From pv magazine USA

The U.S. solar power pipeline is already popping, now the batteries needed to get us to 80% with wind+solar are starting to get down to the mad and exponential growth we’re told to expect.

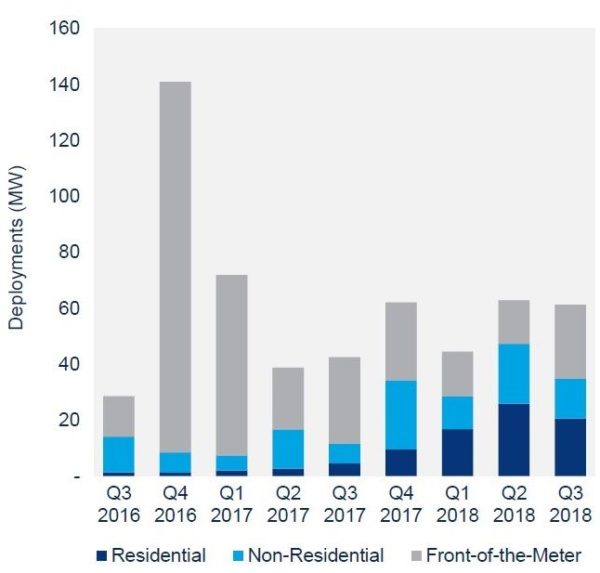

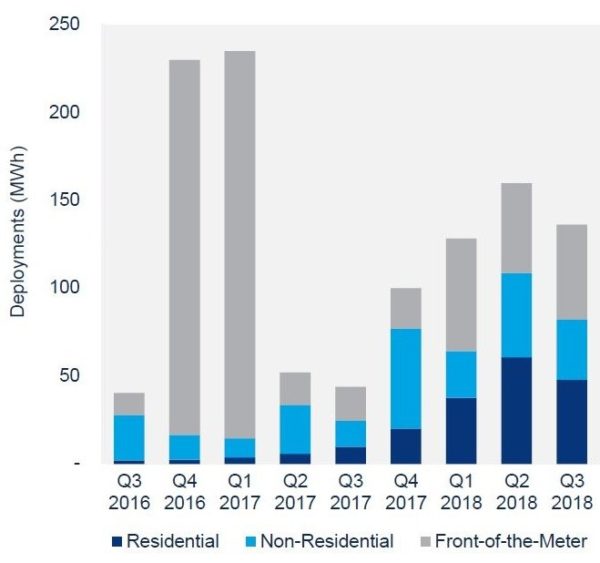

Per the US Energy Storage Monitor, from Wood Mackenzie Renewables & Power along with the Energy Storage Association (ESA), total energy storage deployed, in the U.S. expanded by 60% in terms of energy and 300% by capacity in the third quarter of 2018 versus the prior year. However, given a strong Q2 both energy and capacity were flat or declining in Q3 ’18 versus the previous quarter.

In total, 61.3 MW / 136.3 MWh of energy storage was installed during Q3 2018, in the U.S. California continued to achor the market, while Hawaii and New York had strong quarters. Behind the meter installations accounted for around 57-60% of capacity deployed.

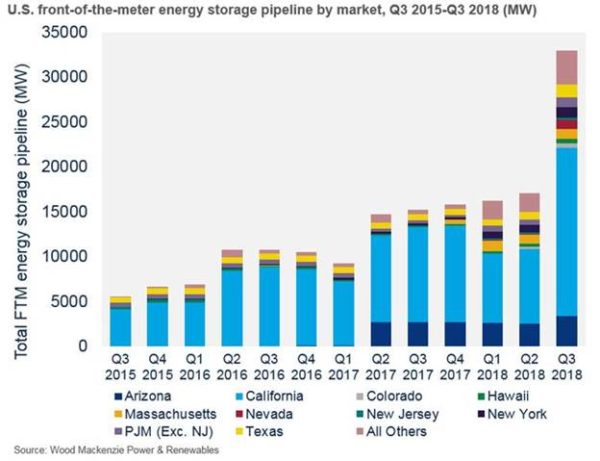

Going out mostly until 2023, the report noted that the front of the meter pipeline expanded to approximately 33 GW of power. This pipeline more than doubled from just over 15 GW reported at the end of the second quarter.

This pipeline does not include behind the meter deployments, and as noted in this report these represented approximately 60% of the volume this quarter. Future growth is expected to heavily expand on the utility scale.

For instance, PG&E recently approved four energy storage projects totalling 567 MW / 2.64 GWh. These include a 300 MW / 1200 MWh system by Vistra Energy, and a 182.5 MW / 1,095 MWh six hour system by Tesla, which are the largest battery projects seen by pv magazine USA staff in the United States to date.

The report estimates that $474 million worth of energy storage will be installed in 2018, and that by 2023, it will break $4.5 billion, representing 10X revenue growth over five years.

Further suggesting that the start of Massachusetts’ SMART program represents a “massive near term opportunity for solar-plus-storage”, the report forecasts that the program will lead toward 80 MW of energy storage installed in total, with Massachusetts’ installed storage expected to grow from 5.4 MW in 2018 to 54 MW in 2019.

Looking at policy developments, both in front of and behind the meter; Nevada and Arizona launched storage incentives, New York is developing programs, and some states are conducting research. Meanwhile, developers and trade organizations are asking for clarity of energy storage eligibility under the federal Investment Tax Credit.

This year there had been two preceeding reports similarly forecasting that behind the meter and residential storage will show significant growth, in the U.S. And as the market grows, more players are getting involved, with inverter manufacturer SolarEdge joining the business.

Concurrent with this rapid growth we are starting to see stresses in the market. For instance, Tesla stated that it had turned off energy storage lines in favor of car battery lines – and then followed up with price increases on its energy storage products.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.