China’s National Energy Administration (NEA) is currently considering how to sustainably continue its support of renewables without feed-in tariffs (FITs). Indeed, while this financing mechanism has been integral to the deployment of the country’s over 100 GW of renewables over the past 10 years, it is time for a rethink.

“FIT has been a success in the sense that the planned deployment of wind and solar has been more than reached. The flip-side of the support mechanism is that the surcharge fund is no longer sufficient for the support and it not possible for political reasons to raise the surcharge further,” says German Energy Agency, Dena.

According to the NEA, in 2017, China’s Renewable Energy Development Fund reached a deficit of RMB 112.7 billion (US$16.4 billion). The rapid uptake of solar, in particular, contributed to this shortfall.

“Faced with over 9.65 GW of solar PV installations in the first quarter of 2018 and a rising surcharge deficit, in May 2018, NDRC announced it would cease issuing FiT quotas for utility-scale PV for the remainder 2018, with some exceptions, as well as sharply limiting subsidy quotas for distributed solar,” says Dena.

In its report, Effective allocation of financial support and enhancement of system integration of renewable energies, which has been compiled to advise the Chinese Government’s annual China Renewable Energy Outlook (CREO), the agency finds that shifting to auctions could be a strong solution in a post-FIT world, particularly as they can be adapted to various market mechanisms.

Regardless of the incentive and support policy instrument, however, Dena argues that the key is to ensure it is designed correctly. Overall, the agency offers four points for deliberation: (i) consider your goals when designing the tool; (ii) different pathways can lead to competition and cost efficiency; (iii) RE policies should be integrated into the overall policy mix; and (iv) investment climate matters.

The whole picture

It is essential to not only consider renewable policies, but also those pertaining to conventional energies, argues Dena. Fossil fuel subsidies in particular – estimated by the International Energy Agency to be around US$260 billion globally and nearly as high as new investments in renewables ($279.8 billion, minus hydropower projects over 50 MW) – distort the true costs of energy and hinder the development of renewables.

“Gradually phasing out subsidies for conventional energy can accelerate the process to reach cost competitiveness for RE,” write the report’s authors.

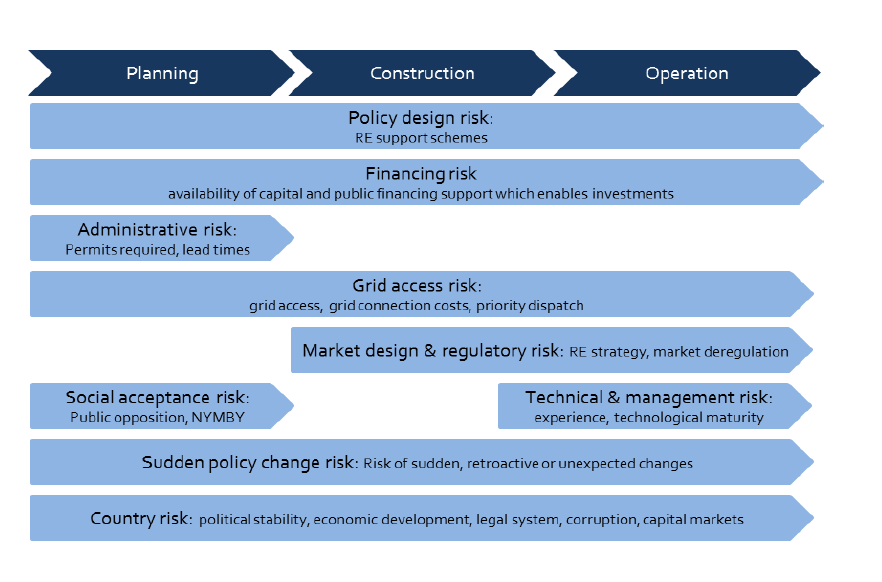

Risk must also be taken into consideration, not only in terms of technology, but also for investors who, naturally, require returns on their investments. “For RE, most of the investments need to be done before any income is generated. Any delays in the project development, construction and commissioning process also delays in-coming cash flows to refinance the projects,” says Dena.

Since interest rates (capital costs) during the “riskier” construction phase of renewable projects are higher, low capital costs are “paramount” for a cost-effective transformation of the energy system, says Dena, adding, “… one of the primary goals of RE support schemes should be to provide a framework for affordable and cost effective financing conditions.”

