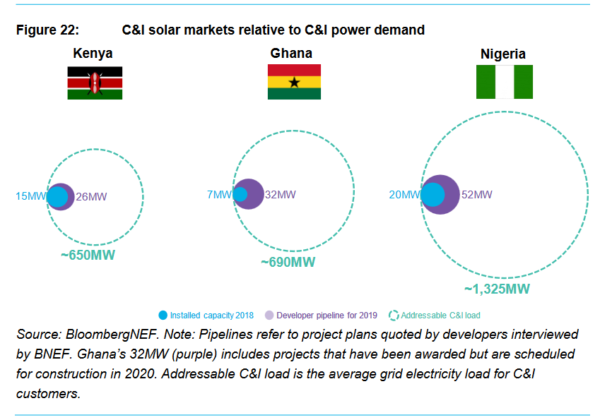

“While the market is still small, it has great potential,” explained the report’s co-author Takehiro Kawahara, a lead frontier power analyst at BNEF. “An immense energy deficit and crumbling infrastructure make sub-Saharan Africa fertile ground for solar. As of November 2018, developers built a record number of 74 MW serving business customers directly, offering them cheaper power than the grid.

“Kenya, Nigeria, and Ghana installed 15 MW, 20 MW, and 7 MW, respectively.”

The growth factor is strong, as BloombergNEF researchers found. Local installers and developers interviewed by the analysts reported being optimistic about 2019 and boasting a C&I pipeline of 26 MW in Kenya, 32 MW in Ghana and 52 MW in Nigeria.

High electricity tariffs play a crucial role, with prices for C&I customers in 2017 ranging from $0.028/kWh in Ethiopia to more than $0.232/kWh in Senegal. By contrast, analysts estimated the costs of C&I solar in the region ranged from $0.10-0.14/kWh and were projected to fall to $0.05/kWh by 2030.

Mining and manufacturing

According to BloombergNEF, developers say they are anticipating fewer administrative delays and stronger off-take agreements with C&I customers. Last year, such developers built a record number of installations to help businesses protect themselves from price volatility.

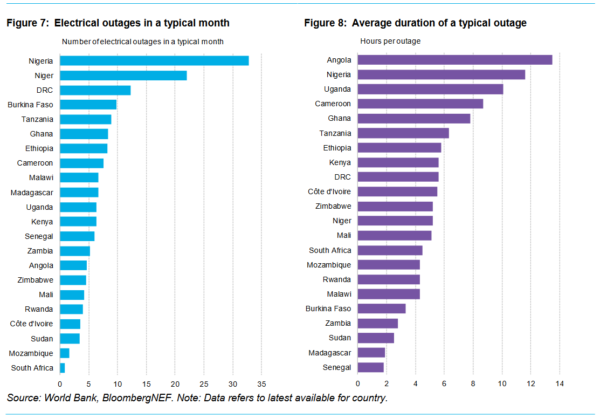

In addition to high tariffs, the report also pointed to poor grid quality as a reason for businesses to turn to on-site solar-plus-storage. While in households poor grid quality and frequency fluctuations cause lights to flicker, the effects in manufacturing can be hugely costly. Sensitive machinery can be damaged and orders can be missed. Nigeria, which currently ranks top for C&I in the region, is plagued by unpredictable daily outages that can last four to 15 hours.

Of 110 projects reviewed for the report, 20% were manufacturing linked. However, measured by size, the mining sector is currently the strongest market for C&I, with 31 MW at an average 6 MW project size. The analysts highlighted, however, solar penetration remains small. For each megawatt of solar built in the mining sector, around three to four megawatts of diesel gensets are added. The low solar ratio, though, makes integration of solar into the system more manageable, with the result that such projects usually include little battery storage.

Challenges remain

While the value proposition has been made in many markets in the region, lack of access to capital remains a big hurdle, and was a factor unanimously cited as the biggest obstacle to the development of solar in sub-Saharan Africa by respondents to the report.

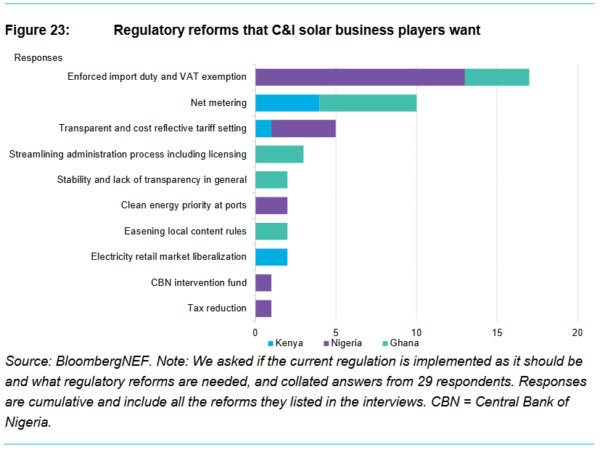

Another issue is regulatory burdens. Though most markets allow for permit free installation of a genset for self-consumption – up to a certain size – the sale of electricity remains uncharted territory. For example, energy-as-a-service business models, whereby solar-plus-storage systems generate power for manufacturing consumption on-site, are a legal grey area at best.

According to BloombergNEF, the result is creative workarounds such as “equipment lease” contracts that cover generation costs but are not considered PPAs and therefore not subject to approval by regulatory authorities.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.