Taiwan-based energy market research company Energytrend has observed a steadily growing PV market over the last week. For polysilicon and silicon wafers, prices have stabilized thanks to supply and demand equilibrium, and could remain steady until after the Chinese new year holidays on February 5.

Prices for cells and modules could experience a slight increase due to individual product demand and Energytrend assumes Tier 1 manufacturers in particular will see steady order books until the end of March.

Polysilicon

Stronger than usual demand has caused polysilicon inventories to shrink. Though there was some price fluctuation in the last week, prices have not risen. The analysts believe high downstream demand will lead to further production capacity increases. The monthly supply quantity after the new year holidays may rise above 32,000 tons.

In China, polysilicon prices stayed at RMB70-73/kg ($0.1034-0.1078), while monosilicon prices fell to RMB78-81/kg. International prices stayed around $0.0820-0.0950/kg.

Silicon wafer

According to Energytrend, silicon wafer demand has aped that of polysilicon. The analysts predict huge order volumes will be shifted after the holiday. However, the market has remained stable due to a balance between supply and demand.

In China, mono wafer prices stayed at RMB3.05-3.10/pc. There were no changes to multi-si prices, which were said to be around RMB2.05-2.20/pc. Black silicon product prices remained at RMB2.25/pc.

On international markets, analysts found mono and multi-si prices stayed in the same range as the previous reporting period. Mono-si wafers were at $0.380-0.390/pc and multi-si traded at $0.258-0.280/pc. Black silicon products stayed steady at $0.305/pc.

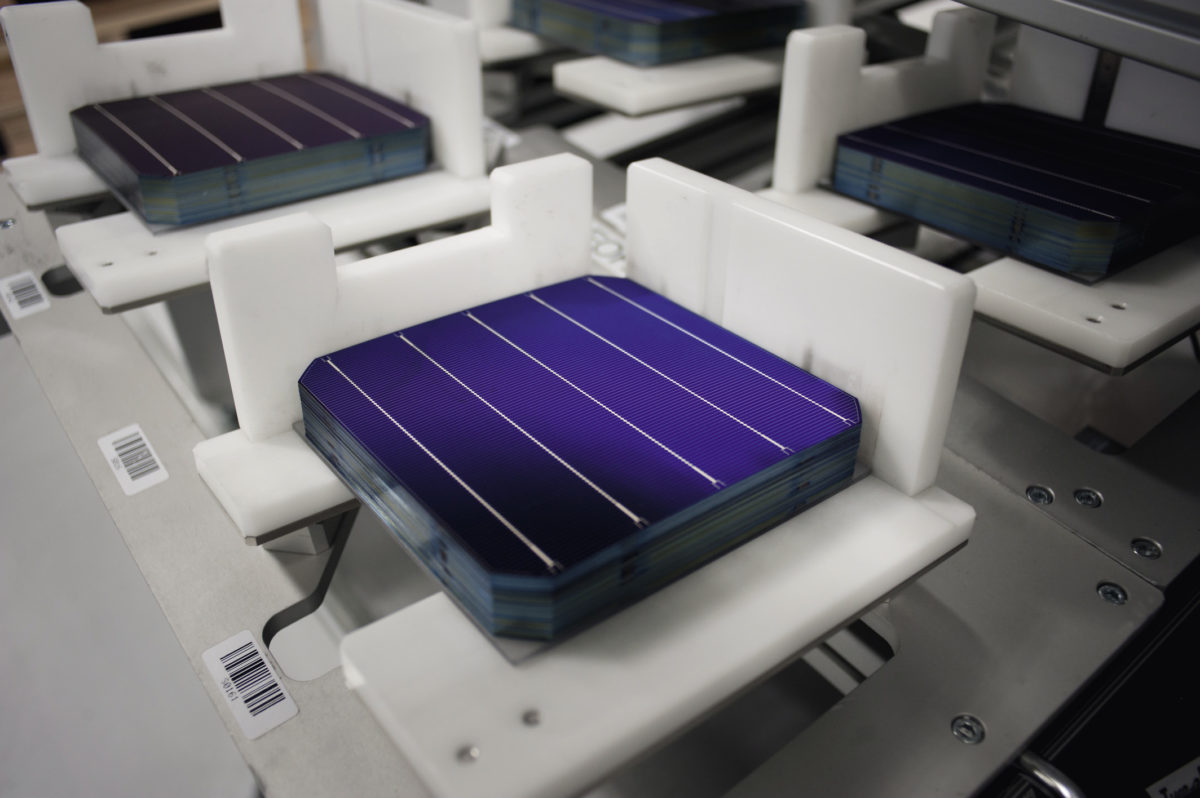

Cells

“This week, the PV cells market has been on fire,” said Energytrend. Considerable transaction volumes and deliveries scheduled for the first quarter caused some Chinese high-efficiency cell supplies to run short. As a result, Energytrend says overseas markets in the high-efficiency segment have seen higher capacity utilization rates.

China’s largely multisilicon market saw cell prices climb to RMB0.88-0.90/W. Monosilicon prices stayed at RMB1.01-1.08/W and high-efficiency mono-si PV cells climbed to RMB1.23-1.28/W. Accordingly, the rate for mono PV cells grew to RMB1.25/W. Prices of ultra-high efficiency mono-si PV cells – with efficiencies of more than 21.5% – also rose, to RMB1.23-1.34/W, while the average price rose to RMB1.31/W.

Multicrystalline cell prices were steady at $0.109-0.137/W on international markets, with the average price rising to $0.113/W. Mono-si prices stayed at $0.145-0.160/W.

In the high-efficiency market, prices rose. High-efficiency mono cell prices reached $0.165-0.175/W, and the average climbed to $0.173/W. Ultra-high efficient mono-si prices also increased by some margin, to $0.173-0.182/W, although the average price stayed at $0.175/W. Bifacial PV cell prices stayed at $1.36/W.

Modules

Energytrend observed stable price development for modules. In China, prices for multisilicon modules – 270-275 W – remained at RMB1.80-1.85/W, while the monosilicon counterparts – 290-295W – levelled off at RMB1.83-1.96/W.

High-efficiency mono-si – 300-305W – traded at RMB2.15-2.30/W, a slight increase on the last reporting period. Another price bracket up, prices remained stable at RMB2.25/W for ultra-high efficiency mono-si – offering more than 310W output.

On the international markets, fluctuations were minute. Multi-si prices stayed at $0.210-0.265/W and high-efficiency multi-si prices stayed at $0.215-0.275/W. Mono-si prices stayed at $0.247-0.360/W and high-efficiency were at $0.265-0.380/W.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.