Overall, Dena has identified nine risks (see graphic above), and mitigation strategies, including FITs or feed-in premiums (FIPs); transparent guidelines and marketplaces; and responsive policy designs.

Overall, Dena has identified nine risks (see graphic above), and mitigation strategies, including FITs or feed-in premiums (FIPs); transparent guidelines and marketplaces; and responsive policy designs.

On the rise

Increasingly, auctions are becoming the support mechanism of choice for the deployment of renewables. Overall, Dena finds that over 29 countries held such auctions in 2017, mostly for solar power, although wind and hydro featured too. Some were standalone energy auctions, although mixed energy auctions are on the rise.

“The goal of all support policies for RE is an energy system and market situation in which RE can participate and compete equally and, in the long run, become the main source of power. One step into this direction which is being chosen by more and more countries is the introduction of auction mechanisms for the allocation of financial support,” write the report’s authors.

In a seperate study released on Tuesday, it was argued that FITs are preferable to tenders, which the researchers said are “limiting deployment” of renewables and should be kept for projects of 40 MW or over.

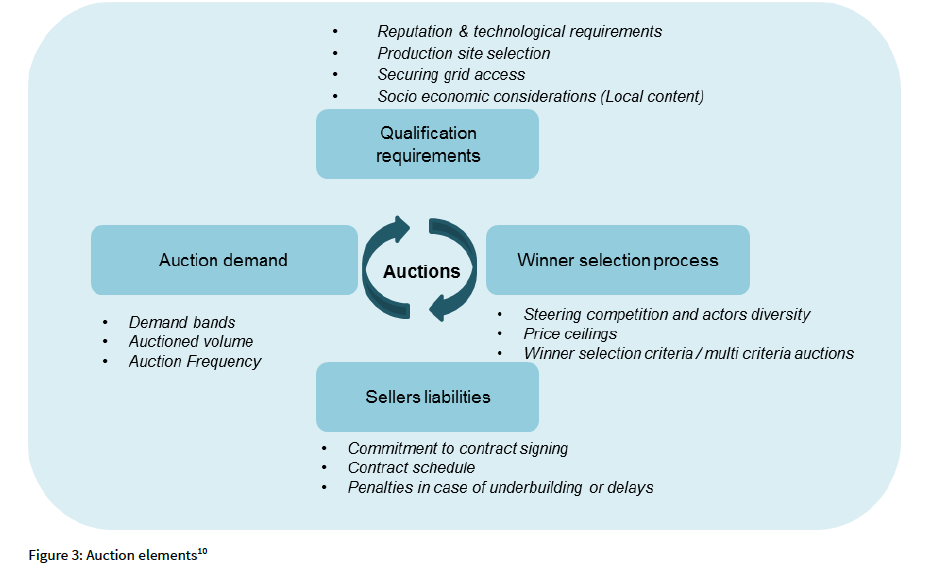

Dena is keen to highlight that an auction is not itself a support instrument, but rather a design element of the general support instrument. If designed well, they say, these instruments can help to provide real-world prices for renewables, avoid windfall profits and/or underfinanced projects that do not get built.

Conversely, bad design can lead to underbuilding and delays in the development and construction phases of projects, or overly low bids, which do not represent real prices.

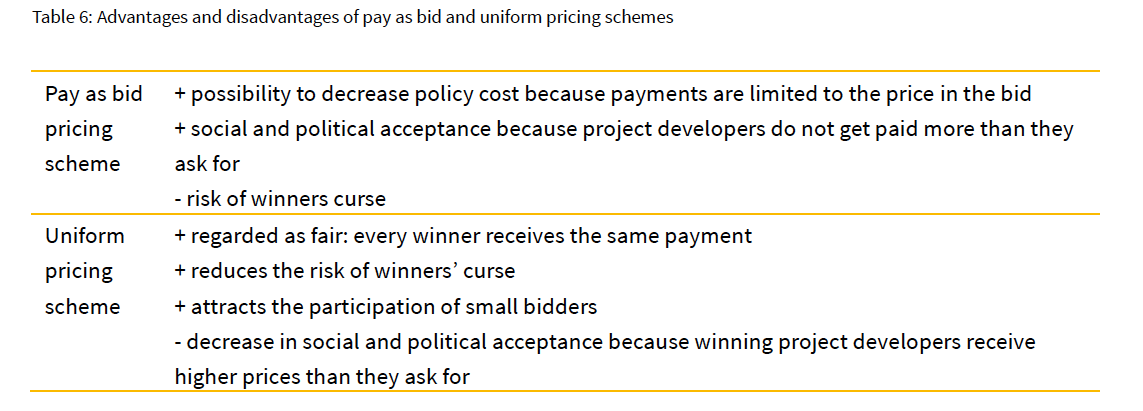

According to Dena, there are two types of auctions: sealed bid; and pay-as-bid pricing schemes. The table below provides an overview on the advantages and disadvantages of each.

Overall, the agency finds that there are various success factors for auctions, including the presence of sufficient competition, and the design of frameworks that are suited to the market they are being rolled out in. Clear rules, transparent processes and stable regulations are also fundamental elements.

Overall, the agency finds that there are various success factors for auctions, including the presence of sufficient competition, and the design of frameworks that are suited to the market they are being rolled out in. Clear rules, transparent processes and stable regulations are also fundamental elements.

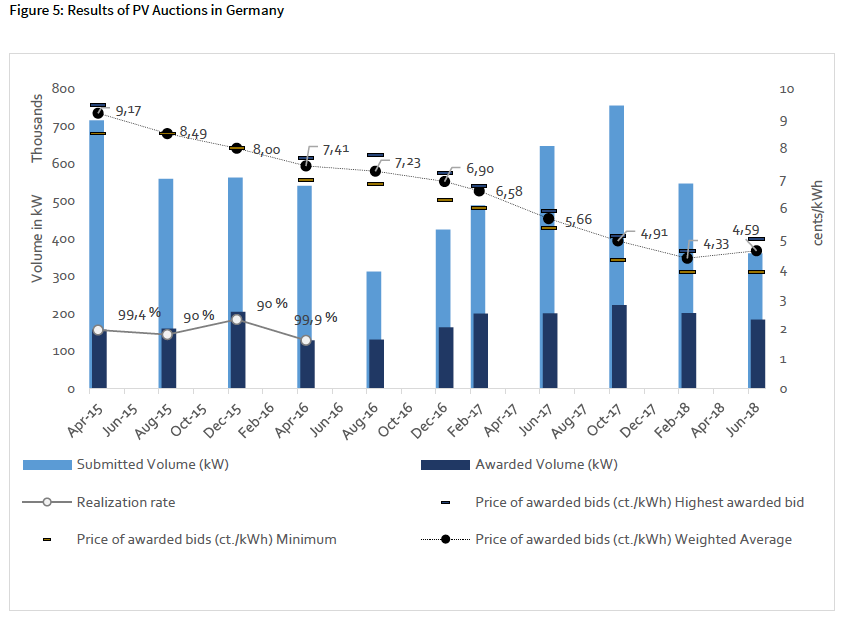

Holding up Germany as an example of a country having designed successful renewable energy auctions, which have been underpinned by a strong country-wide policy – the EEG, introduced in 2000 – Dena finds that participation has been high, while realization rates have been between 90% and 99.9%, and prices have decreased from 9.17 euro cents/kWh in the first auction in 2015 to 4.59 euro cents/kWh in 2018.

The agency also analyzes auctions held in the United States, which holds both utility-led, and technology neutral tenders; and notes that China also has experience in this area. Most recently, its Top Runner Program works on an auction-based system.

“As with FiTs, China has long experience with RE tenders: The NDRC launched the first renewable tender in 2003, six years before creating the FiT policy, when the renewable industry was still its infancy. At that phase, the purpose of tenders was to find the actual market cost given the small the number of prior RE projects. At that time, winning bids showed wide variance in bid prices, demonstrating the industry’s immature stage of development,” write the report’s authors.

“Now that China has several years of experience and over 100 GW of wind and solar PV installed, auctions are likely to produce a more narrow range of pricing, and should help address the need to reduce investment cost while continuing deployment of low-carbon energy. In the mid-term, the auctioning of a FiP-like payment scheme should be targeted in order to link the RE incentive policies to the setup of power market structures in an early stage.”

You can view the full report here.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.